… continued from previous article.

Image Source: Creating a Real Life Version of Psychohistory from Isaac Asimov’s Foundation Series -: Indiana University

THE LOST ART OF DECISION MAKING: DECISION-DRIVEN BEFORE DATA-DRIVEN

The logical first-step obviously was to list down all the decisions taken in the company. We very quickly discovered there has never been any documented list of decisions in the company. We then, made an attempt at informally discussing with some of the senior managers in different departments.

The conversations were all similar, if not same.

Summary below –

- Everyone believes they take a lot of decisions…though most cannot recall anyone of them..

- Everyone agrees the quality of decisions does make a difference to the quality of business-outcomes

- Instinctively, they know some decisions are more important than others, but never paused to think or list down those important decisions.

- When forced to list at least one important decision that they took in the preceding 12 months, those who could, invariably mentioned investment decisions involving large capital outlay.

Some have asked me the equally disconcerting question back – “How about you? Do you have a list of important decisions that you take?” …

Honest answer was that I was equally guilty. I never made my own list!

While there was no published research on developing a roadmap for a data-driven organization, there were a few well-written articles on the importance identifying critical organizational decisions.

Taking inspiration from the Decision X-Ray process of Bain & Company, I have created a Questionnaire that I could distribute amongst the managers to collect and collate the list of organizational decisions. Bain’s case study refers to 33 critical decisions that managers at Nike identified…

However, my initial experience administering the questionnaire was a disaster. Most managers simply did not know what to list as a decision, and Identifying critical decisions was even more difficult. Nearly all of them have listed ‘Investment decisions’ (which involved purchase of capital goods or capitaliSable services) as the most critical decisions that they take.

We have also included a few questions on how exactly does each of the decisions listed impacts Organizations’ top-line and Bottom-line, or impact on meeting strategic objectives. Most managers had difficulty explaining the $$ impact of their decisions on business-outcomes.

TYPES OF DECISIONS

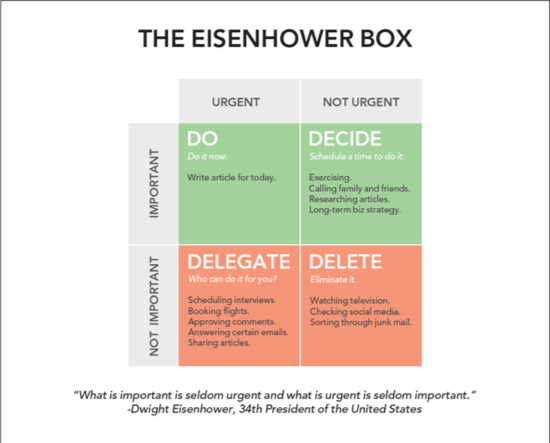

The first recorded attempt at identifying and categoriSing decisions has been made by the war-hero (and 34th President) General Eisenhower.

The famous Eisenhower principle – PrioritiSing tasks by urgency and importance results in 4 quadrants with different work strategies: What is important is seldom urgent, and what is urgent is seldom important.

The famous Eisenhower principle – PrioritiSing tasks by urgency and importance results in 4 quadrants with different work strategies: What is important is seldom urgent, and what is urgent is seldom important.

We saw a few typical text-book style categorization of decisions.

- Programmed and non-programmed decisions:

- Major and minor decisions

- Routine and strategic decisions:

- Organizational and personal decision:

- Individual and group decisions:

- Policy and operating decisions:

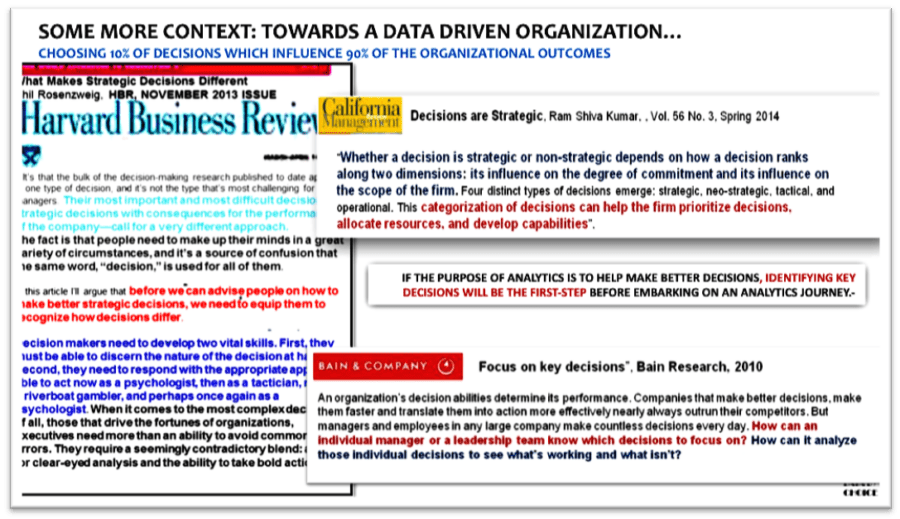

While we expected, there would be a mountain of published research on categorization of decisions, and proven methodology for identifying the most critical organizational decisions, we were completely disappointed…

There was little to no published research on the importance of categorization of decisions, let alone a process for identifying the top 10%.

The notable exceptions below:

- What Makes Strategic Decisions Different? – HBR November 2013 Issue, Phil Rosenzweig

While the article does not give any process for categorization of decisions, it does argue that categorization of decisions, and recognizing strategic decisions as different from routine decisions is an important first step before advising people on how to make better strategic decisions.

- Decisions are Strategic. California Management Review, Vol 56, No.3, Spring 2014 (by Ram Shivakumar)

Under a chapter titled “A Framework for Evaluating Decisions”– it provides yet another 2×2 that has Degree of Commitment and the Scope of Firm on its two axes. The degree of commitment is reflected by the extent to which a particular decision is reversible; and the scope of a firm is defined by its choice of products, services, activities, and markets.

- Bain & Company. Focus on Key Decisions, Bain Research, November 19, 2010 (Bain Brief By Marcia W. Blenko, Michael C. Mankins and Paul Rogers)

The most comprehensive and relevant article for our purpose. While we still do not get a definitive process for decision prioritisation, the article does provide the basic steps involved in the process. Excerpts below –

“An organization’s decision abilities determine its performance. Companies that make better decisions, make them faster and translate them into action more effectively nearly always outrun their competitors. But managers and employees in any large company make countless decisions every day. How can an individual manager or a leadership team know which decisions to focus on? How can it analyze those individual decisions to see what’s working and what isn’t?”

(The article) shows how to identify your organization’s critical decisions, the ones that most affect results. And it shows how to use a tool we call a decision X-ray to expose the trouble spots and begin to identify improvements. Taken together, these actions can tune up your organization to deliver peak performance.”

The article further talks about Critical decisions being of high-value, or of high-value over-time, and applying the 80-20 rule to identify critical decisions.

The process for identifying critical decisions (as per the article) is in two steps –

- Creating a Decision Architecture: Creating business process of different parts of the organization in value-creation strategy so-as to list all the organization decisions.

- Winnowing the list: Prioritising decisions by Value, followed by Degree of Management Attention required.

The article further mentions “Decision X-ray process” (that Bain seems to have used extensively at Nike) which essentially is a diagnosis of a day-in-the-life-of-a-decision, what works and what doesn’t, enablers etc.

Our Journey

While one gets the drift of what Bain conveys as an idea through the article, we thought it was too simplistic to “winnow the list” just by two factors – 1) The cum. value of the decision, 2) Management-attention required. How much of Management- attention is required is an abstract number at best.

We have worked on a series of alternative models which possibly work on diverse set of businesses. We finally concluded that the key criteria for decision prioritisation is its’ impact on business-outcomes; hence one must identify those 10-20% of decisions which impact 90% of business outcomes”.

Over-time, we have evolved a methodology to score decisions based on their impact on business outcomes, and to run a Pareto-analysis to identify the key 10% decisions.

RECAPTURING THE PURPOSE

- Building a data-driven organization requires supporting organizational decisions with data & analytics … Given that not all decisions are equally important, Decisions need to be prioritized based on relative value.

- If the first step in building a data-driven organization is to choose the right decisions to support with data…then the next set of logical questions that need to be answered–

- Which decisions?

- How to categorize decisions?

- How to prioritize decisions?

- As it applies in economics, Pareto principle applies in business too …we find 80-90% business outcomes are influenced by 10-20% of the decisions. The question is – which 10-20%…?

- Those taken by CxOs?

- Capital Investment decisions?

- Strategic Direction decisions?

DECISION PRIORITISATION: FACTORS TO CONSIDER

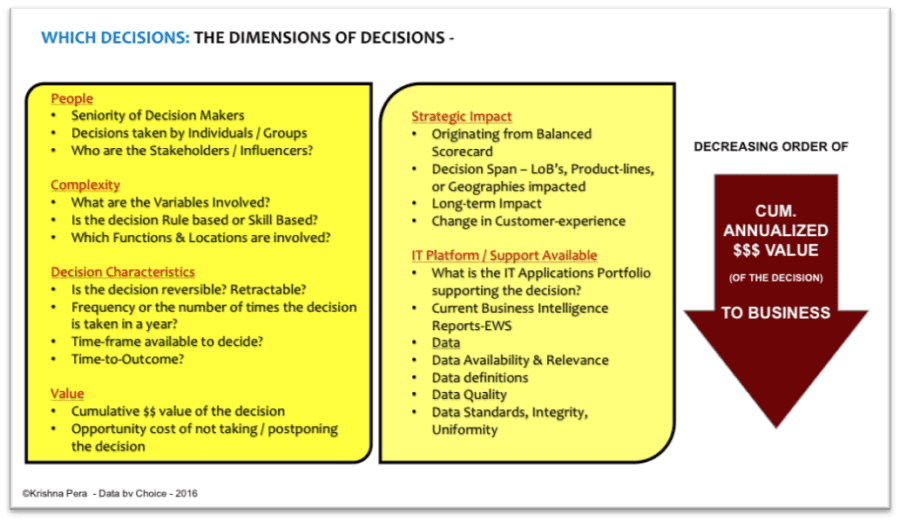

When we started listing the criteria for decision prioritisation, we have very quickly agreed that the value-of-the-decision, and the scope of business the decision affects are two primary factors that need be taken into-account. Pretty much the-same set of factors that were mentioned in Bain’s article quoted above. We have also quickly recognized there are repetitive decisions which individually are of small-value, but add-up to a much larger value over a period-of-time.

But as we started listing decisions, and started discussing with the decision makers, we have been forced to list several other important factors that might significantly affect the prioritisation.

We found some decisions are far more complex than others, while some decisions can be rule-based, and routine. While some decisions lead to measurable outcomes, several others do not.

Some decisions lead to immediate results-and-outcomes in the near-term, while several other decisions lead to results-outcomes that can only be felt over a long period of time. Further, some decisions can be reversible, while many others are not. Then there are decisions that need to be taken with very little or no notice, while some decisions can be taken at leisure – after carefully considering all the implications. Unplanned decisions are usually reactionary and are taken in response to the occurrence of an unplanned-disruptive event.

We have also felt the planned decisions which emanate from Organizations strategy-map and the balanced scorecard need a higher priority.

So, the list-of factors (not in any particular-order) which influence decisions is given below –

- Originating from Balanced Scorecard

- Strategic-Tactical-Operational

- Decision Span (Lob’s / Revenue-Streams / Markets Covered)

- Impact & Value to Business

- Customer Experience

- Frequency

- Time-Frame Available to Decide

- Time to Outcome

- Retractability

- Long-Term Impact

- Opportunity Cost

- Availability of Quality Data

- Complexity

- Uncertainty

- Cost-Benefit

In our experience, the weightages to be accorded to each of these factors will have to be different in in different companies, in different lines-of businesses, in different countries. So, the exercise of decision prioritization once again gets complicated if you are dealing with a multi-national operating in diverse businesses.

Added to the above, would be what are called ‘dimensions of decisions’ by consulting companies like Decision Management Solutions. (I wish I had seen more insight into the meaningful work this company does – But I really go to see most of it last year. Decision Management Solutions categorizes decisions based on their relative score on 9 different dimensions – Repeatability, Measurability, Time to Outcome, Approach, Upside vs. Downside, Regulation, Available Data, Historical Data & Uncertainty).

We however used the following, and they are not very different from the criteria one uses for categorization of decisions, except perhaps that each of the variables here can be clearly measured.

People

- Seniority of Decision Makers

- Decisions taken by Individuals / Groups

- Who are the Stakeholders / Influencers?

Complexity

- What are the Variables Involved?

- Is the decision Rule based or Skill Based?

- Which Functions & Locations are involved?

Decision Characteristics

- Is the decision reversible? Retractable?

- Frequency or the number of times the decision is taken in a year?

- Time-frame available to decide?

- Time-to-Outcome?

Value

- Cumulative $$ value of the decision

- Opportunity cost of not taking / postponing the decision

Strategic Impact

- Originating from Balanced Scorecard

- Decision Span – LoB’s, Product-lines, or Geographies impacted

- Long-term Impact

- Change in Customer-experience

IT Platform / Support Available

- What is the IT Applications Portfolio supporting the decision?

- Current Business Intelligence Reports-EWS

Data

- Data Availability & Relevance

- Data definitions

- Data Quality

- Data Standards, Integrity, Uniformity

DECISION PRIORITISATION: PUTTING TOGETHER A PROCESS

Finally, when we started putting together a process for decision prioritisation, what became very clear is that we need to list the decisions in the ‘decreasing order of cumulative-annualised-$$ value-impact-on the business’.

One needs extra-care to understand the words ‘cumulative and annualised’ here – While cumulative refers the ‘collective value of small-value decisions’ which has substantially large impact on the organizations’ business outcomes, the word ‘annualised’ refers to fact that the $$ impact of the decision may spread across more-than-one financial year and hence the data needs to be normalised to the value in one financial year.

Following Pareto’s principle, the actual number of decisions which impact 80-90% of business value is expected to be small… while the actual number and the percentage may differ in different companies.

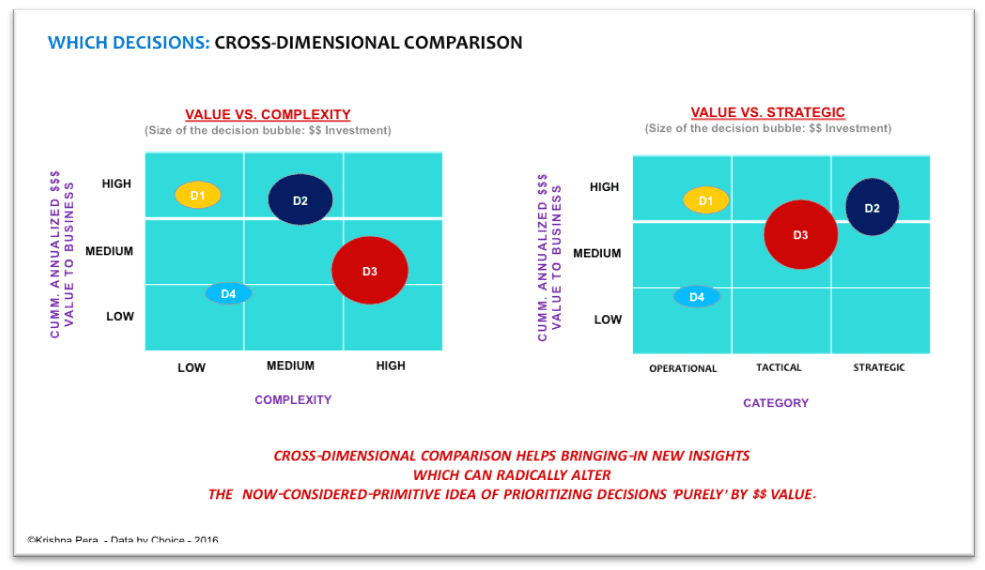

However, we could clearly see that once we assign a score against each of the decision dimensions, the whole perspective of which decision is important could change when we do a cross-dimensional comparison.

Reference Fig shown here – The size of the bubble indicates the $$ value of the investment into each of the decisions.

The decision which has highest ‘cumulative annualized value’ could turn out be most complex decision, perhaps with a strategic long-term impact, while there could be another decision which has high cum. annualized value, and relatively less complex which can be a more obvious priority for data-driven decision making.

A few decisions which represents the highest cumulative-annualised-value, besides being most complex, may also have little-to-no data available. Hence, such decisions tend to be largely intuitive, purely based on the experience of the managers.

Conclusion:

Cross-dimensional comparison helps in identifying if a specific decision qualifies as one among the top-10% opportunities for data-driven managerial interventions which potentially influence 90% of business-outcomes.

Copy [email protected] Krishna Pera, Data by Choice LLP.