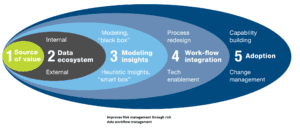

Fintech industries have been catching up quite well in blending advance analytics with RPA (Robotic Process Automation) implementation in its business process in the journey of digital transformation. Human time is too expensive to be wasted in carrying out mundane and repetitive tasks. Data and advance Analytics are proving to be a huge differentiator in most of the businesses primarily in BFSI Sector. Business decisions related to revenue, cost control, risk management etc. mostly revolves around organization’s data management capability. People are shifting from intuitive to data based model to back their decisions. We moved long ago, from flat file to data ware house management equipped with fast and parallel processing (MPP- Massively Parallel Processing) capability. We have started augmenting DWH (Data Ware house) with Big Data capability to embrace both structured (primarily data coming from OLTP viz. CRM, ERP, SCM etc.) and unstructured data (Data coming from blogs, social media, web sites, IoT devices etc.). Data management capability helps business to draw insight and carryout analysis for better informed decision. In parallel to that we have been appreciating radical evolution in analytics space from traditional BI (Business Intelligence) analytics to the Advance Analytics (AA). Traditional analytics, which is enabled through OLAP (On Line Analytics Processing engine), coupled with Data ware House or Data Mart, is still bread and butter for most of the business operation. In parallel to traditional analytics, Advance Analytics (AA) practice is catching up quite fast as an essential component in digital strategy road-map. Without AA, traditional business model will fail. AA delves deeper in the data system to find out avenues for new revenues, area to cut operation cost, eliminate redundant process, identify automation candidates in etc. while re-architecting the new business model.

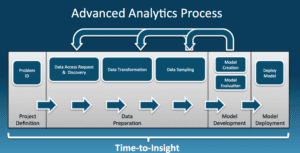

According to Gartner, Advanced Analytics (AA) is the autonomous or semi-autonomous examination of data or content using sophisticated techniques and tools, typically beyond those of traditional business intelligence (BI), to discover deeper insights, make predictions, or generate recommendations. AA is the key pillar to support sophisticated automation, bring newer prospect of revenue, cost optimization, prediction etc. across industries. I will touch upon some of Financial Services activities that can be hugely benefited through proper implementation of Advance Analytics. Industries could be at different stage of data maturity curve (Explorative -> Diagnostic -> Predictive -> Prescriptive), however, technologists (CIOs, CDOs etc.) must keep AA practice in the overall data strategy in order to increase throughput as well as productivity.

Some applications of Advance Analytics: – Improve Risk Discrimination – Banks or financial lending institutions can increase the efficiency to discriminate between bad risk and good risk. An essential statistics indicator ‘Gini Coefficient’ can improve towards 1 (in the range of 0 to 1) if banks transforms model by applying 360 degree view of customer’s interaction across different dept. or appending external data related to their behavior/transaction (purchase, twit etc.) followed by running the resultant data through AA application (AA application could be sophisticated form of ML developed recommender or classifier model). Ability to store, filter and analyze textual information leads to much improved and insightful information related to RISK determination. Textual sources such as blogs, journals, analyst’s reports, twits and many more are abundant. AA solutions encapsulated with data engineering and machine learning solution can unravel traces of risks before the same comes uncontrolled. Sentiment analysis and the information it yields can improve banks’ credit-rating models tremendously. Improve Underwriting – Banks (mostly SME or institutions in developing world) can enrich thin customer data with corresponding TELCO data to derive insight about their paying behavior. In AA setup such enrichment could lead to be a great predictive solution and that could be an incredible help for cost effective UW policy. Front line desk or Call center or sales rep can improve the effectiveness if they are presented with the prediction (AA output with high accuracy) about next product / service that a customer has come to buy for.

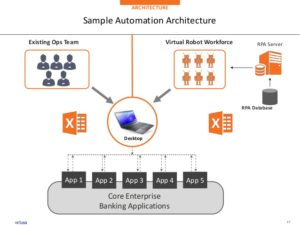

Robotic Process Automation (Integration of AA solution with RPA): Let me attempt to make a small work flow that should help summarize the effect of automation enabled with AA. If we could create a model that captures the sentiment index (downward or negative) early on and prescribes to alleviate the cause can be a path breaking product. Such RPA work flow (such as Journal/Blogs/News/Twitter =>AA Model (Text Analyzer) => Sentiment Index => Prescriptive Analyzer => Remediation plan) can bring accuracy with timeliness to obviate damage/loss in brand or sales as well as mitigate risks. This brings incredible benefits to the credit officers and regulators. In addition to that, Banks can use these crowd-sourced AA solution enabled with RPA system to gauge industry trend for better informed decision. RPA enabled with AA/Cognitive computing can take up good amount of financial audit, compliance monitoring, regulatory and legal work.

Summary: – Robotic Process Automation (RPA) is not a question of ‘if’ but ‘when’, Industries must spell out strategy from mid to long term about its enablement. Automation shouldn’t be merely looked as the replacement of mundane human task but should also factor elements of timeliness, accuracy and business context for semantic and cognitive. Business context in Financial Industries can be quite complex while dealing with tons of regulations (BaselI/III, Solvency II, GDPR, AML, IRFS and many more). We must start early to train supervised machine learning algorithm with minutest behavior of financial/data transaction so that we can conceive a robust RPA solution. Organizational data strategy generally plans to address internal to external data (to break silos in business units), structured to un-structured data, cloud infrastructure, data security & privacy, MDM and data quality etc., must also cover AA and RPA requirement in the beginning. Business critical processes, such as data actuaries, policy underwriting, CRM, SCM, R&D, Sales & Marketing, claim adjudication, asset management and many more shall have step up automation plan enabling through AA followed by resource upskilling and redeployment in more fruitful area. Automation is proving human time to be more precious and valuable that industries require very cautious and elegance approach to dispense it generate value in the society.

Click here to read original article