Note: This is a blog that I wrote back in 2014, but seems even more apropos given all the discussions about the use of technology to achieve digital transformation. Bottom-line: you best invest the time to truly understand your sources of value creation – where you are providing competition differentiation and where you are just providing competitive parity – and drive your technology and people investments accordingly. Remember that Digital Transformation is more about reinventing your business model than it is about technology. Enjoy!

I’m always a bit confused when organizations struggle to differentiate between technology investments to achieve competitive parity, versus those technology investments that can create unique, compelling competitive differentiation. Let’s explore this difference in a bit more detail by starting with some definitions and examples:

- Competitive parity is achieving similar or same operational capabilities as those of your competitors; to leverage industry best practices and pre-packaged capabilities to create a baseline or foundation that, at worst, is equal to the operational capabilities across your industry. Organizations seek to achieve competitive parity when they buy their foundational operational processes through enterprise software packages such as Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Human Resources (HRMS), Sales Force Automation (SFA), Supply Chain Management (SCM), etc. This is also a growing area where organizations outsource to third parties their non-differentiated functions such as payroll, benefits, human resources, office maintenance, distribution, logistics, etc.

- Competitive differentiation is when an organization leverages people, process, and technology to differentiate its products, services, and brands from those of its competitors in ways that add value for the end customer. In order to create a compelling and differentiated offering, an organization must clearly articulate to consumers the benefits of its product, service, or brand. They must also contrast its unique qualities with those of competing and replacement products and services. The goal of competitive differentiation is to have the customer perceive an organization’s offering as being superior—in areas that are important to the customer—when compared to competitive offerings.

Leading organizations “buy” foundational / undifferentiated capabilities, but “build” what is differentiated in order to add value for their customers’ business. Let’s call this the SAP effect. SAP was supposed to make everyone more profitable by delivering operational excellence. But when everyone is running the same application, what’s the source of the competitive differentiation?

Analytics, on the other hand, enables organizations to optimize their key business processes and uncover new monetization opportunities with unique insights that they gather about their customers, products, and operations. These insights are gleaned from integrating operational data sources (like SAP, SalesForce.com, PeopleSoft, Siebel, Workday, Google Analytics, etc.) with company-unique customer engagement and product usage data (e.g., consumer comments, sales force notes, email threads, social media postings, customers’ financial data).

History Lesson: From Order-Entry to Value-Added Partnerships

Since history has a way of repeating itself, let’s start this discussion with an example. The American Hospital Supply Corporation (AHSC[1]) developed the Analytical Systems Automated Purchasing (ASAP) system in the early 1960s. ASAP is an early example of an organization leveraging technology to transform its strategic importance to its customers and enable the delivery of compelling, unique business differentiation[2].

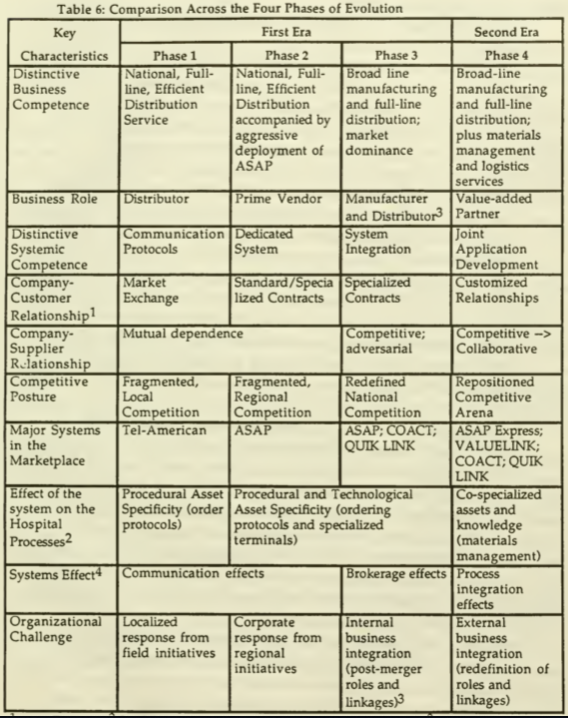

Analytic Systems Automatic Purchasing (ASAP) was a computerized system developed for ordering, tracking, and managing supplies in the hospital supply market. American Hospital Supply Corporation (AHSC) began by focusing on automating its internal order entry and billing procedures. But what began as an internal effort to automate the company’s distribution function expanded in the 1960s and 1970s to become one of the first and most successful supplier-to-customer electronic linkages in the industry (see Figure 1).

Figure 1: ASAP Strategic Roadmap

AHSC and the entire hospital services marketplace were on the threshold of a major strategic transformation—where proprietary technology platforms was providing compelling differentiation for AHSC, as well as redefining the roles of the critical players in the marketplace.

A significant aspect of AHSC’s strategy was to work with the hospitals to define, measure, and improve the non-product-related costs of materials management. This emphasis led AHSC by the mid-1970s to begin providing to select hospitals Customer Purchase Analysis reports showing historical ordering patterns for supplies, but also providing insights that could be used to determine economic order quantities and other materials management functions.

The bottom line: the ability of AHSC to deploy technology to provide the product line necessary for “one-stop shopping” and the systems capability to provide service-level reports and delivery schedules on these products emerged as key competitive differentiation for AHSC in the hospital supply marketplace.

Leveraging Technology to Power Competitive Differentiation

There are many examples of organizations that buy operational systems for parity and cost reduction (e.g., point of sale, financial, human resources, sales force automation), but leverage new data sources coupled with deep analytics to build strategic applications that provide competitive differentiation. Here are some examples of organizations that have custom-built differentiated capabilities leveraging new sources of data and deep analytics:

- Google: PageRank® and Ad Serving

- Yahoo: Behavioral Targeting and Retargeting

- Facebook: Ad Serving and News Feed

- Apple: iTunes®

- Netflix: Movie Recommendations

- Amazon: “Customers Who Bought This Item”, 1-Click® ordering and Supply Chain & Logistics

- Walmart: Demand Forecasting, Supply Chain Logistics and Retail Link®

- Procter & Gamble: Brand and Category Management

- Federal Express Critical Inventory Logistics

- American Express and Visa: Fraud Detection

- GE: Asset Optimization and Operations Optimization (Predix®)

None of these organizations bought these strategic, business-differentiating applications off the shelf. They understood what was necessary to provide differentiated value to their internal and external customers, and they leveraged data and analytics to build the applications that delivered competitive differentiation.

Summary

Big Data offers an unprecedented opportunity for organizations to create new applications that deliver competitive differentiation. Leading organizations will couple the wealth of customer, product, and operational data with deep analytics to gain and exploit new insights that can optimize existing key business processes and uncover new monetization opportunities. This means that we do not have to wait in vain for the arrival of our “Godot.” The next-generation of analytics-fueled, competitively differentiated applications can be buit today leveraging big data.

[1] American Hospital Supply Corporation was later acquired by Baxter

[2] Strategies for Electronic Integration: From Order-Entry To Value-Added Partnerships At Baxter; N. Venkatraman and James E. Short, June 1990 (Revised February 1991); https://dspace.mit.edu/bitstream/handle/1721.1/49059/strategiesfore…