Note: this blog introduces the concept of the Marginal Propensity to Reuse which is the primary driver behind the Data Economic Multiplier Effect and the Schmarzo Economic Digital Asset Valuation Theorem. The Marginal Propensity to Reuse states that an increase in the reuse of a data set across multiple use cases drives an increase in the attributable value of that data set at zero marginal cost.

Why do I spend so much time talking about the economics of data and analytics? It’s because economics is the language of business, and if data and analytics are going to be taken seriously by business executives, then we need to talk about the value of data and analytics in their language.

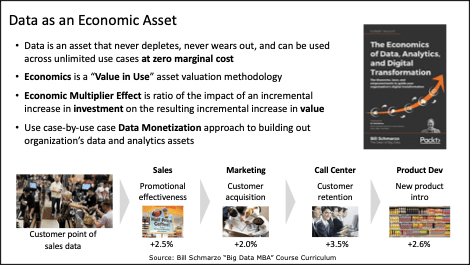

What makes data a unique economic asset is the fact that data (when properly “curated” including cleansing, indexing, tagging, standardizing, normalizing, aligning, engineering, transforming, enriching, cataloging and governing), never wears out, never depletes, and can be reused across an unlimited number of use cases at zero marginal cost. That means that data, when shared and reused across multiple use cases, exhibits the Economic Multiplier Effect, which is the ratio of the impact of an incremental increase in investment on the resulting incremental increase in output or value (see Figure 1).

Figure 1: Data as an Economic Asset

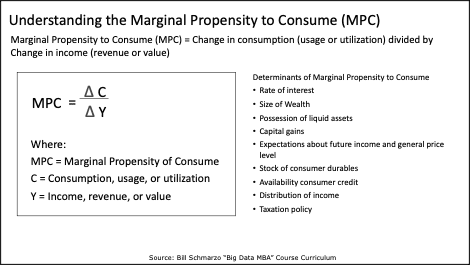

In Keynesian economic theory, the power of the economic multiplier effect is driven by the Marginal Propensity to Consume (MPC). The Marginal Propensity to Consume is calculated as the change in consumption (usage or utilization) divided by the change in income (revenue or value). See Figure 2.

Figure 2: Marginal Propensity to Consumer (MPC)

MPC measures how an increase in consumption (usage or utilization) drives an increase in income (revenue or value). And the greater the MPC, the greater the Economic Multiplier Effect.

In economic terms, the main factors that impact the MPC are the availability of credit, taxation levels, and consumer confidence. And MPC is counter-balanced by the Marginal Propensity to Save (MPS). However, since there is no motivation to “save” data, in the world of data, the Multiplier Effect is entirely driven by consumption, or more precisely, ease of consumption.

Factors that Increase Marginal Propensity to Consume (MPC) for Data

To fully exploit the Economic Multiplier Effect for data, organizations need to increase the MPC for data; that is, make it easier for data users to consume data. That includes:

- Ease of identifying, locating and accessing the most relevant data given the problem state no matter where that data might be located (cloud, on-premise, hybrid cloud). This involves tagging, metadata enhancements, and cataloging the data.

- Ease of integrating data from multiple data sources to provide a more holistic understanding of the given problem state. This involves clean primary and secondary keys from which to integrate data from different source systems. This also where data management must address lags in data latency and data granularity.

- Ease at which the data consumer can analyze the data and get actionable analytic insights with respect to relevance to the given problem state, and the understandability and actionability of the analytic results in that the next best recommended action is easy for the user to understand and act upon.

- Confidence in the quality of the data; that is, the data consumers have enough confidence in the quality of the data to trust the resulting the analytic insights and recommendations.

However – and this is a big however – there is an even bigger driver behind the Economic Multiplier Effect for data, and that is the Marginal Propensity to Reuse (MPR).

Understanding and Exploiting Marginal Propensity to Reuse (MPR)

We know from the Schmarzo Economic Digital Asset Valuation Theorem that the value of a data asset increases the more that it is reused across business and operational use cases, and that if the data is “curated” and governed correctly, this reuse comes at near zero marginal cost. Yea, it is really like free beer.

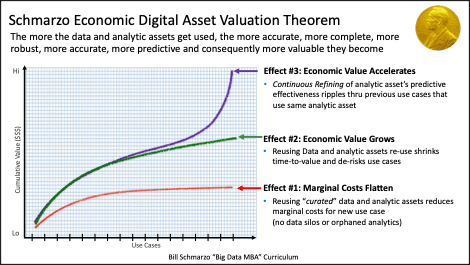

The Schmarzo Economic Digital Asset Valuation Theorem states that organizations can realize three effects or benefits from the sharing, reuse and continuous refinement of the organization’s data and analytic assets (see Figure 3):

- Effect #1: Reduction in marginal costs in each subsequent business and operational use case through the reuse of data and analytic assets

- Effect #2: Growth in marginal value as the reuse of the data and analytic assets shrinks time-to-value and de-risks each subsequent business and operational use case

- Effect #3: Accelerated growth in economic value through the continuous refinement of the analytics data and analytic assets, which ripples predictive improvements through all the previous use cases that used those same data and analytic assets

Figure 3: The Schmarzo Economic Digital Asset Valuation Theorem

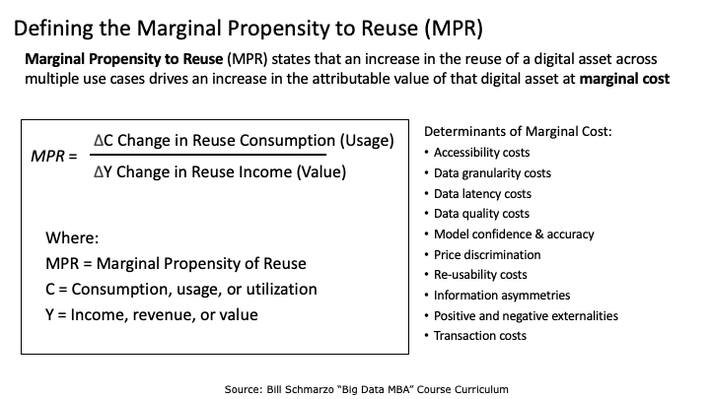

Now let me introduce a new and very powerful economic concept for digital assets, the Marginal Propensity to Reuse (see Figure 4):

The Marginal Propensity to Reuse (MPR) states that an increase in the reuse of a data set across multiple use cases drives an increase in the attributable value of that data set at zero marginal cost.

Figure 4: The Marginal Propensity to Reuse (MPR)

The key point here isn’t just the use of an organization’s data, the MPR for data is driven by the reuse of the same “curated” data, where any improvements in that data set (cleanliness, accuracy, completeness, granularity, latency, enrichments) ripples through all the other use cases that used that same data.

Note: The MPR is only relevant for digital assets – like data and analytic assets – where the marginal cost of reusing those digital assets is near zero. MPR is not relevant for physical assets where the physical asset cannot be reused across an unlimited number of use cases at near zero marginal cost. There are considerable marginal costs (usage costs, maintenance costs, utilization costs, operating costs, scarcity costs, availability costs) associated to reusing a physical asset like a car, wind turbine, chiller, CT scan, or train.

Data Silos, Shadow IT Spend, and Orphaned Analytics…Oh My!

What can we do to maximize the full benefit of the MPR? Eliminate data silos, shadow IT spend, and orphaned analytics.

Anything that prevents the reuse and refinement of the data and analytic assets, is destroying the economic potential of data. If there is no sharing and reuse of the data and analytic assets, then the Economic Multiplier Effect cannot take effect. And we have a formula, that I introduced in Chapter 5: Economic Value of Data Theorems in my new book “The Economic Value of Data, Analytics, and Digital Transformation” that can help organizations calculate the cost of Data Silos, Shadow IT Spend and Orphaned Analytics:

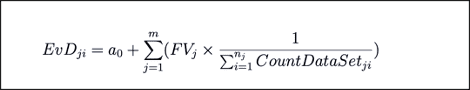

The Economic Value of a Data Set (EvD) equals the sum of the Attributed Financial Value (FV) of a specific Use Case (Use_case_FV) that each data set provides to that specific Use Case where m is number of use cases, n_j is number of data sets per use case j and a_0 is a bias.

Figure 5: Economic Value of Data Formula

I am currently in the process of working with my colleagues at the University of San Francisco to take this formula to the next level. The formula in Figure 5 assumes an even attribution of the value of each data set based upon value of the use case. However, we know that some variables (and consequently their corresponding data sources) are more valuable than other variables to the predictive performance of the analytics. We are in the process of getting an academic paper released with the updated formula (academic publications are so persnickety about sharing research work ahead of publication).

“You can’t fully assess the value of your data in isolation of the business”

Why do I spend so much time talking about the economics of data and analytics? It’s because economics is the language of business, and if data and analytics are going to be viewed in their full business and economic potential by the business executives, then we must learn to talk in the language of business – the language of economics.

After the publishing of my book, I am even more fascinated about the economic potential of data and analytics and will continue to research and write on the below Data Economics subjects:

- Nanoeconomics

- Marginal Propensity to Reuse (MPR)

- Updated Economic Value of Data research with the University of San Francisco

- Updates to the Schmarzo Economic Digital Asset Valuation Theorem

- Marginal Propensity to Continuously Refine (watch this space for more on that)

Yes, I am on a mission. Besides, what else am I going to do in my spare time. I really suck at playing golf…