If you’re a manager tasked with overseeing a return to the office strategy, the last year has likely been a headache for you. In the Summer of 2021, many companies had begun calling their workers back into the office, by the following Fall, the Omicron variant of Covid-19 was beginning to ramp up and, just as they had the year before, many companies had to put their plans on hold. There are indications that a similar pattern may be taking place this year, with yet another variant in the wings, as well as the potential complications of Monkeypox.

Covid-19 Only Accelerated the Trend Towards WFH

Political leaders are not likely to call for any more lockdowns (the political will is simply not there from either side) and an attitude seems to be emerging that the pandemic is now entering an endemic phase. Annual boosters will likely be needed for some years to come but there is enough capacity now that even if a spike occurs, hospital systems can likely absorb it.

However, even given that, downstream effects of the pandemic are still playing out, and likely will do so for several years, if not decades. Work from home (WFH) has become well-entrenched in the culture of today’s workers, and even if a move towards returning to offices does exist, roughly 35% of new jobs are now designated as remote. What’s more, this phenomenon persists even as signs signal an economic slowdown, as business profits are down but overall unemployment is at historic lows (and may in fact be negative).

Digitization Is Driving The WFH Revolution, Not Vice Versa

This trend seems to play out strongest, not surprisingly, in those sectors where the capacity for work from home is strongest. Programming and data science efforts both have migrated heavily into the cloud, and as such, arguments about facilities’ needs are weakest there. However, other traditional office functions – from finance and marketing to human resources, product fulfillment, and executive management – have also followed this path as companies such as Salesforce or Microsoft Office become dominant primarily as cloud plays. Put another way, most of the physical electronic infrastructure that a company needs for work now no longer resides on-prem.

Another factor influencing this trend has to do with the disappearance of geofencing and the second wave of outsourcing. New York City saw a net emigration of 19 million people in the last few years. Similar situations hold for San Francisco and Los Angeles, among other large cities. These cities were facing situations where the cost of living was driving out many essential personnel, forcing up wages and causing bidding wars for those talents that were willing to work at offices in the cities.

As work from home became the reality, however, workers were able to work farther (in some cases much farther) from the office, raising their actual standards of living while simultaneously giving them back a certain amount of control over their time. This had the additional effect of dramatically expanding the boundaries where reasonable work could be done (typically within five time zones). If your headquarters is in Los Angeles and your workers are in New York, the commute becomes a killer, forcing many companies into the unattractive position of either firing productive workers or allowing work from home to continue.

This also produced another unattractive conundrum: the elimination of geofencing may mean an expanded pool of talent may be available, but that talent also has many more opportunities for work than they did before 2020. Companies that have based their recruiting efforts on pre-pandemic expectations with regard to wages are now encountering sticker shock as forward-thinking companies have already snapped up the best talent, or as that talent has essentially decided to go freelance or form their own consultancies.

Demographics Are Reinforcing These Trends

To that end, for a company to arbitrarily announce that everyone must return to the office is proving to be an expensive blunder, as workers, faced with a significant reduction in freedom and income, head for greener pastures. This blunder is second only to companies, when faced with reduced profits, start to fire staff en masse. During a normal recession, this behavior has come to be seen as justified because labor pressures are usually weak leading into a recession and the expectation is that these same people (or their equivalents) can be rehired when economic conditions strengthen. This may not be the case this time around.

Demographically, we are in a period of workforce contraction. On one end the bulk of the Boomers are now retiring (fully or partially), with the peak of that workforce hitting 65 in 2018. Four years later, 67% of that generation are retired (roughly 32 million people), and by 2026, that number will be 81% (40 million). This means that over the next four years, there will be 8 million people leaving the workforce due to retirement.

The birthrate peaked in 2000 (after another peak in 1993), and had dropped by about 2% by 2008, before dropping far more precipitously thereafter. There are signs that we may have troughed in 2021, but we won’t know that for likely another 5-7 years. Assuming that people start entering the workforce meaningfully at 16, we’re just now seeing this decline reflected for those born between 2000 and 2018, there are roughly 2% fewer workers entering the workforce, which is already causing shortages in unskilled labor. Starting in 2023, the 16- to 30-year-old demographic will decline by 1% per year until 2037, for a total drop of 14% (assuming no other stimuli).

What this means in practice is that over just the next four years, we will be seeing a total labor force decline of about fourteen million people. This means that worker retention is going to become one of the most important success factors for business, potentially even beyond earnings and dividends.

Towards a More Distributed Workforce

As a manager facing these obstacles, there are several things that you can do and questions to answer.

- Evaluate your RTO strategy with the assumption that labor pressures are going to get worse over time, not better.

- Decide whether your RTO strategy based upon real need (must have people at work to function) or perceived need (management does not trust workers when not supervised in person, facilities are sitting dormant, corporate culture requires in-person esprit de corps, etc.). If the latter, quantify how much these factors.

- Would an office downsizing or hoteling strategy make more sense than a pure RTO?

- Would the creation of local hubs in satellite cities fulfill the same need, giving you a limited RTO that may be more palatable to your workers?

- Would a conferencing strategy, where your workers met collectively at regular intervals over the year at various locations, work better than a full RTO, especially if these conferences were subsidized?

- Do your managers need to be retrained to better work with distributed virtual forces?

- What digitization efforts can better facilitate a more distributed workforce moving forward? This not only affects your workforce needs but may also impact your digitization strategies.

The future of work is unlikely to look like its past. Building an effective distributed workforce may prove to be easier, less costly, and more effective than how you worked twenty or thirty years ago.

In Media Res,

Kurt Cagle

Community Editor,

Data Science Central

To subscribe to the DSC Newsletter, go to Data Science Central and become a member today. It’s free!

Data Science Central Editorial Calendar

Every month, I’ll be updating this section with topics that I’m especially looking for in the coming month and are more likely to be featured in our spotlight area. If you are interested in tackling one or more of these topics, we have the budget for dedicated articles. Please contact Kurt Cagle for details.

- Labeled Property Graphs

- Telescopes and Rovers

- Graph as a Service

- DataOps

- Simulations

- RTO vs WFH

DSC Featured Articles

- Introducing the Data Product Development Canvas (Version 1.0) Bill Schmarzo on 31 May 2022

- How Big Data Can Transform Talent Management Aileen Scott on 30 May 2022

- How IoT Technology Is Improving the Future of Transportation ManojKumar847 on 30 May 2022

- Countering Data Tech’s Cheap Speech Alan Morrison on 30 May 2022

- Could ABBAtars be the business model for the metaverse and 5G? ajitjaokar on 30 May 2022

- Does Your Business Require AI For Dedicated Internet Access? Costanza Tagliaferi on 30 May 2022

- How to Protect Your Cloud from Cyberattacks During and After Migration Evan Morris on 30 May 2022

- How 3 Key Ecommerce Metrics Can Inform Your Data Analysis Evan Morris on 30 May 2022

- The Technological Arms Race of Software Licensing Scott Thompson on 30 May 2022

- Benefits of Power BI for Small Businesses ImensoSoftware on 29 May 2022

- Best Practices for Implementing Breadcrumb SEO Strategy for Mobiles Karen Anthony on 29 May 2022

- Interactive Packaging: How to Make Packaging Smarter with AI and IoT Nikita Godse on 26 May 2022

- How to Choose the Best Salon CRM Software Edward Nick on 26 May 2022

- 10 Best Practices For Data Science Ankit Dixit on 25 May 2022

- Python Book Goodies and Apache Arrow ajitjaokar on 25 May 2022

- How Valid-Page Metadata Helps Businesses Grow Karen Anthony on 25 May 2022

- Why You Need an Augmented Data Integration Tool Vanitha on 25 May 2022

- DSC Weekly 24 May 2022: Is an AI Autumn Around the Corner? Kurt Cagle on 25 May 2022

- Pros And Cons of AI In Manufacturing ManojKumar847 on 25 May 2022

- Lessons Learned from Writing My First Python Script Vincent Granville on 25 May 2022

- Top Ways in Which Data Science Improves E-Commerce Sales Ryan Williamson on 24 May 2022

- Why is the Gig Economy a New Future? Rumzz Bajwa on 24 May 2022

- Russian Troll Detection By Their Tweets myabakhova on 24 May 2022

- Importance of Fearlessness to Exploit the Potential of AI Bill Schmarzo on 24 May 2022

- Why Should the Retail Sector Move to Cloud Computing? Ryan Williamson on 23 May 2022

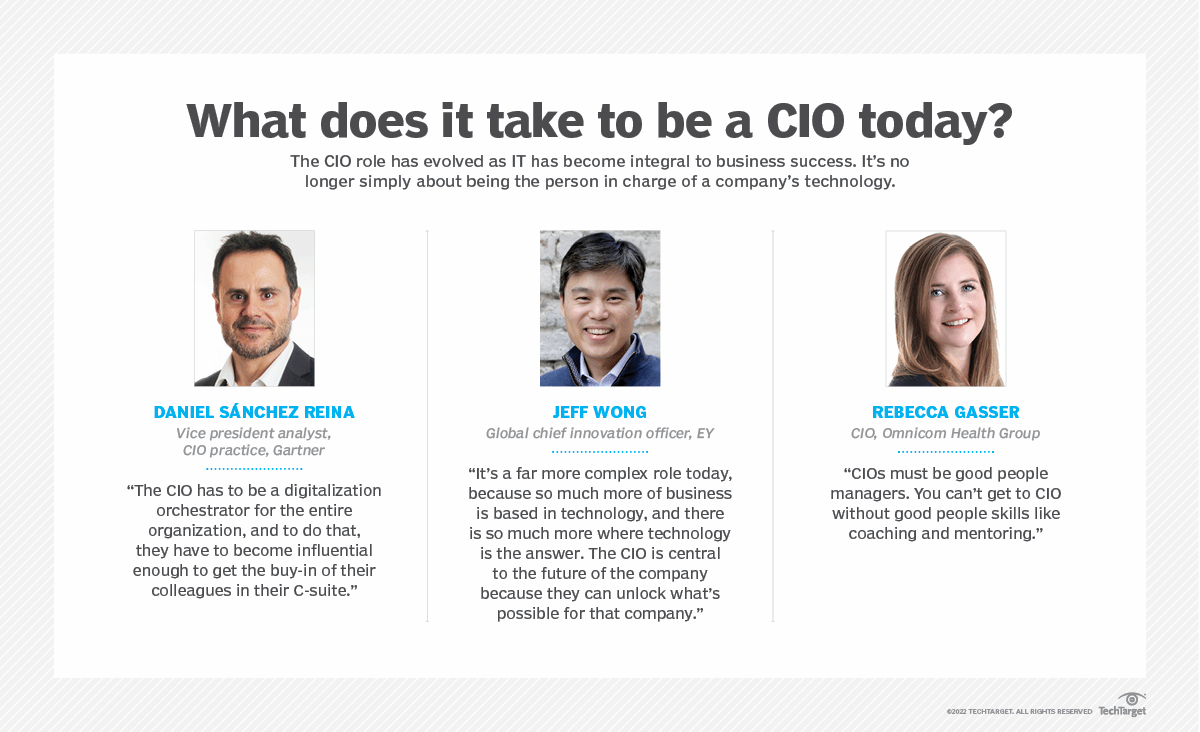

Picture of the Week

What Does It Take To Be a CIO Today?