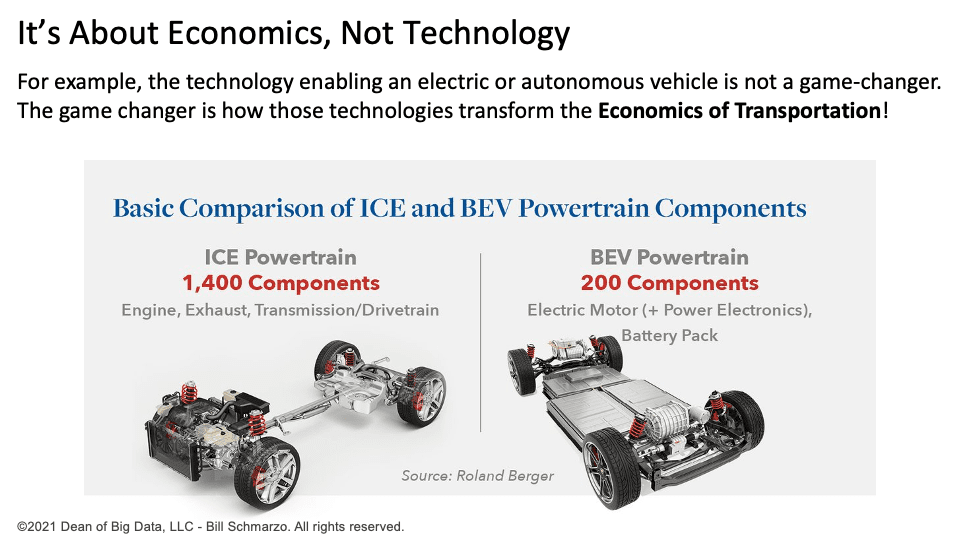

It’s not technology advancements that are the game-changers. The game-changer is how those technological advancements are leveraged to economically transform industries and society.

2024 is going to be a big year, especially in the realm of Artificial Intelligence (AI). Generative AI (GenAI) has lit a fire under organizations that suddenly have a senior management and Board of Directors mandate to “leverage AI to get value from their data.” However, there are two challenges that organizations will face in 2024 to “leverage AI to get value from their data.” And the first step in addressing these two challenges is to realize that this is not a technology challenge. The technology works. Period. No, the two challenges are:

#1) There is too much focus on “implementing AI” and not enough focus on “deriving value from AI.” And that requires first understanding how the organization defines and measures its value-creation processes. Don’t become data-driven or AI-obsessed. Instead, become a value-fanatic!

#2) Empowering the organization to help identify where and how AI and data can be leveraged to create value. That means educating everyone on AI and data literacy so that everyone understands their roles, responsibilities, and rights concerning the meaningful, relevant, responsible, and ethical deployment of AI.

This two-part blog series will highlight the potential of GenAI / AI from an economic perspective. With a focus on economics, the potential for GenAI / AI to transform industries and society is overwhelming. But first, a word of warning…

Beware the Productivity Trap

Beware: faster does not always mean better outcomes. Better means more accurate, more reliable, more responsible, more relevant, and less risky outcomes.

The productivity trap occurs when organizations focus on doing more in less time and with less effort, based on the assumption that productivity is the ultimate goal of an organization. However, this flawed assumption can be dangerous, leading to poor outcomes for the organization and its customers, stakeholders, and constituents. Some of the negative ramifications of the productivity trap include:

- Increased risk: By not taking the time to thoroughly identify, articulate, and quantify the risks associated with potential failure and potential unintended consequences, organizations may expose themselves to legal, financial, reputational, or operational damages.

- Reduced accuracy: By trying to make well-defined, accurate decisions and actions quickly, organizations may compromise the quality of their work or ignore important details.

- Diminished relevance: By neglecting to create a compelling and differentiated relationship with their customers, stakeholders, and constituents, organizations may lose their competitive edge or fail to meet their expectations.

- Irresponsibility: By doing things faster without full consideration of the actions’ impact on the environment, diversity, and social issues, organizations may harm their social and environmental responsibility.

We can’t become complacent by the GenAI productivity sirens because faster doesn’t always mean better, more accurate, or less risky when reengineering or transforming operational processes and business models. Remember, faster does not equal “better” (Figure 1).

We must adopt a growth mindset to escape the productivity trap. A growth mindset leverages economics and design thinking to empower and unleash the creative juices of the entire organization to identify new sources of wealth or “value” that benefit customers, constituents, and society.

GenAI / AI is an economic opportunity to transform industries and society by creating new methods and models to derive and drive new sources of customer, product, service, and operational value. But first, we must embrace that economic mindset.

Creating the Economic Mindset

Economics is the branch of knowledge concerned with producing, consuming, and transferring wealth or value.

The economic mindset is a way of thinking and acting that focuses on creating new sources of value rather than just doing more things in less time. But do not confuse an economic mindset with a financial mindset.

- A financial mindset is a way of thinking and acting that focuses on managing money and achieving financial goals.

- An economic mindset is a way of thinking and acting that focuses on creating and distributing value for customers, stakeholders, and society.

The benefits of an economic mindset include:

- Constantly striving to blend, bend, and re-engineer to uncover new, innovative ways to create value.

- Thrive in today’s competitive environment by finding a unique competitive advantage through value-creation creativity and innovation.

- Prepare for the future by capitalizing on market changes and challenges to identify new models for creating value.

- Improve organizational performance by optimizing the value-creation resources and processes.

- Enhance social well-being by balancing profits, operational excellence, environmental impact, society improvements, and ethical treatment.

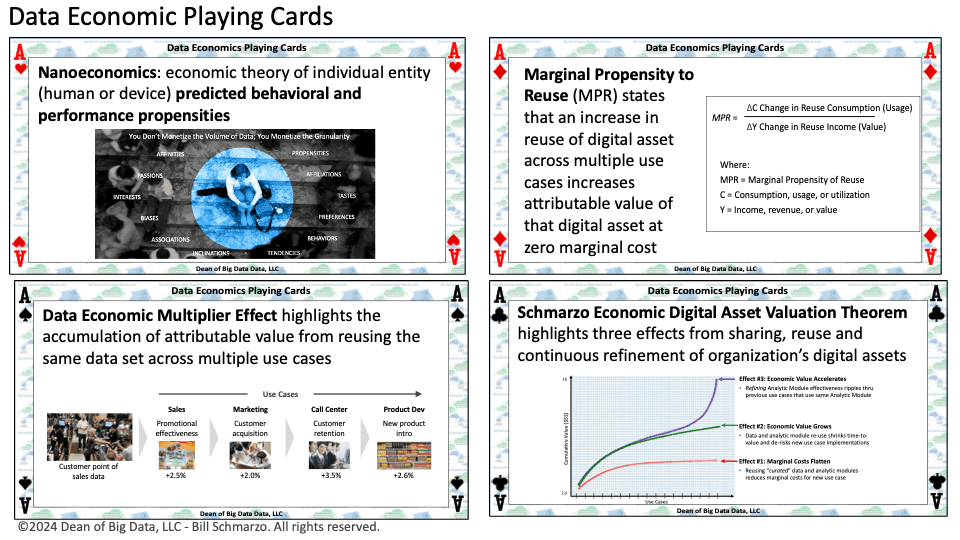

In the era of Big Data and AI, an economic mindset means embracing new data economic concepts and theorems that can guide organizations in creating these new sources of value, including (Figure 1):

- Nanoeconomics is the economic theory of individual entity (human or device) predicted behavioral and performance propensities (insights). Nanoeconomics helps organizations understand the behaviors of their customers, stakeholders, machinery, devices, operations, and other entities to deliver more relevant and meaningful outcomes.

- Data Economic Multiplier Effect is the economic ramifications of accumulating attributable and quantifiable value from reusing a data set against multiple use cases. It shows how data, when properly curated and sharable, exhibits an Economic Multiplier Effect, which is the ratio of the impact of an incremental increase in investment on the resulting incremental increase in output or value.

- Schmarzo Economic Digital Asset Valuation Theorem determines the value of a data asset based on its reuse across multiple use cases. It states that a data asset’s value increases the more it is reused across multiple use cases and that if the data is “curated” and governed correctly, this reuse comes at near zero marginal cost.

- Marginal Propensity to Reuse (MPR) explains how data reuse across multiple use cases can increase data value. It is based on the idea that when adequately curated and governed, data never wears out, never depletes, and can be reused across unlimited use cases. The more a data set is reused, the more value it generates for the institution.

Figure 1: Data Economic Playing Cards

Fueling Economic Transformation

Industry economic transformation leverages innovation (i.e., technology, process, people-based innovation) to re-engineer the economics of an industry by altering industry competition, disrupting traditional business models, and reengineering value creation processes to unleash new sources of value.

History is full of examples of technological advancements that led to economic transformation:

- Printing press: The printing press transformed the production of books, significantly lowering book production costs while increasing the spread of literacy, education, religion, science, and culture.

- Internet: The Internet transformed nearly every industry by eliminating time and distance as operational constraints and stimulating new forms of innovation, entrepreneurship, and collaboration that created new industries such as e-commerce, online education, and social media.

- Personal computing: Personal computing (PCs) transformed the computer industry, significantly reducing computing costs while empowering individuals to create new industries such as software development and digital media creation.

Today, we are witnessing other examples of technology advancements transforming industries:

- Renewable Energy: Renewable energy is transforming the energy production, distribution, and consumption industries by improving energy security, affordability, and diversity while reducing greenhouse gas emissions, air pollution, noise pollution, and dependence on fossil fuels.

- Electric Vehicles: Electric vehicles (EVs) are transforming the transportation industry by improving energy efficiency, mobility, and accessibility while reducing greenhouse gas emissions, air pollution, noise pollution, and dependence on oil imports.

Figure 2: It’s About Economics, Not Technology!

Economics is a powerful force that seeks to balance differing perspectives and rationales to deliver meaningful, relevant, responsible, and ethical organizational and societal outcomes. In today’s digital age, data economics is the “force multiplier” that can take your organization to game-changing levels of performance and innovation.

Summary

It’s not technology advancements that are the game-changers. The game-changer is how those technological advancements are leveraged to economically transform industries and society.

In Part 1, we talked about how to leverage an economic mindset to avoid the productivity trap. We also discussed some critical enabling data economic concepts and how those concepts can take your organization to the next level of game-changing performance and innovation.

In Part 2, we will dive deep into the nanoeconomics concept, the game-changing “force multiplier” that organizations can leverage to economically transform their industry. And we will provide a surprising perspective on GenAI’s role in activating those economic concepts.