Note: This blog was written by Dr. William Goodrum and originally posted on www.elderresearch.com.

____________________________

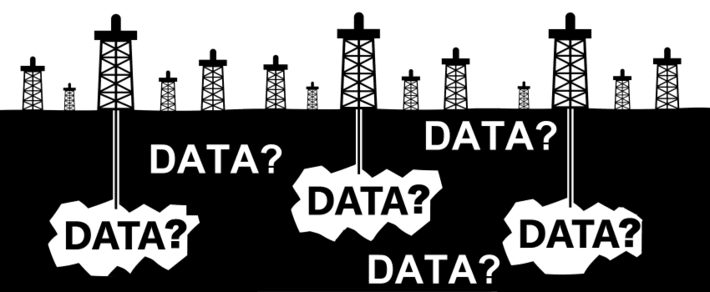

It has become common to talk about data being the new oil. But a recent piece from WIRED magazine points out problems with this analogy. Primarily, you must extract oil for it to be valuable and that is the hard part. Framing data as oil is not illuminating for executives trying to value their data assets. Oil is valuable, marketable, and tradable. Without significant effort, data is not. Data has more in common with land that may contain oil deposits than it does with oil.

Framing data as a real asset may help executives understand its value.

Why Data Is Not Oil

Some high-profile publications recently emphasized the lucrative potential of data. For example, the New York Times highlighted how revisions to Facebook’s privacy wall caused an explosion of third-party data sharing, and referred to it as “the most valuable commodity of the digital age.” The Economist called data “the most valuable resource in the world,” surpassing “black gold” and other commodities in terms of its revenue potential.

In WIRED, Antonio Garcia Martinez critiques the oil analogy from an economic perspective, especially the proposed “data dividend” schemes that attempt to remunerate consumers for the use of their data. The article is well-written and clarifies the economics of data.

But Garcia Martinez does not go far enough and provide an alternative analogy. Not all assets are fungible or tradable, but all assets have value. So, if data is not a fungible, marketable good, then what is it?

Data As A Real Asset

A better analogy is to think of data as a real asset; in other words, land. Martinez misses on this in his Amazon data example. He argues that receiving hard drives with the complete set of Amazon customer data is worthless because it references only Amazon customers and therefore is only valuable to Amazon. He is wrong to argue that this data cannot be sold to others on its own. The data are not worthless, one would just have to work hard to make good use of them.

Data are an asset, but merely having them does not reveal their value; it must be developed to maximize its value. The value of data is not what someone else will pay for it, it is in how you can use it.

Assess Data Value In Context

In real estate the three most important factors impacting property value are location, location, and location. Selling someone a house in the mountains does not make sense if they want to be near the beach. Creating a subdivision downwind of a paper mill is a bad idea unless land is so scarce that getting a home anywhere is still desirable (regardless of the smell). The primary factor for determining property value is location: is it close to something or somewhere that people care about so much that they will pay for that proximity?

Similarly, valuation of data assets must assess how close they are to a company’s strategy and goals. Data delivers value only when it is used to solve problems or answer important questions. In his book,Infonomics, Laney measures the performance value of a data asset from the relative change in a Key Performance Indicator (KPI) over time. In this way, the “location” of the data relative to business value can be tangibly assessed. That is, if the KPI is well-defined, its change in value while the data asset was established and maintained is the contribution of that data asset.

To Martinez’ point, Amazon data is primarily valuable in the Amazon business context. For example, data on past purchases can be used to recommend future purchases. But other secondary contexts exist where that same data could provide value. Consider predicting relocation based on Amazon search history for items related to moving. Or using the data to predict the efficacy of cross-promotion into new markets. If your goal is to acquire new customers, collecting additional data on existing customers is not likely to help. Or, if you are interested in modeling the churn of your existing customers, introducing aggregated data on new customers is not likely to help. Just like in real estate, proximity is key; here, of third-party data to your business problem.

Data Development — build, baby, build

Anyone who has bought or sold real estate knows that the value of the land changes dramatically when you make substantial improvements – e.g., you build a house on it. Developers stake their businesses on being able to upgrade valuable spaces, whether that is retail, commercial, or mixed use. Land is worth more when improvements are made to it.

Land is what economists call a rival good: only one person, entity, or corporation may possess and make use of it at any time. Also, once land has been improved, it cannot be used for something else without destroying its previously envisioned purpose. As a recent article by Jones and Tonetti illustrates, data is a non-rival good: more than one person or entity can develop it in completely different ways, deriving value for their context without eroding the value available to another party. For example, if you want to understand your customer’s behavior your Data Scientists could develop applications related to:

- Likelihood to purchase

- Recommendations of like items

- Detection of fraudulent transactions

While the raw data for all of these applications will likely be identical or very similar, the specific datasets going into each model will be different due to feature engineering and derivation. For this reason, it is important for companies to have a cohesive data strategy. Clear governance, with strategic intent to retain important raw data, can have value implications across many arms of a business. Because data is non-rival, it may in fact be even more valuable than the real assets that your company holds!

The hype around data, Data Science, Machine Learning, and AI — in addition to the stratospheric valuation of big tech companies like Google, Facebook, and Amazon — make a case for the “data is like oil” analogy. Still, the analogy is fundamentally flawed. Thinking about data as oil does not help CDOs, CAOs, or CEOs to properly value their core data assets, since it relies on estimating the market value of their data to others. It also assumes that the value available in data has already been painstakingly extracted. A better, though still imperfect analogy is treating data like land; that emphasizes that the data must be developed for it to be useful and valuable. Thinking of data as a real asset can guide the formation of a cohesive data strategy that can deliver real value in support of business goals.

There might be oil in those hills, but you’ll have to buy the land and work it if you want to reap the rewards.