“If you make decisions based upon averages, at best, you’ll get average results”

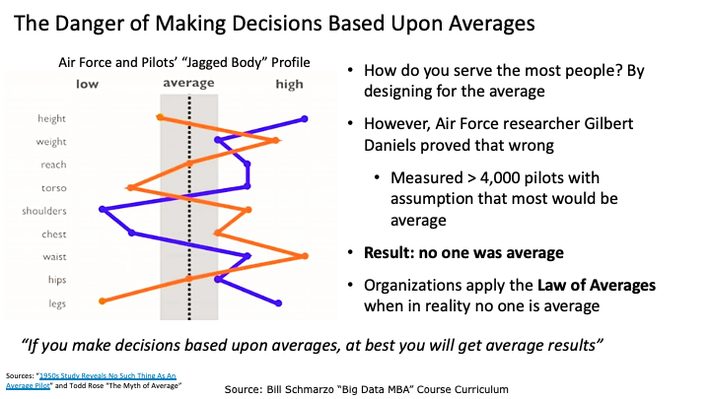

During the 1950s[1], United States Air Force pilots were having trouble controlling their planes. The problem turned out to be the cockpit, or more specifically, the fact that the cockpit had just one design: one designed for the 1920’s average pilot. The Air Force concluded that they simply needed to update their measurement of the average pilot, adjust the cockpit accordingly, and the pilot handling troubles would go away.

With the help of Lieutenant Gilbert Daniels, the Air Force measured more than 4,000 pilots across 10 size dimensions. The air force had assumed that the vast majority of pilots would fall within average across the 10 dimensions. In reality, none NONE fell within average across the 10 dimensions; that is, out of 4,000 pilots, zero of them were “average” (see Figure 1).

Figure 1: The Danger of Making Decisions Based Upon Averages

The Air Force’s “aha” moment?

If the cockpit was designed for the average pilot, it was actually designed for no pilot

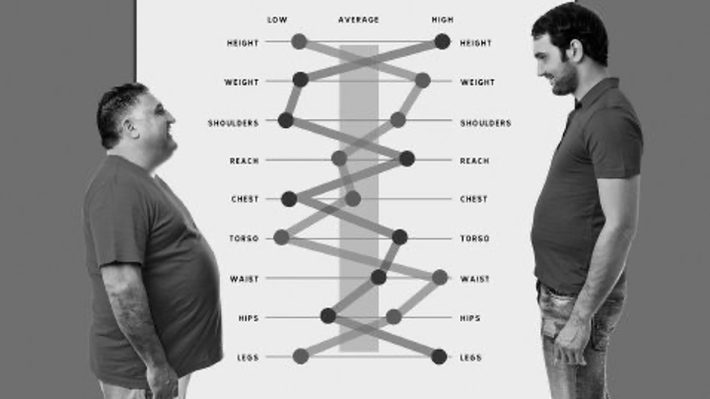

Todd Rose came up with the Jaggedness Principle of individuality. The Jaggedness Principle asserts that measuring a collection of traits across a sufficiently large number of individuals, roughly half of individuals will be above average, and roughly half will be below average for any particular trait. And that across all the traits, few (if anyone) will actually be “average” (notice the “jagged” line for each individual in Figure 2).

Figure 2: Source: https://publicism.info/business/average/5.html

Since no one is “average”, why do organizations continue to make decisions based upon averages? We have spent much of our university education and professional career being taught to make decisions based upon averages – average churn rate, average click rate, average market basket size, average mortality rates, average COVID19 infection and death rates. And maybe when your data analytics tool of choice was a spreadsheet, then the best we could do was using averages to make overly generalized policy and operational decisions. But the world is changing¦ and changing rapidly!

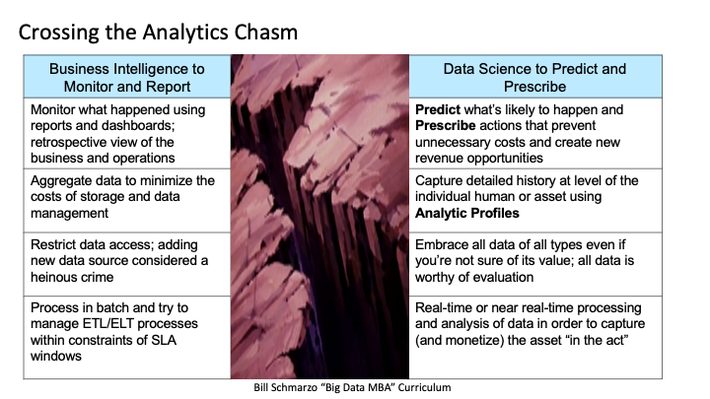

Moving Away from Averages to Cross the Analytics Chasm

Unfortunately, averages don’t provide the level of granularity necessary to make precision decisions that drive the optimization of the organization’s key business and operational use cases. “On average” is not how successful companies will survive in a world of continuous transformation.

Fortunately, Big Data, Data Science, Analytic Profiles, and Nanoeconomics provide the foundation for changing the organization’s decision-making frame. It’s time for organizations – and management teams – to “Cross the Analytics Chasm” from making overly-generalized operational and policy decisions based upon averages, to making granular, precision decisions using big data and data science (see Figure 3).

Figure 3: Crossing the Analytics Chasm with Nanoeconomics

Some critical concepts for crossing the Analytics Chasm include:

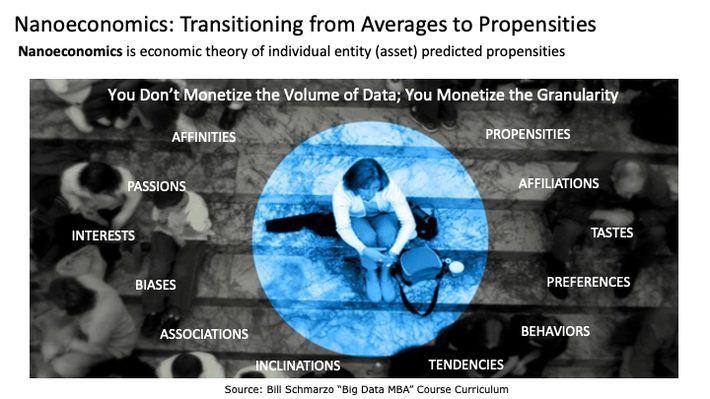

- Nanoeconomics. Nanoeconomics is the important concept guiding organizations across the Analytics Chasm. Nanoeconomics is economic theory of individual entity (asset) predicted propensities, whether the entity (asset) be human (doctor, nurse, technician, operator, teacher) or device (wind turbine, automobile, chiller, compressor). See Figure 4.

Figure 4: Nanoeconomics is economic theory of individual entity predicted propensities

Nanoeconomics is based upon identifying and codifying individual asset (human or device) predictable propensities, tendencies, patterns, and relationships. And from those predicted propensities, organizations can make informed, precision decisions that seek to optimize the organization’s key business and operational use cases.

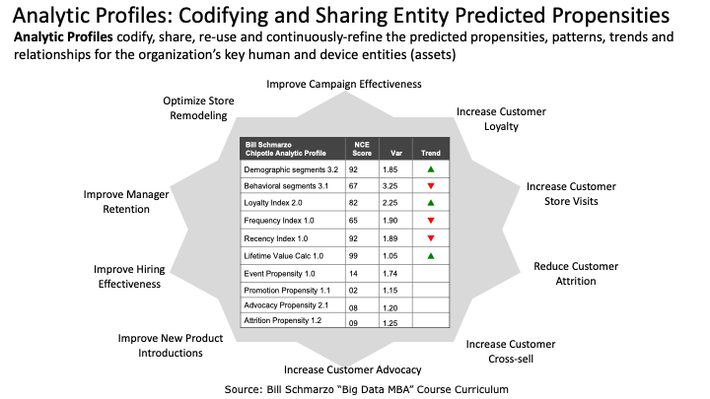

- Analytic Profiles. Those predictive propensities are captured in Analytic Profiles (or asset models) that facilitates the application of those customer, product, and operational propensities against the organization’s key business and operational use cases (see Figure 5).

Figure 5: Analytic Profiles

See the blog “Analytic Profiles: Key to Data Monetization” for more details on the concept of Analytic Profiles.

Summary

“If you make decisions based upon averages, at best, you’ll get average results”

Crossing the Analytics Chasm requires a mind shift in how organization’s make decisions. Making decisions based “on average” is not how successful companies will survive in the age of digital economic transformation. Organizations need to embrace the power of nanoeconomics – the economics of individual entity (human or device asset) predicted propensities.

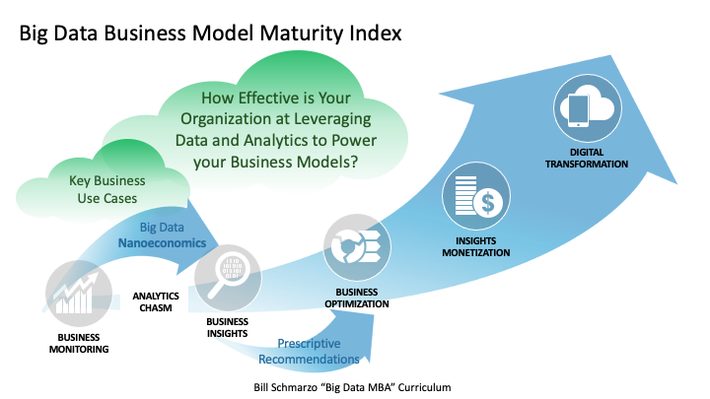

Organizations can couple the concept of nanoeconomics with Analytic Profiles to leap across the Analytics Chasm in transitioning from decisions based on averages, to decisions based upon predicted propensities. And as a result, these organizations can become more effective at leveraging data and analytics to power their business and operational models (see Figure 6).

Figure 6: The Big Data Business Model Maturity Index

The valuable data and analytic concepts mastered to cross the Analytics Chasm – nanoeconomics and analytic profiles – positions the organization to exploit the economic potential of data and analytics and transverse the Big Data Business Mode Maturity Index to re-invest business and operational processes, dis-intermediate customer relationships, and transform industry value creation processes.

But first ya gotta start by getting over that darn Analytics Chasm!

[1] Story taken from the Harvard Graduate School of Education article “Beyond Average”