It’s hard to get into the world of the Internet of Things (IOT) without eventually talking about Digital Twins. I was first exposed to the concept of Digital Twins when working with GE. Great concept. But are Digital Twins only relevant to physical machines such as wind turbines, jet engines, and locomotives? What can we learn about the concept of digital twins that we can apply more broadly – to other physical entities (like contracts and agreements) and even humans?

What is a Digital Twin?

A Digital Twin is a digital representation of an industrial asset that enables companies to better understand and predict the performance of their machines, find new revenue streams, and change the way their business operates[1].

GE uses the concept of Digital Twins to create a digital replica of their physical product (e.g., wind turbine, jet engine, locomotive) that captures the asset’s detailed history (from design to build to maintenance to retirement/salvage) that can be mined to provide actionable insights into the product’s operations, maintenance and performance.

The Digital Twin concept seems to work for any entity around which there is on-going activity or “life”; that is, there is a continuous flow of new information about that entity that can constantly update the condition or “state” of that entity.

The Digital Twin concept is so powerful, that it would be a shame to not apply the concept beyond just physical products. So let’s try to apply the Digital Twin concept to another type of common physical entity – contracts or agreements.

Applying Digital Twins To Contracts

Many contracts and agreements have a life of their own; they are not just static entities. Many contracts (e.g., warranties, health insurance, automobile insurance, car rental agreements, construction contracts, apartment rental agreements, leasing agreements, personal loans, line of credit, maintenance contracts) once established, have a stream of on-going interactions, changes, enhancements, additions, enforcements and filings. In fact, the very process of establishing a contract can constitute many interactions with exchanges of information (negotiations) that shape the coverage, agreement, responsibilities and expectations of the contract.

Let’s take a simple home insurance contract. Once the contract is established, then there is a steady stream of interactions and enhancements to that contract including:

- Payments

- Addendums

- Claims filings

- Changes in terms and conditions

- Changes in coverage

- Changes in deductibles

Each of these engagements changes the nature of the contract including its value and potential liabilities. The insurance contract looks like a Digital Twin of the physical property for which it insures given the cumulative history of the interactions with and around that contract.

Expanding upon the house insurance contract as a living entity, the insurance company might want to gather other data about the property in order to increase the value of the contract while reducing the contract’s risks, liabilities and obligations. Other data sources that the insurance company might want to integrate with the house insurance contract could include:

- Changes in the value of the home (as measured by Zillow and others)

- Changes in the value of the nearby homes

- Changes in local crime

- Changes in local traffic

- Changes in the credentials and quality of local schools

- Quality of nearby parks

- Changes in zoning (the value and liabilities of a house could change if someone constructs a mall nearby)

- Changes in utilities (a house with lots of grass might not be as attractive as the price of water starts to increase)

- New nearby construction permits (residential and commercial)

- Aerial photos (to check for unauthorized additions or construction)

- Changes in the location of mass transit

- Even predicted changes in local climate (see Figure 1)

Figure 1: “As Climate Changes, Southern States Will Suffer More Than Others” New York Times

If the goal of the insurance company holding the home insurance policy is to 1) maximize the value of that policy while 2) reducing any potential costs, liabilities and obligations, then creating a Digital Twin via a home insurance contract seems like a smart economic move.

Applying Digital Twins To Humans

“Big Data is not about big data; it’s about getting down to the individual!”

Your customers and prospects are leaving their digital fingerprints everywhere on the Internet. From social media (likes, retweets, posts, shares), mobile apps, website clicks, keyword searches, blog postings, on-line forum comments, posting photos, listening to music and watching videos, your customers and your best prospects are sharing their digital DNA including their interests, passions, associations and affiliations (see Figure 2).

Figure 2: Consumers Digital Fingerprints (https://visual.ly/community/infographic/how/internet-real-time)

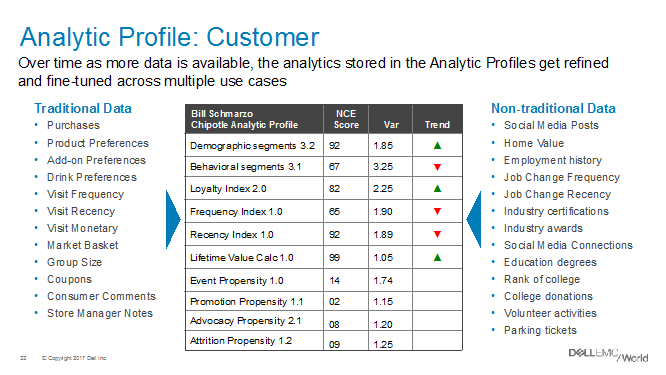

One of the keys to data monetization is to understand the behaviors and tendencies of each individual including consumers, students, teachers, patients, doctors, nurses, engineers, technicians, agents, brokers, store managers, baristas, clerks, and athletes. In order to better serve your customers, you need to capture and quantify each individual customer’s preferences, behaviors, tendencies, inclinations, interests, passions, associations and affiliations in the form of actionable insights (such as propensity scores). See Figure 3.

These actionable insights can be captured in an Analytic Profile for re-use across a number of use cases including customer acquisition, retention, cross-sell/up-selling, fraud reduction, money laundering, advocacy development and likelihood to recommend (see Figure 3).

The behavioral insights captured in the Analytic Profiles ultimately allow organizations to optimize their entire value chain process – from product design, development, and manufacturing to optimizing marketing activities, prioritizing sales efforts, and optimizing service and support activities (see “Big Data MBA: Course 101A – Unit III” for more details on opportunities for monetizing Michael Porter’s Value Chain Analysis).

Summary

GE uses the concept of Digital Twins to create a digital replica of a physical product that captures the asset’s detailed history (from design to build to maintenance to retirement/salvage) that can be mined to provide actionable insights into the product’s operations, maintenance and performance.

That same Digital Twins concept can be applied to contracts and agreements in order to increase the value of those contracts while minimizing any potential risks and liabilities. And the Digital Twins concept can also be applied to humans in order to better monetize the individual human (customers) across the organization’s value creation process.