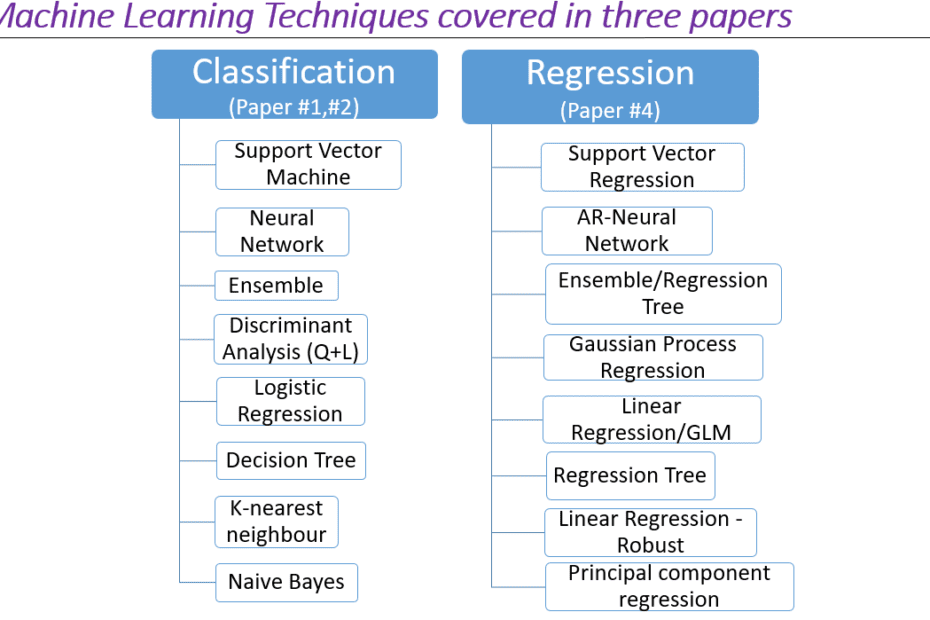

Applying Machine Learning Techniques in Quantitative Finance

Two weeks ago, I was invited to present about Machine Learning and its applications in Quantitative Finance at a conference in London, UK. Without a… Read More »Applying Machine Learning Techniques in Quantitative Finance