Dramatically improving currency trading models with AI using Keras Deep Learning and PivotBillions.

As has become more and more apparent in this day and age, data is scaling and changing beyond the ability of human-powered machine learning to make the most of it. This makes enhancing current analyses with deep learning all the more necessary and profitable. Our team invested heavily in developing a trading model that could continue to trade profitably in the currency exchange markets. Though we succeeded in developing such a model, there was still a lot of room for improvement and we were reaching the limits of our current machine learning methods. Due to the growing power and versatility of deep learning, we decided to enhance our model with a deep neural network.

The first question we faced was how to represent our financial currency data as an image. There were many ways to reshape currency data into an image; however, each required a great deal of processing power and research. Working through 143 million raw tick data points and countless possible features was dramatically slowing down our research cycle. Then we decided to power our analysis with Pivot Billions, which allowed us to quickly load and analyze our data and reshape it into an image using their custom module. The entire process from modifying our raw data to converting it to image data and then running deep learning on it now took a matter of minutes. This also made our selection of input features much easier since it allowed us to add and quickly iterate through various features that could be relevant to our deep learning.

Incorporating Pivot Billions into our Keras workflow quickly prepared our data by simulating and creating a profit label for our model’s signals, including the last 100 minutes prior to each of those signals in the row for that respective signal for each of our input features, and setting up our training and testing datasets. After many iterations with the types of input features and the structure of our deep neural network, we were able to determine a deep learning model that learned our model’s weaknesses and strengths and more accurately predicted the profitable signals.

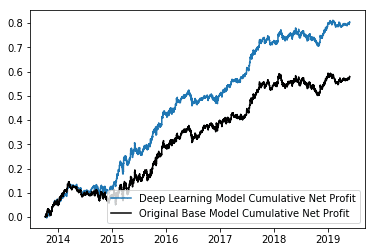

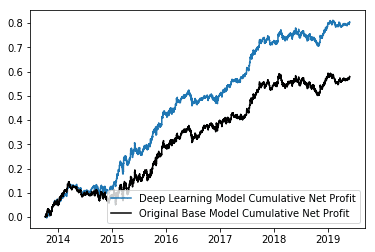

Our raw base model (black line) was profitable but highly volatile due to periods of noisy and underperforming trades. However, our deep learning enhanced model (blue line) achieved amazing and much greater profit throughout our data!

We were happy to see our deep neural network heavily reduced the periods of drawdown in the original model and produced much more stable profit. We’ll continue to develop our deep learning models so look forward to another blog post with even greater improvements!