In my previous post, I introduced the ELAINE Community Tool that can be used to discover variables from textual communications.

Statistical predictors work well for charting the course of economic activities based on macro factors that elicit supply and demand if the market environment is within a close proximity of a pattern that resembles previous economic cycles. Unfortunately, in today’s geo-political environment, many of these new variables are injecting forces that drive the volatility of the financial market. It is beyond the scope of statistical analysis or probability analysis when these variables are new and unknown.

While the traditional wisdom is to use statistical data to formulate investment strategy, this technique only works if predictors are known. In every case, Symbolic Logic can serve as a sanity check to validate the adequacy of statistical predictors.

In a nutshell, this is how Symbolic Logic can help:

1. An input source of substantial financial news stream

2. A Symbolic Logic implementation that performs the following:

- Align semantics and context from news source with Symbolic Logic

- Discover subjects such as person, place, event, action etc. from the news

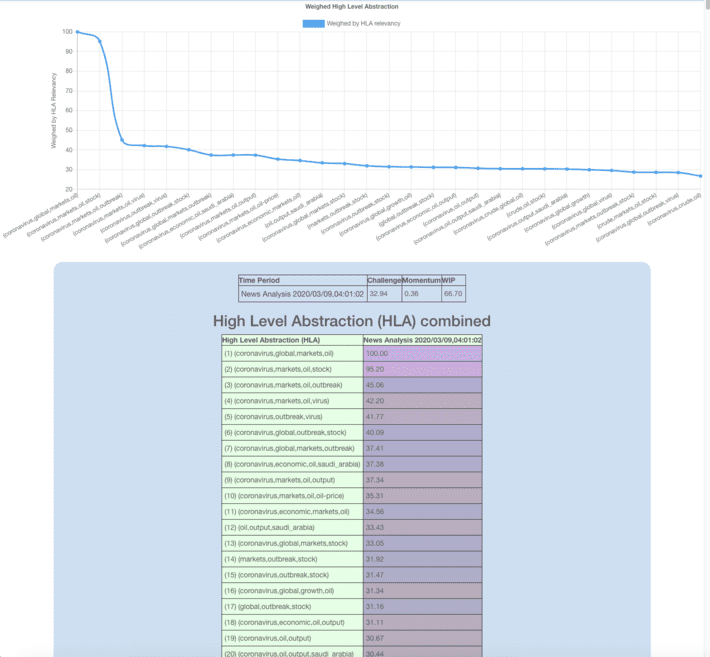

- Derive High Level Abstraction (HLA) from these news details

- Associate HLA as labels to each of these news excerpts

- Rank relevancy of each of these news excerpts by HLA based on three criteria, i.e., momentum, challenge, and work-in-progress

3. Discriminants derived from top ranking HLA against statistical predictors help to identify the missing variables and the effectiveness of predictions.

To further demonstrate this discussion, the following is a link that point to ELAINE’s news analysis in the morning of 3/9/2020.

https://www.sitefocus.com/cif/elaine/qanews_20200309_040150.html