Perspectives from various industries.

Financial forecasting has long been a cornerstone of strategic planning, essential for managing liquidity, budgeting accurately, and navigating uncertainty. Yet, for many businesses, especially SMBs, forecasting has historically relied on outdated tools, static spreadsheets, and delayed reporting cycles.

Today, artificial intelligence is transforming this landscape. From ingesting real-time data to automating scenario planning, AI-powered platforms are helping organizations forecast with greater speed, accuracy, and insight.

Real-time accuracy drives smarter decisions

Traditional forecasting often relies on outdated data, undermining responsiveness. AI-enabled systems connect directly with operational tools, ERP platforms, accounting systems, and CRM software, to pull live data and generate up-to-date projections.

As Alex Vasylenko, Founder of Digital Business Card, explains: “AI helps fix that. It connects with tools your business already uses, like accounting software, sales systems, inventory platforms, and pulls data in real time. That means the forecast is always based on what’s actually happening right now, not what happened last month” This capability is especially critical in fast-moving sectors like retail or e-commerce, where even slight demand shifts can impact profitability.

Leveling the playing field for SMBs

High-precision forecasting was once a luxury reserved for enterprises with large finance departments and specialized software. Now, SMBs can access the same intelligence without heavy investment. “Thanks to AI-powered forecasting tools, SMBs can use the same kind of smart planning that large companies do,” says Steve Morris, Founder & CEO of NEWMEDIA. These tools are increasingly designed for smaller teams, democratizing access to advanced financial planning.

Adapting to fast-paced digital economies

Digital platforms dealing in virtual goods, from gaming to NFT marketplaces, face volatility that traditional tools can’t handle. “Platforms that manage digital goods need forecasting systems that work at the speed of users, not accounting cycles,” says Adam Fard, Founder of UX Pilot AI. AI’s ability to process rapid behavioral shifts enables digital-first companies to manage inventory, plan payouts, and adjust pricing in real time.

Surface risk and opportunity before it’s too late

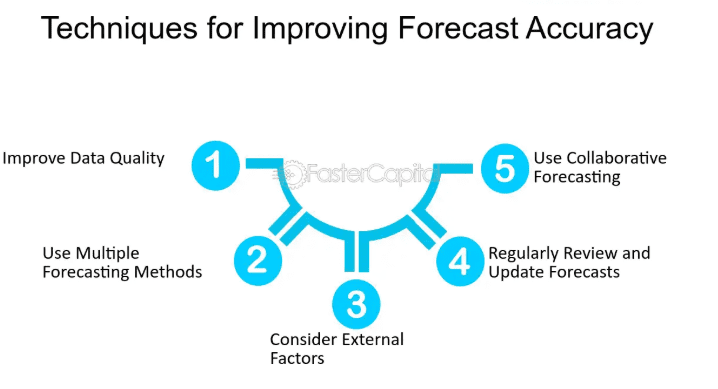

In both financial markets and corporate environments, timing is everything. AI tools detect emerging patterns across sales, customer behavior, or operational costs. As Julian Merrick, Founder of SuperTrader, notes: “In trading, the edge comes from spotting patterns early. The right scanner backed by AI doesn’t just follow the market , it filters noise, surfaces setups in real time, and helps users act on probability, not guesswork.” Studies indicate AI can reduce forecasting errors by 30% to 50%, significantly improving business agility.

Scenario planning at scale

“What if” modeling, essential for stress-testing budgets and planning for downturns, used to require hours of spreadsheet manipulation. AI streamlines this with instant scenario generation. Sammi Li, CEO of JuCoin, puts it succinctly: “Protecting your wealth starts with planning for both good years and bad. Whether it’s your business or your retirement, long-term security comes from seeing the risk before it hits.” Businesses can now simulate multiple economic or operational futures without overburdening finance teams.

Speed and precision in asset-heavy sectors

For industries like real estate or logistics, timing and accuracy are everything. AI tools aggregate local trends, liquidity projections, and capital costs to inform deal decisions. Dan Close, CEO of BuyingHomes, states: “We’re not just guessing anymore, we’re making data-backed decisions on the fly.”

Aligning marketing to financial objectives

When finance and marketing operate on shared, real-time data, execution improves. Accurate forecasts help CMOs adjust campaign spend, optimize ROI, and align marketing strategy with business performance.

“When businesses understand their cash flow in real time, marketing stops being reactive. It becomes a strategic lever, not just a cost center. We’re seeing smarter execution, because the insights come early, not after the fact.” says Julian Lloyd Jones of Casual Fitters.

Smarter discounting in retail and e-commerce

Discount strategies require careful balance. AI models help businesses determine optimal timing and audience segmentation for promotions. “Smart forecasting doesn’t just help with inventory or budgeting, it tells you when customers are most responsive to savings. When timing and personalization align, discounts stop being a cost and start becoming a growth lever.” says Sundze Mohammed, CEO of RTCoupons. This precision prevents margin erosion while boosting engagement.

Expanding financial visibility beyond the CFO

Forecasting shouldn’t live only in the C-suite. Modern AI tools provide department-level insights without exposing sensitive data. “When SMBs and enterprises understand who’s behind key transactions, vendor relationships, or credit patterns, they can forecast with far greater confidence. People’s data helps decode financial risk, not just in spreadsheets, but in the human factors that drive them,” says Bill Sanders of QuickPeopleLookup. Transparency enables faster, more cohesive planning across the organization.

Reducing low-value finance work

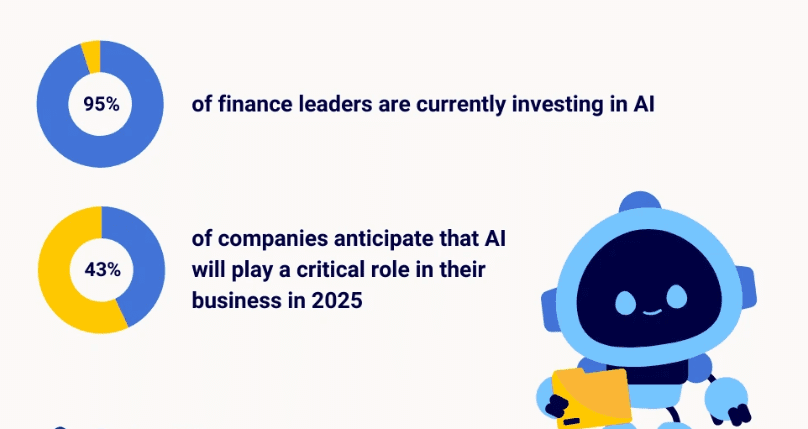

Manual report generation, spreadsheet corrections, and data re-entry are time sinks. AI automation alleviates this burden, freeing finance teams to focus on strategic insights. “Teams have more room to think clearly and look at long-term goals, instead of staying stuck in short-term tasks,” says Ernestas Duzinas, CEO of GoTranscript. A recent report found that 95% of finance leaders are investing in AI, with 43% projecting it will be critical by 2025.

Staying agile amid market disruption

Price fluctuations, supply delays, and sudden demand changes require immediate forecasting updates. AI tools adjust projections in real-time to reflect shifting business conditions.

“AI tools help businesses keep up by making forecasting more flexible. They don’t just show a static report , they update your numbers as new data comes in. This means your forecast adjusts with the real world, not after it’s too late.” explains Tariq Attia, Founder of IW Capital – EIS Investment Experts.

The technology stack matters

Forecasting accuracy hinges on system integration. “If financial data is stuck in silos, even the best AI won’t deliver reliable insights,” warns Leo Baker, CTO at Vendorland. Enterprises should prioritize clean, connected data pipelines to fully capitalize on automation.

In closing

Artificial intelligence is no longer a fringe experiment in finance, it’s a foundational tool for modern forecasting. Across industries, from digital commerce to real estate, AI enables faster, more accurate, and more strategic decision-making. For SMBs and enterprises alike, the competitive advantage now lies in real-time data, integrated systems, and the foresight only AI can deliver.