I have played with a few bubbles – stock market, real estate – and it seems that they are relatively predictable, with their growth being spectacular in their last few months. While it is difficult to identify when a bubble starts to form, it is my rule of thumb that you can expect to extract on average 1/3 of a bubble’s energy and turn it into profit. Another rule of mine is to sell if your asset’s value increased by more than 200% within a four year time period. I am wondering if some scientists are analyzing these bubbles, to identify patterns that help extract money from these bubbles, and find better rules than mines.

A simple example is the stock market. In early 2000, the Nasdaq bubble that had been forming since the mid-nineties, deflated rapidly, as seen in the chart below (first peak). It went from 1,300 to 4,000, then back to 1,300 over a period of 5 years. My point is that it is easy to enter at 2,000 (pre-peak) and exit at 2,900 (either pre-peak or shortly after the peak on the way down), doing 1/3 of the ride. The bubble deflation is like an Earthquake, with several after-shocks over a short time period (strong ups and downs), and these waves (the after-shocks) can be leveraged too, as they are somewhat predictable, both in intensity, velocity, and duration. One trading strategy consists of doing nothing for years with your cash, then ride out all these waves after a big bubble collapse, then keep your money till the next big event.

In the real estate market, my home (in the Bay Area) went from $270k when we bought it brand new in 2000, to about $650k by 2007, and then back down to $230k by 2013. We sold in 2005 for $550k as I strongly felt the bubble, bought a new home in Washington state in an area that was not experiencing a bubble, and managed to win both in CA and in WA. In this case, we substantially outperformed our 1/3 rule of thumb: we extracted (550-270) / (650-270) = 74% of the bubble, and turned it into real money. Since we were not requested to make a down payment when we bought the house (only to prove that we had the money to do so), you could say that our return on investment was infinite.

The duration of a bubble, the moment when it will deflate, how fast and how low it will fall back, the exponential shape, all these parameters seem to be relatively predictable and rather constant across all types of bubbles, as if these bubbles are governed by physical laws. Words like bubble deleveraging seems to imply that there is a physical phenomenon at play. And at least – using gut feelings – you can do well enough to allow you to extract 1/3 of the wealth generated (and subsequently lost if you did not exit), as if these bubbles are, to some extent, predictable and rather well behaved..

Are there any people actually using models to leverage these bubbles? Maybe VC firms? Has anyone written research papers about them?

Here are two other bubbles (they haven’t popped yet), and how I rode them out, with advice applicable to anyone:

- Education: Cost is growing exponentially, many university curricula are outdated partly because of old tenured professors and heavy administration. And ROI is shrinking for students. There will be a few great schools that will adapt and survive, and many that will disappear. In my case, I earned my education overseas for a fraction of the cost and with no student loan: anyone can do it. Many data camps are now being offered for a fraction of the cost and time required for college education, especially in data science and for highly educated people: they are offered as on-demand, online programs. The time is perfect right now to offer such training, charge $1,000 per program, and make a few million dollars, for the entrepreneur who execute well. As for financing my kids’ education, instead, I consider having them enrolled in my free apprenticeship, and have them work for my company, saving up to $200k in college costs, if they are interested.

- Healthcare: Population is aging, with more risk-adverse people ready to pay top dollars for health care. Cost is increasing exponentially as long as people are ready to pay for it. My solution is to avoid official health care as much as possible, focusing on self-healing and prevention (sugar-free diet), especially after seeing a few one-hour emergency visits that cost $5,000 and are totally worthless, as well as walking out of emergency clinics (due to long waiting lines) and surviving just fine. Another way to make money from this bubble is to create a startup that provides prices for dozens of popular procedures across thousands of hospitals (with confidence intervals), based on patient bills submitted online by users, and anonymized. Such a startup would easily become valued billions of dollars on Wall Street.

A final note about the stock market:

The reason why it is very hard to consistently make money on the stock market is because it is like your morning commute. Tons of very smart people are looking at traffic patterns and any way to beat the traffic each day, and as a result, all roads are clogged and there is no way to win. This is indeed explained by a mathematical theorem that says that arbitraging in a saturated, non-regulated market is impossible. That said, there are some solutions and winners: people telecommuting, changing their work schedule, moving to a different city, taking the company bus or a driver-less car to go to work and working during commute time. In some ways, this is similar to people using insider trading or bubble riding to win in the stock market. Talking about commuting, the energy market (gas) is another example of a bubble that went burst.

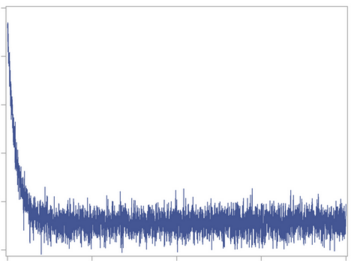

And if you ask my predictions for the stock market, my answer is that it is entering a long, probably permanent phase of neutral behavior with high volatility, just like any MCMC simulation algorithm, after a rather long training period, enters a stable mode (no more growth or decline) characterized by many deep lows and highs, as illustrated below. If you compress time and use a logarithmic scale in the top picture in this article, both charts will exhibit very similar patterns after appropriate mapping.

Source for picture: click here

Conclusion:

Somehow, leveraging bubbles is equal to leveraging innumeracy. The guy who purchased my CA home for $550k eventually defaulted. Some of those who spend a lot of money in healthcare and are otherwise in good health, may do so because they overestimate the risks (of not visiting a doctor, of not getting the most expensive treatments) and are not analytically savvy: they want tons of exams, the most modern drugs, the most modern medical procedures, they refuse to get drugs from abroad for a third of the cost. They don’t inquire about how much a procedure will cost, they do not do proper comparison shopping (when price variance is phenomenal). They end up spending at least $500k more in health care expenditures over their lifetime (including cost of insurance) than me, for similar if not worse results.

Finally, I could have named this article An Easy Way to Make One Million Dollars: according to my computations, that’s pretty much what I have gained, with almost no amount of work: with just pure (good) decision making. I have no doubt that you can do better, in a bigger scale, by automating what I did, and by carefully analyzing data to make decisions, rather than relying on gut feelings. But you still do need to have a good judgment to be able to succeed: data and models alone won’t be enough here.

One day, time permitting, I might offer this type of financial services. Bubble leveraging is a skill that some data scientists naturally have. I am not sure how, and to what extent it can be learned. But I am convinced that many – especially data scientists – can learn to dramatically improve financial management, and apply the newly gained skills to better their personal life, their business, or for the benefit of their employer. Playing with bubbles can be a lot of fun, and very rewarding!

About the author: Vincent Granville worked for Visa, eBay, Microsoft, Wells Fargo, NBC, a few startups and various organizations, to optimize business problems, boost ROI or to develop ROI attribution models, developing new techniques and systems to leverage modern big data and deliver added value. Vincent owns several patents, published in top scientific journals, raised VC funding, and founded a few startups. The most recent one – Data Science Central – is growing exponentially, and delivers a substantial profit margin. Vincent also manages his own self-funded research lab, focusing on simplifying, unifying, modernizing, automating, scaling, and dramatically optimizing statistical techniques. Vincent’s focus is on producing robust, automatable tools, API’s and algorithms that can be used and understood by the layman, and at the same time adapted to modern big, fast-flowing, unstructured data. Vincent is a post-graduate from Cambridge University.

Related article:

DSC Resources

- Career: Training | Books | Cheat Sheet | Apprenticeship | Certification | Salary Surveys | Jobs

- Knowledge: Research | Competitions | Webinars | Our Book | Members Only | Search DSC

- Buzz: Business News | Announcements | Events | RSS Feeds

- Misc: Top Links | Code Snippets | External Resources | Best Blogs | Subscribe | For Bloggers

Additional Reading

- What statisticians think about data scientists

- Data Science Compared to 16 Analytic Disciplines

- 10 types of data scientists

- 91 job interview questions for data scientists

- 50 Questions to Test True Data Science Knowledge

- 24 Uses of Statistical Modeling

- 21 data science systems used by Amazon to operate its business

- Top 20 Big Data Experts to Follow (Includes Scoring Algorithm)

- 5 Data Science Leaders Share their Predictions for 2016 and Beyond

- 50 Articles about Hadoop and Related Topics

- 10 Modern Statistical Concepts Discovered by Data Scientists

- Top data science keywords on DSC

- 4 easy steps to becoming a data scientist

- 22 tips for better data science

- How to detect spurious correlations, and how to find the real ones

- 17 short tutorials all data scientists should read (and practice)

- High versus low-level data science

Follow us on Twitter: @DataScienceCtrl | @AnalyticBridge