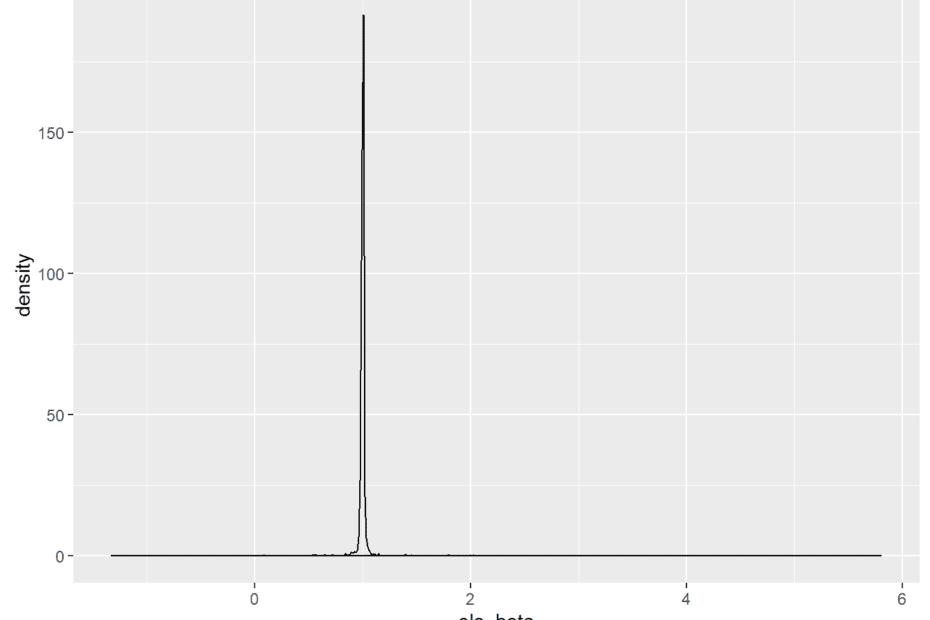

The Likelihood Principle, the MVUE, Ghosts, Cakes and Elves

In my prior blog post, I wrote of a clever elf that could predict the outcome of a mathematically fair process roughly ninety percent of… Read More »The Likelihood Principle, the MVUE, Ghosts, Cakes and Elves