Differential ML on TensorFlow and Colab

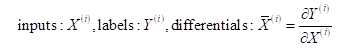

Brian Huge and I just posted a working paper following six months of research and development on function approximation by artificial intelligence (AI) in Danske Bank.… Read More »Differential ML on TensorFlow and Colab