Two weeks ago, I was invited to present about Machine Learning and its applications in Quantitative Finance at a conference in London, UK.

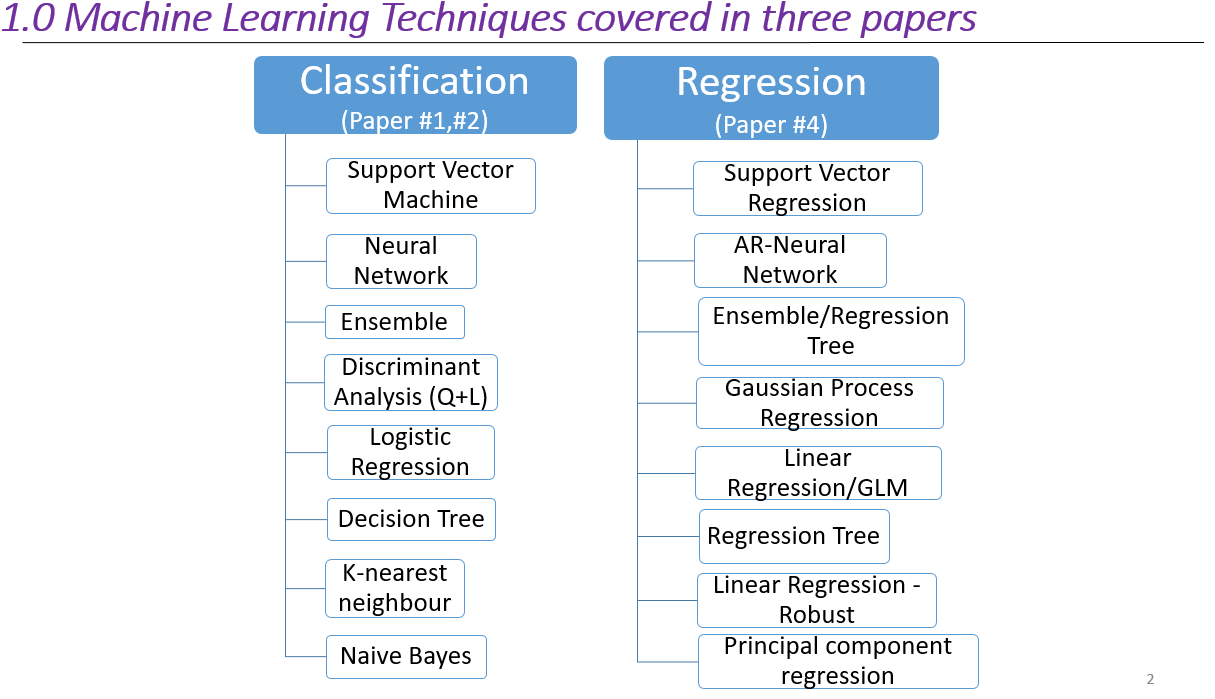

Without a break, I went through four research papers which I completed over the last two years with my co-author; here is one page of the presentation.

- CDS Rate Construction Methods by Machine Learning Techniques: Methodology and Results; Brummelhuis and Luo, forthcoming in peer-reviewed journal, 2018a

- CDS Rate Construction Methods by Machine Learning Techniques: Parameterization, Correlation and Benchmarking; Brummelhuis and Luo, forthcoming in peer-reviewed journal, 2018b

- Arbitrage Opportunities in CDS Term Structure: Theory and Implications on OTC Derivatives. Brummelhuis and Luo, SSRN journal, 2018c

- Bank Net Interest Margin Forecasting and Capital Stress Testing by Machine Learning Techniques. Brummelhuis and Luo, SSRN journal, 2018d (will be available soon)

In the next few weeks, I am planning to write a few blogs with the hope to explain what motivate me to solve a given problem in banking/finance using Machine Learning Techniques/Data Science/Mathematics as presented in the above four research papers. Some of the Machine Learning techniques used are displayed below.

As always, if you find it interesting, please support our academic research by downloading the papers above, even better, if you do research in related areas, we are grateful to you if you can cite our research papers.

Compared with some of the previous conferences, nobody asked whether we should or could use Machine Learning techniques in finance; instead, everyone is talking about how to better use Machine Learning in finance (see imagine below).

Compared with some of the previous conferences, nobody asked whether we should or could use Machine Learning techniques in finance; instead, everyone is talking about how to better use Machine Learning in finance (see imagine below).