Mike Romeri, CEO

Analytics2Go

During the current COVID-19 pandemic, virtually all companies have faced significant changes in demand. Some companies have seen significant increases (e.g., grocery chains, packaged food companies), and others have seen their revenue drop to unsustainable levels (e.g., air travel, hospitality, automotive). Still others have seen both outcomes if they serve different industry segments with very different levels of end-user demand.

While the specific circumstances vary, all product-producing companies shared a common experience, which included:

- Adverse trends were not identified early enough

- Implications of disruption were hard to understand

- The ability to forecast the near- and medium-term future was limited

- It was difficult to develop a coherent set of alternative scenarios

- Companies were slow to identify and select the best approach

- Current planning and execution systems were not redirected quickly enough

- Analytic solutions in use were siloed and not smart enough

- Existing predictive and prescriptive analytics were not very helpful

It is not hard to understand why this happened. Supply chain analytics deployed so far have been most effective when they were backward-looking and could be used to understand and help resolve current problems. Supply chains are designed to manage coordination and collaboration over a vast number of suppliers and service providers. The pandemic created so many problems that the supply chain was impacted pervasively—e.g., unexpected problems with a single key supplier could complicate decision making across the entire supply chain. Current planning and execution systems and related analytics were all designed to provide insights for a subset of, and not the entire, supply chain.

How Smarter Analytics Can Help

It is probably safe to assume that the future will continue to be less predictable than current supply chain design teams expected. Accordingly, analytics need to become smarter in three essential ways in order to enable existing enterprise processes (e.g., S&OP) and IT solutions (e.g., ERP) to perform more effectively in the face of greater uncertainty. So, what is required from new, smarter supply chain analytics?

- Need to identify adverse trends at the earliest possible moment

- Rapid development and evaluation of alternatives to avoid disruptions

- Quick delivery of agreed plans to SC planning and execution workflows

Up until now, the computing power needed to fulfill this vision has not been either time- or cost-effective enough to support it. The availability of on-demand compute resources makes real-time, supply-chain analytics feasible. And over time, the cost of on-demand compute time will continue to decline at a rapid rate, especially as new GRU solutions enable real-time algorithms to make use of pre-built quantum computing solutions.

Smart SC analytics will focus on predicting the future. A key element will be far more extensive monitoring of social, business, and governmental behaviors. Data sets already exist to support the early identification of changes in the environment that can be used to predict both changes in demand and potential disruptive events.

Most companies have developed, but not automated, business continuity plans that can be implemented in the face of many different forms of potential disruptions. Imagine using analytics to create a set of recommended actions automatically that consider the logic of past business continuity planning and strategies. But that is only the beginning.

Most supply chain knowledge workers, managers, and executives are becoming familiar with the concept of AI and human collaboration. We have learned that AI is far better at finding important insights in vast, daily datasets (e.g., POS data from a key customer). Let’s now stretch that thinking toward the future. Companies often have hundreds or thousands of suppliers and manage tens or hundreds of thousands of SKUs. Understanding how to adjust the supply chain to a new future “at-scale” is also an advantage that AI will have over humans.

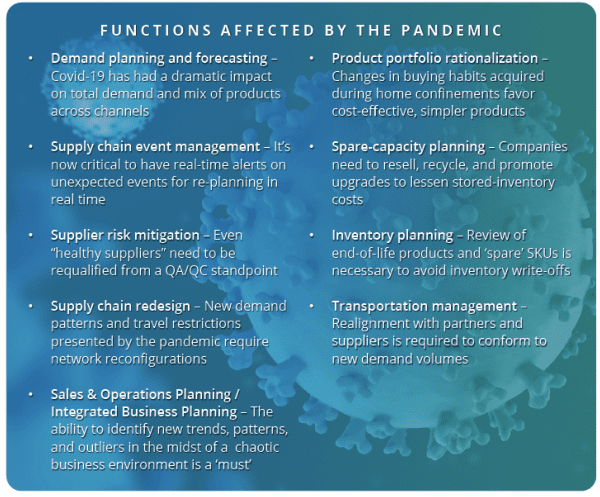

Companies have pursued and are still pursuing a vast number of focused improvement efforts. Below is a representative list of the challenges and opportunities that smarter analytics can address:

- Demand planning and forecasting – Most forecasting models used by companies are based on multiple years’ time series, which are unable to yield accurate predictions at the moment given the dramatic impact of Covid-19, not only on total demand, but also on the mix of products across channels.

Analytics opportunity: Monitor demand drivers and help knowledge workers understand how changes in relevant consumer and business behaviors are evolving and how they will affect product demand selectively (product, season, geography, etc.) as well as globally. - Supply chain event management– Real-time alerts on unexpected events have become even more critical than they already were. End-to-end, real-time re-planning is a vital capability to avoid eroding the bottom line further.

Analytics opportunity: Automatically launch pre-defined work-disruption-avoidance workflows and provide necessary data and recommended decisions to knowledge workers within their current operation context (IT solution, workflow, device, etc.). Monitor progress, identify risks, and define and predict when necessary changes need to be completed to avoid a disruption. - Supplier risk mitigation– Companies need to complete a thorough review of their supplier portfolio to reevaluate, forecast, and monitor on an ongoing basis the financial health of each supplier and put in place contingency plans accordingly. Even “healthy suppliers” will need to be requalified from a QA/QC standpoint (because most will try to bring down their sourcing, production, and delivery costs, potentially jeopardizing quality and punctuality).

Analytics opportunity: Identify and prioritize at-risk suppliers and external data and launch-requalification and corrective action workflows, again providing the insights knowledge workers need to make optimal decisions. - Supply chain redesign – With new demand patterns and travel restrictions poised to persist over the longer term, companies have a crucial need to reassess their current supply chain network and to re-evaluate optimization strategies.

Analytics opportunity: Identify redesign priorities and create redesign scenario alternatives automatically or semi-automatically. - Sales & Operations Planning / Integrated Business Planning – The ability to identify new trends, patterns, and outliers in the midst of the chaotic business environment that has become the new normal since mid-March is becoming a critical competitive differentiator. Companies capable of getting more accurate and timely insights—typically by blending recent internal data with external indicators—will be able to use their S&OP process as a strategic weapon.

Analytics opportunity: Use updated forecasting models to change planning assumptions rapidly and to enable execution processes to reflect the new reality as quickly as possible. - Product portfolio rationalization – Covid-19 is bringing major changes in buying habits for the long term. More cost effective, simpler products are likely to fare better than complex, feature-rich, more expensive products. Companies should start immediately looking at their product portfolio and develop a rationalization strategy to maximize their focus on best sellers and reduce overall costs.

Analytics opportunity: Based on changes in demand drivers, identify products that are candidates for early retirement and provide supporting data and decision recommendations for relevant knowledge workers to apply in an accelerated way. - Spare-capacity planning– Except for a few industries, most companies are now faced with spare capacity for the foreseeable future (machines, tools, and people). Strategies will need to be designed to make the most of it (resell, recycle, upgrade, ….)

Analytics opportunity: Identify spare capacity across the entire supply chain and provide analytic insights and decision recommendations for knowledge workers to evaluate and execute. - Inventory planning – Safety stock policies need to be immediately reviewed, leading to a reclassification of all SKUs. Products whose end of life was accelerated by Covid-19 should be monitored very closely to avoid a spike in inventory write-offs.

Analytics opportunity: Reevaluate safety stock calculations and automatically launch standard workflows to make adjustments as needed across the enterprise as quickly as possible. - Transportation management – Companies that have outsourced their transportation to 3PLs need to urgently review their contracts to obtain better terms that are more in line with the new demand volumes and patterns.

Analytics opportunity: Rapidly develop new planning assumptions to enable internal and partner planning and optimization analyses to be re-evaluated based on the changes in the operating environment.

Conclusion

It has taken many years or decades to develop the solutions and workflows that are used to manage and optimize current planning and execution efforts. An inherent assumption in the design of these “systems” has been that the past can be a good predictor of the future. It is a risky assumption to believe that now, considering the impacts of pandemics and likely changes in China-US trade relations.

Smarter supply chain analytics are required to adapt to future, unpredictable disruptions. The most successful companies will use analytics to reformulate planning and execution assumptions quickly enough to avoid suffering major impacts from each potential supply chain assumption.

In addition to being future-focused, smart analytics need to provide knowledge workers with detailed insights that make adjusting to the new future easier to understand and to implement. As always, we don’t recommend a big-bang approach. Start small and build on your success. Adopting new, smarter analytics is necessary for the companies who will continue to excel in the years to come.