Crudely, blockchain is to accounting and finance what the internet was to computers ages back. While even the fastest traditional bank takes an hour to clear a check, a DLT-based clearinghouse does it in 20 seconds flat! The distributed ledger technology working through a network of thousands of globally distributed computers promises deliverance to businesses and their leaders thanks to its immutability, security, reliability, and speed.

Unchaining Through Blockchain

While blockchain accounting applications promise unmatched degrees of traceability, accuracy, permanence, and transparency of transactions to users, they are perhaps most valuable because the ‘consensus’ feature of blockchains brings in the advantage of the immutability of transaction records, reducing the possibility of fraud and tricks – assuring management accountants that they can safely work in trustless environments. Not to be lost out on, DLT also offers a time-stamp feature that allows for the network to become auditable, which leads to it being ‘tamper-proof’.

The life of an accountant or an auditor revolves around an accounting cycle that essentially involves 8 steps: identifying transactions, recording transactions, posting accounts to the ledger, calculating trial balance, analyzing worksheets, adjusting journal entries, generating financial statements, and closing the books. Blockchain-based accounting and finance applications are set to change all of this and more.

The Blockchain Birdview

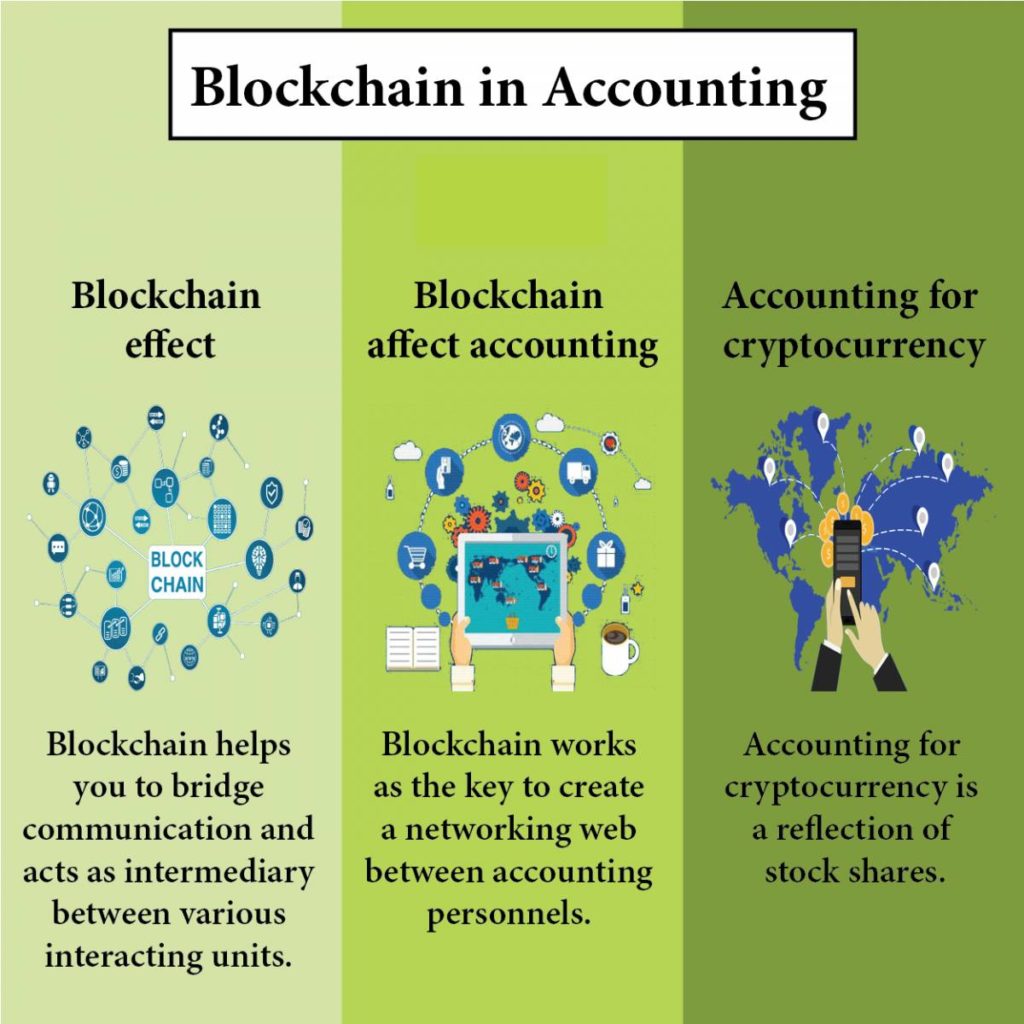

Blockchain is a public and distributed digital ledger. It aggregates and authenticates every transaction from anywhere worldwide, making it nearly impossible to alter transactions through unauthorized means. These unique features of blockchain-based accounting technology promise management accountants peace of mind, safety, speed, and the much-needed functional freedom to engage in higher-value advisory roles.

In short, blockchain allows for smart contracts, consolidated bookkeeping, standardization in auditing, security, trust, and less paperwork for accountants. The following are its benefits:

- Processes bank balance, invoices, and other accounts with full transparency using smart contracts

- Enables employees to log all their transactions at one place

- Helps auditors to verify the data much faster and easier

- Secures data through decentralization and immutability

- Eliminates the dependency on paperwork

- Adds strength to professionals who can focus on delivering value elsewhere.

For instance, professionals can spend time on areas requiring more judgment and advice while conducting due diligence.

This has increased the scope of accounting. Blockchain holds promise when considering difficult or unreliable matters like the value of data an organization holds. At the same time, these features of blockchain could threaten accountants’ basic work. Let us delve deeper into the implications of blockchain for auditors.

Implications of blockchain for auditors

Blockchain applications in the company’s finance tasks mean a reflective change in how auditors work. In combination with appropriate data analytics, blockchain helps with the statements involved in the audit, and thus the auditor’s skills can be better spent in answering higher-level questions.

Elements of judgment – such as recording and classifying transactions that cause an outflow of money [cost of sales or expenses] and other concerns, require business knowledge. With blockchain, auditors can spend more time on these questions. Blockchain needs to be developed, standardized, and optimized to become an integral part of the financial system, which may take many years. Though we can find many blockchain applications and start-ups in this domain, they are still at the pilot study stage or not beyond the proof of concept.

This calls for additional skills from professionals. Accountants are seen as experts in record-keeping, application of complex rules, business logic, and standards-setting. They are expected to craft regulations and standards alongside leading accountancy firms and bodies. Also, accountants can work as advisors to companies. A mix of financial knowledge and business tactics will position them as experts for companies looking to adopt this new technology. Let’s understand how these professionals can lead the industry with blockchain.

Skills every accountant will need for the future

To increase the efficiency and value of the accounting function, professionals need to understand data analytics, machine learning, blockchain, and other modern technologies. Sub-fields of accounting, such as transactional assurance and transfer of property rights, can be transformed by blockchain and smart contract approaches.

As a result, the spectrum of skills represented in accounting is bound to change. To mention a few, they are:

- Reduction or elimination of works like reconciliations and provenance reassurance

- Expansion of work related to technology, advisory, and value-adding activities

- Focus on transaction recordings and their recognition in financial statements

- Decision on elements of judgment such as valuation

- Confirmation of transactions in real-time and with certainty

To summarize, accountants must be able to advise on blockchain adoption and its impact on businesses and clients. They need to act as mediators for technologists and business stakeholders. They should strongly understand blockchain’s principal features, functions, and beneficial aspects to lead the industry forward.

Read More: Acquire The CIMA® Charter To Power Your Career Ahead