In 2023, online payment fraud cost the world US$48 billion. Businesses prioritize fighting payment fraud and minimizing its financial and reputational damage. In addition to monetary losses, payment fraud can damage a customer’s trust and loyalty, as well as increase the scrutiny from regulators and law enforcement. Organizations use machine learning to combat this growing threat.

Machine learning fights payment fraud effectively due to its power and adaptability in the field of artificial intelligence. Machine learning can identify patterns and anomalies that indicate fraud in real time using large datasets and advanced algorithms. Learning machines can assist businesses in securing their payment processes, thereby protecting their clients, revenues, and reputations.

Investigators can identify suspicious behavior that may indicate fraud by analyzing complex data networks with advanced algorithms. As technology advances, graph analytics may become more important in fighting financial fraud.

How are AI and automation used in fraud prevention?

The prevention of fraud is being revolutionized by technological advancements like AI and automation. Artificial intelligence (AI) is the practice of imitating human intelligence in machines, most notably computers. Learning, reasoning, problem-solving, perceptual processing, and language comprehension are just a few examples of this type of cognitive ability. AI can find patterns and anomalies in large data sets to prevent fraud.

Automation reduces human involvement through control systems and information technologies. Automation helps to identifying new patterns of digital payment fraud prevention by processing and analyzing massive amounts of data that would be too difficult to review manually.

The ability to detect and prevent fraud is improved by AI and automation. They detect fraud in real time, preventing fraudulent transactions. They let predictive analysis find weaknesses and threats before they can be used against you.

How does machine learning work for payment fraud detection and prevention?

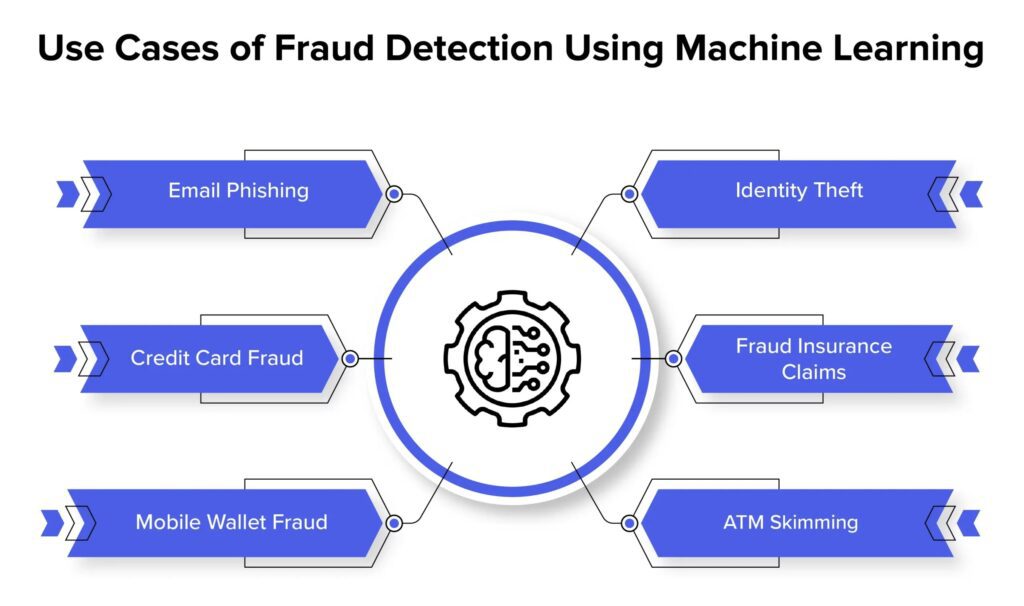

Due to its ability to analyze large amounts of data, identify patterns, and adapt to new information, machine learning is increasingly used in fraud prevention and detection. Common machine learning fraud prevention applications include:

Anomaly detection

Machine-learning algorithms can spot abnormal transactional data patterns. Algorithms learn to distinguish between legitimate transactions and potentially fraudulent behavior by “training” themselves on historical data.

Scoring risk

According to transaction amount, location, frequency, and past behavior, machine-learning models can assign risk scores to transactions or user accounts. A higher risk score indicates that there is a greater possibility of fraud, which enables businesses to prioritize their resources and investigate particular transactions or accounts.

Network analysis

Fraudsters often work together in networks. By analyzing relationships between entities like users, accounts, and devices and identifying unusual connections or clusters, machine-learning methods like graph analysis can reveal these networks.

A text analysis

Emails, social media posts, and customer reviews can be analyzed by machine-learning algorithms to identify fraud or scam patterns or keywords.

Verifying identity

For the purpose of preventing identity theft, machine-learning models can verify the information provided by users, such as images of IDs or data on facial recognition.

Adaptive learning

Machine learning excels at adapting to new information. Machine-learning models can be retrained on new data to detect new fraud patterns as fraudsters change their methods.

Companies can improve detection, reduce false positives, and improve security and customer experience by using machine learning in fraud prevention.

How can machine learning algorithms help in fraud detection and prevention?

AI analyzes data and responds to human language. Pattern recognition and real-time prediction are their functions. Combining ML models is common in AI algorithms.

ML analyzes data and teaches systems autonomously. Over time, ML algorithms improve with more data. Supervised and unsupervised ML are the main methods. UML algorithms find hidden patterns in data, while SML algorithms predict outcomes using labeled data.

For instance, SML algorithms train supervised machine learning models using fraudulent or non-fraudulent historical transaction data. Based on features, UML would use anomaly detection algorithms to identify unusual transactions. However, UML models are less accurate than SML models despite requiring less human intervention.

Behavioral Profiling: The foundation of modern security analytics

Behavioral profiling analyzes security data using machine learning and advanced analytics to define user or computing system behavior profiles. This helps identify behavioral anomalies that may be attacker activity.

As attackers become smarter, behavioral profiling is needed. Signatures (like a malware binary file) and rules (like blocking a user for logging in more than five times in an hour) no longer work to identify all attacks. Attackers may use TTP unknown to the organization’s security. All attacker activity deviates from normal behavior.

Analytical techniques and models

A descriptive analysis

Historical data is analyzed for patterns, trends, and fraud insights using descriptive analytics. To understand fraud patterns, summary statistics, visualizations, and clustering algorithms may be used. This can help companies set benchmarks and spot suspicious behaviors that may indicate fraud.

Predictive analytics

Based on historical data and trends, predictive analytics predicts fraud using machine learning and statistical models. Using logistic regression, decision trees, and neural networks, we can identify instances of fraudulent activity. These methods can predict fraudulent transactions and customers. This helps organizations prioritize high-risk cases and optimize resources to prevent fraud.

Prescriptive analytics

Prescriptive analytics goes beyond prediction to suggest fraud prevention strategies. A combination of descriptive and predictive analytics and optimisation techniques suggests the best course of action. Based on cost-benefit analyses, a prescriptive model may suggest alert or audit thresholds for an organization. Prescriptive analytics helps businesses reduce fraud detection costs and improve pre-emptive measures.

Embracing data analytics techniques for fraud detection

Several data analytics methods are used to detect and combat fraud. These methods allow organizations to analyze massive data sets for patterns, correlations, and anomalies that may indicate suspicious activity. Key fraud detection methods:

Pattern recognition

Data is analyzed for patterns or relationships that may indicate fraudulent transactions. For fraud detection and prevention, association rule learning and sequence mining can identify common schemes or behaviors.

Machine learning algorithms

Improved fraud prediction models can be helped along by machine learning algorithms. K-means, DBSCAN, regression analysis, and neural networks (deep learning, recurrent neural networks) are examples. By using these algorithms, companies can improve their fraud detection and adapt to new fraud types.

Conclusion

In conclusion, the rise in global online payment fraud highlights the need for businesses to strengthen their defenses and adopt AI and automation. This arsenal uses machine learning for anomaly detection, risk scoring, network analysis, text analysis, and identity verification to detect fraud in real time. AI and automation efficiently process large datasets and reduce human intervention, improving fraud prevention.

Modern security analytics relies on machine learning-based behavioral profiling to identify potential attacks by analyzing behavioral anomalies. Descriptive, predictive, and prescriptive analytics help prevent fraud. Data analytics is essential for protecting financial assets, customer trust, and digital reputation as organizations navigate payment fraud. AI, machine learning, and automation must work together to secure a resilient digital payment platforms.