I am always looking for examples to bolster my University of San Francisco “Economic Value of Data” research efforts, and I think I’ve found a good one. The NHO article “Is value creation with data something Norway can live off of?” states that Norway believes that 1) the financial or economic value that Norway will be able to extract from data is on a par with the oil, while 2) the value of data is even more important than oil when considering the broader society impact.

Specifically, the article discusses:

- The productivity growth resulting from the use of resource data in the rest of the public and private sectors, and the economic value this generates in the form of increased GDP.

- The welfare increase that the use of resource data provides in the form of better public services (or reduced public expenditure), better health, fewer accidents, reduced queues, reduced climate and environmental problems and many other socio-economic effects.”

[Note: The article is written in Norwegian, so open the link in Google Chrome to get English translation.]

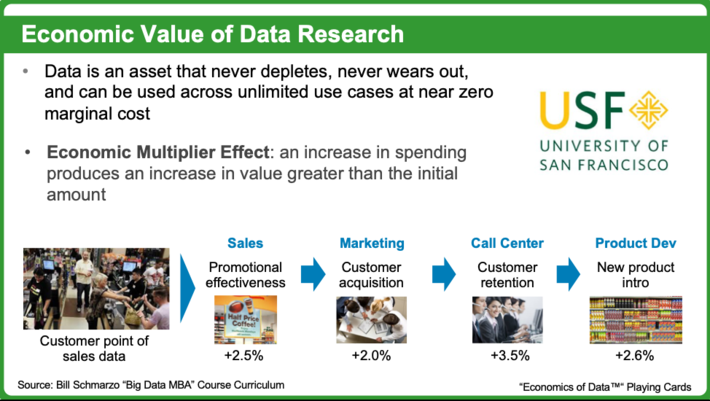

The economic value attained through business productivity growth and the society value attained through welfare or society benefits supports our research into the unique economic characteristics of a digital asset – data – that never wears out, never depletes and can be used across an unlimited number of use cases at a near zero marginal cost.

This begs the real question about the economic value of data: Does the infinite re-usability of data ultimately make it a more powerful driver of economic growth than oil?

Understanding the Economic Value of Data Research

I have written extensively about the economic value of data, starting with the research paper that I published with Professor Mouwafac Sidaoui at the University of San Francisco titled “Applying Economic Concepts to Big Data to Determine the Financial Value of the Organisations Data and Analytics and Understating the Ramifications on the Organization’s Financial Statements and IT Operations and Business Strategies”. Yes, very long, formal sounding title makes a big difference when publishing a university research paper!

By the way, the blog “Determining the Economic Value of Data” provides more details on the methodology (for those who do not want to trudge through the research paper).

The big break-through for me on the research project was transitioning from an accounting frame to an economics frame. Accounting is a retrospective-looking methodology for determining asset valuation based upon the acquisition cost of an asset. This accounting perspective frames the way organizations measure and manage their business operations (e.g., balance sheets, income statements, cash flow statements, depreciation schedules).

Economics, on the other hand, brings a forward-looking perspective on determining asset valuation. Organizations that use an economics frame to measure and manage their business operations focus on the value or wealth that an asset can generate or create. Not only does economics provide a forward-looking organizational valuation frame, but the unique characteristics of digital assets (such as data, analytics and applications) exploit that economics frame further (see Figure 1).

The problem with traditional physical assets – cars, trains, machinery, CT scanners, oil – is that they wear out over or deplete over time. Physical assets have a limited life, which is why organization’s use accounting techniques to financially account for the depreciation or depletion of these assets. However digital assets like data and analytics never wear out, never deplete and the same digital asset can be re-used an infinite number of times at near zero marginal cost. Try pulling off that trick with your wind turbines, locomotives, compressors, chillers, and industrial presses!

Mastering the economics of data is a great start, but why stop there? Can Norway (or other countries) take the economics of digital assets one step further and validate “Schmarzo’s Digital Asset Valuation Theorem” (and my bid for a Nobel Prize in economics) by creating physical assets – cars, trains, planes, elevators, compressors, presses – that appreciate, not depreciate, in value?

Let’s explore this further.

Creating Assets that Appreciate, not Depreciate, in Value

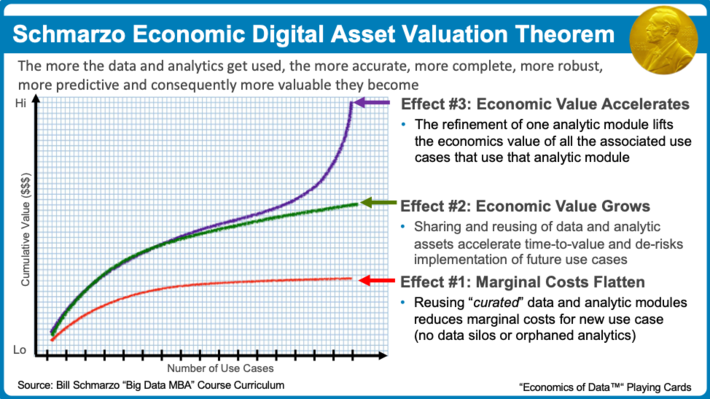

As a reminder, The Schmarzo “Economic Digital Asset Valuation Theorem” articulates why organizations need to invest in the creation, operationalization and reuse of their data and analytics digital assets (see Figure 3).

The Schmarzo “Economic Digital Asset Valuation Theorem” yields three economic “effects” that are unique for digital assets:

- Digital Asset Economic Effect #1: Marginal Costs Flatten. Since data never depletes, never wears out and can be reused at near zero marginal cost, the marginal costs associated with reusing data and analytic models flattens.

- Digital Asset Economic Effect #2: Economic Value Grows. Sharing and reusing of data and analytic models accelerate future use case time-to-value while de-risking implementation.

- Digital Asset Economic Effect #3: Economic Value Accelerates. Analytic model refinement (to improve analytic model accuracy, precision and recall) lifts the economic value of all associated use cases (that use that same analytic module).

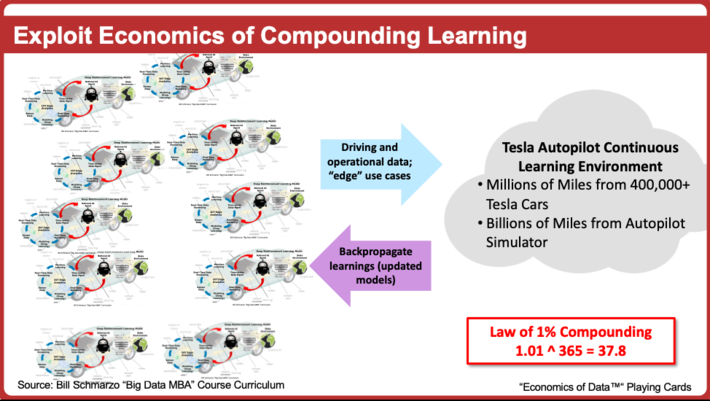

Effect #3 is driven by what I call the Elon Musk effect:

“If you buy a Tesla today, I believe you’re buying an appreciating asset, not a depreciating asset.” – Elon Musk

Elon Musk believes that Tesla cars appreciate in value as a result of the collective knowledge / wisdom / intelligence gleaned from the operational and driving data that is being captured across the usage of the growing fleet of Tesla autonomous cars; that what is experienced and learned by one Tesla car, is validated, codified and propagated back to every other Tesla car making the collective Tesla cars more intelligent, and therefore more valuable.

Tesla autonomous cars are exploiting the capabilities of Deep Learning to create continuously learning autonomous cars that get more reliable, more efficient, safer, more intelligent and consequently more valuable through usage…with minimal human intervention!

Norway and the Economic Value of Data Summary

The NHO article states:

“New enabling technologies such as big data analytics and artificial intelligence pave the way for a new data era. In the years ahead towards 2030, Norway will be able to realize large economic values from the resource data. We have estimated that the potential for data-based value creation will reach approx. NOK 300 billion in 2030. Based on available forecasts for Norwegian oil and gas operations, value creation from data will thus be able to pass value creation from Norwegian petroleum activities. It can therefore be argued that data actually has the potential to become Norway’s “new oil” in the economic sense. If we include the socio-economic gains beyond the value creation that can be measured in GDP (the “welfare increase”), the resource data has a value to society that far exceeds the petroleum resources.”

Couldn’t have said it better myself.

So, how valuable is data and analytics to the future of your country, or company, or even yourself?

Economic Value of Data Series

For those interested, here is the series of blogs that I have written about the Economic Value of Data and Digital Assets. You can say that I can’t get the topic out of my blood! Print that on my tombstone? I don’t know; surprise me.