Digital capabilities leverage customer, product and operational insights to digitally transform business models. And nowhere is this more evident than the rush by industrial companies to digitally transform consumption models by transitioning from selling products to selling [capabilities]-as-a-service (thusly, Xaas). For example:

- The key issue for the airlines is to maximize their core revenue generating mechanisms:flight scheduling and the hours that the airplane is actually flying. So instead of looking at the features of the jet engine, GE turned their attention to helping airlines more effectively generating more revenue; GE they moved from selling engines to offering Thrust (engines)-as-a-service[1].

- Kaeser Kompressoren, who manufacturers large air compressors, leverages sensors on its equipment to capture product usage, performance and condition data off of the machines.Kaeser leveraged the product and operational insights gained from these data sources to start selling air by the cubic meter through compressors that it owns and maintains …compressed Air-as-a-service[2].

But let’s be honest, anyone can create an Xaas business model. The key is not creating an Xaas business model; the key is creating a profitable Xaas business model. That means that organizations moving to an Xaas business model must master operational excellence (remote monitoring, sensors, predictive maintenance, first time fix, inventory optimization, technician scheduling, asset utilization), pricing perfection and meeting agreed-upon customer Service Level Agreement (SLA) requirements to ensure Xaas business model success.

Loss of Manufacturers “Pricing Inefficiency” Advantage

Xaas business models eliminate manufacturer or producer pricing advantages where people and consuming organizations were willing to over-pay for capacity; that is, consumers or consuming organizations often bought more than they actually needed for convenience, safety stock and/or to support maximum demand requirements (Christmas shopping). For example, buying a car. On average, a car is used less than 5% of the time[3]. However, consumers buy this expensive asset (average car price = $34,000 in 2019[4]) that sits unused over 95% of the time.

This elimination of the producer pricing advantage – also known as Producer Surplus – is part of the economics behind the growing success of ride-sharing services. If consumers or consuming organizations only need to pay for what they use (outside of a customary monthly minimum), then the manufacturers/producers stand to lose consider revenue from these consumers and consuming organizations that historically have over-bought capacity.

Xaas service models can be a huge win for consumers and consuming organizations because they 1) avoid large, upfront capital expenditures (CapEx) while 2) only paying for what they use. And as in most important business factors, a lot of the impact of Xaas can be explained by basic economics theories.

Economics and the Laws of Supply and Demand

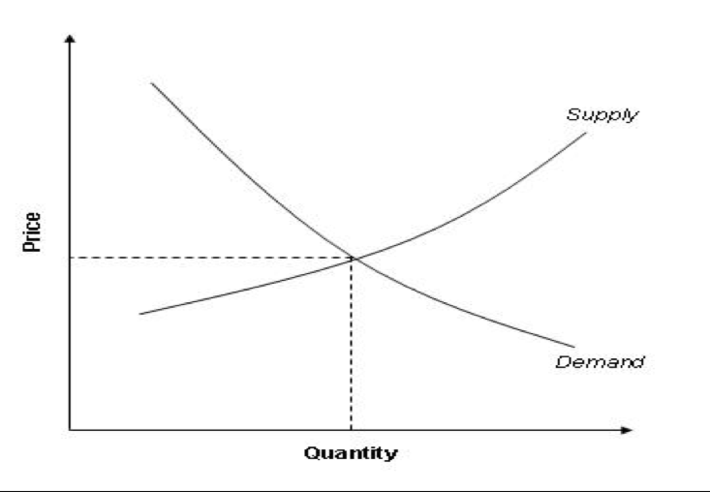

The law of supply and demand explains the interaction between the producers of a resource and the consumers for that resource. The theory defines how the relationship between the availability of a particular product and the desire (or demand) for that product has on its price. For the vast majority of goods and services, an increase in price will lead to a decrease in the quantity demanded (see Figure 1).

Figure 1: Laws of Supply and Demand

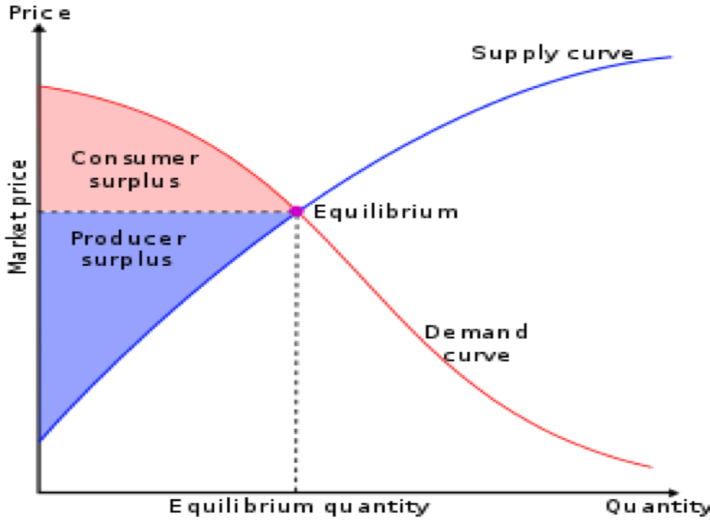

The interaction of the Supply and Demand Curve has two relevant off-shoots from an Xaas perspective: Consumer Surplus and Producer Surplus (see Figure 2).

Figure 2: Source “Producer Surplus”

Key aspects of Figure 2 are:

- Consumer Surplus, as shown highlighted in red, represents the benefit consumers get for purchasing goods at a price lower than the maximum they are willing to pay. That is, Consumer Surplus is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest price that they would be willing to pay. Benefit: Consumer.

- Producer Surplus, as shown highlighted in blue, is the amount that producers benefit by selling at a market price that is higher than the least for which they would be willing to sell. That is, Producer Surplus is the amount that producers benefit by selling at a market price that is higher than the least price for which the producer would be willing to sell; this is roughly equal to profit. Benefit: Producer.

With the Producer Surplus, the Producer benefits from imperfections in the granularity of the capabilities being bought, which forces consumers to over-buy these capabilities just in case they might need them in certain situations.

This critical producer advantage is lost in an Xaas consumption model. As an example, let’s look at the impact that ride sharing services are having on the automobile manufacturing industry.

Ride-sharing’s Impact on Automobile Manufacturing Industry

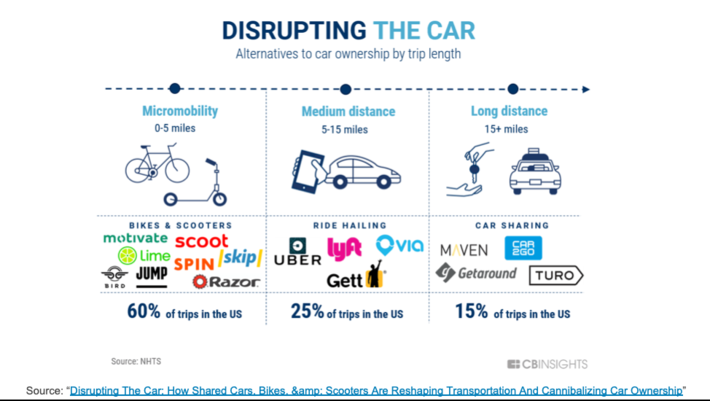

To better understand the potential impact of Xaas business models on manufacturers, let’s look at the impact that ride-sharing services (Uber, Lyft) has had on the automobile manufacturers.

Figure 3: Source: “Disrupting The Car”

The automobile manufacturer industry is already starting to feel the impact of ride-sharing services on automobile demand. CNBC’s Mad Money article “Ride-sharing is killing car sales—and it’s only going to get worse” (March 8, 2018) provides this perspective:

“How come the automakers are struggling when the rest of the economy is in such great shape? The main issue is clearly the rise of ride-sharing. Services like Uber and Lyft have brought a secular change to the world of transportation, offering far cheaper travel alternatives to owning a car, especially for city-dwellers.”

The economics of the automobile industry model are already starting to shift as fewer cars are sold, and those cars that will be sold will be built for durability (200,000+ miles) and easier maintenance (and the maintenance aspect will be further impacted by the economics of electric vehicles). However, the maintenance and parts businesses will likely keep growing as these ride-sharing services still need to have their cars operational in order to reduce unplanned operational downtime – if they ain’t drivin’ the cars, they ain’t makin’ no money!

Xaas Business Model Keys to Success

What can be a big win for consumers and consuming organizations can be a big loss for manufacturers. To offset the loss of the Producer Surplus advantage, producers need to seek new economic advantages through the acquisition of superior customer, product and operational insights gathered from IoT, machine learning and artificial intelligence capabilities.

Superior insights into consumer productusage patternscoupled with superior insights into product performance patternsenables Xaas industrial manufacturers to determine the optimal operational, pricing and customer service (SLA) models to ensure a viable and profitable Xaas business model.

The keys to Xaas business model success include the following:

- Superior consumer product usage insights (product usage tendencies, inclinations, affinities, relationships, associations, behaviors, patterns and trends). Xaas players must be able to quantify and predict where, how and under what conditions the product will be used and the load on that product across numerous product usage dimensions including work type, work effort, time of day, day of week, time of year, local events, holidays, work week, economic conditions, weather, precipitation, air quality / particulate matter, water quality, remaining useful life, salvage value, etc.

- Superior product operational insights (product performance or operational tendencies, inclinations, affinities, relationships, associations, behaviors, patterns and trends) to support product operational excellence use cases including reduction of unplanned operational downtime, predictive maintenance optimization, repair effectiveness optimization, inventory cost reductions, parts logistics optimization, elimination of O&E inventory, consumables inventory optimization, energy efficiencies, asset utilization, technician retention, remaining useful life, predicted salvage value, etc.

- Superior data and instrumentation strategy; knowing what data is most important for what use cases and where to place sensors, RTU’s, and other instrumentation devices in order to capture that data so as to balance the costs of False Negatives (from lack of instrumentation) versus False Positives (from too much instrumentation).

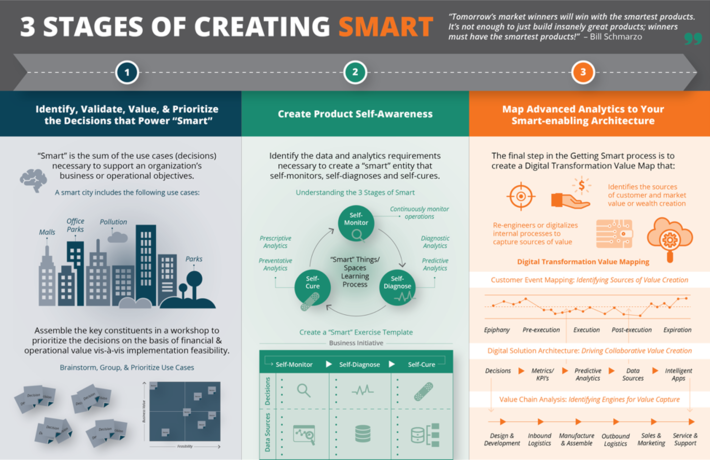

Xaas business model profitability can be achieved when you marry all three of these data, instrumentation and analytics strategies, and this is a level of data, instrumentation and analytics well beyond what most industrial organizations are contemplating today. It is only when these three dimensions are optimized can one optimize Xaas business model success through a “smart” operational environment that knows how to self-monitor, self-diagnose and self-heal (see Figure 4).

Figure 4: 3 Stages of Creating Smart

See the blog “3 Stages of Creating Smart” for more details on how leading industrial organizations are leveraging data and analytics to digital transformation their operational and business models.

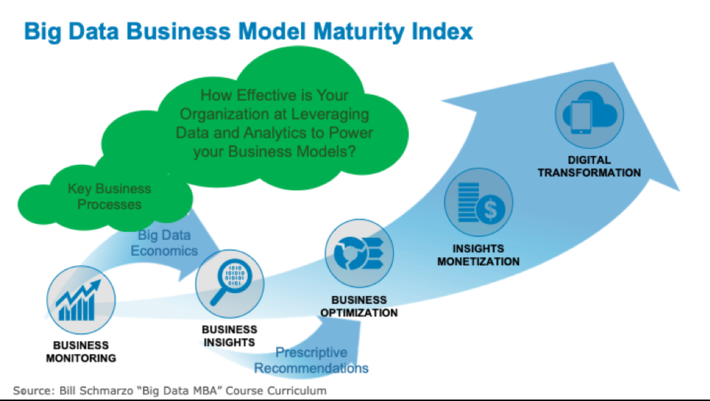

As anyone who is working to achieve their Big Data MBAknows, the organizations that win in this era of digital transformation are those organizations that successfully leverage data and analytics to digitally power their business models (see Figure 5).

Figure 5: The Big Data Business Model Maturity Index

[1] “Turning Products Into Services”

[2] “How Can You Sell Air? As a Service, Of Course”

[3]“Why do Uber and automation really matter? Because we barely drive t….”