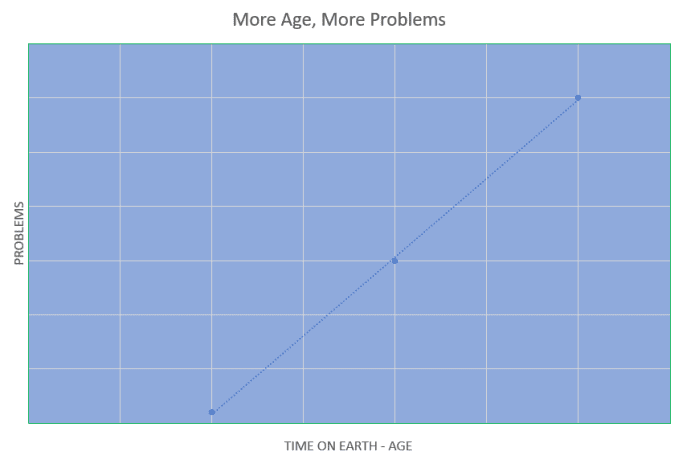

We all have problems. There seems to be a direct correlation between time spent on earth and the problems one encounters. In a way, it seems logical: the more time ‘t’ you would spend in your life, i.e., as you age, the number of variables (e.g., first you are single and then married, then children likewise you are a student, then you start working etcetera) and their interaction and interplay (e.g., it was easy to manage life as a single-student, it might not be when you have a spouse child, office, work etcetera).

Therefore, the golden principle to be at peace with these irritants in your life is simple: Simplify it.

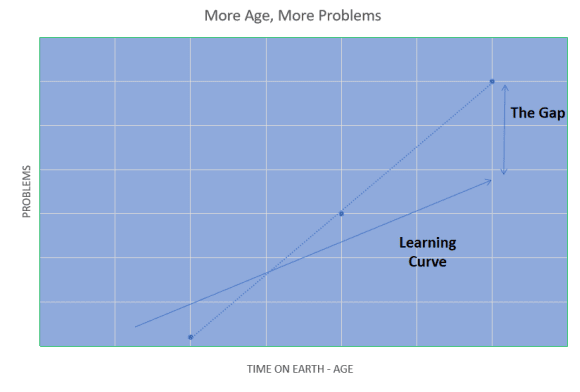

From another point of view, the more you spend time here, you should also have a growing learning curve. However, we tend to learn in retrospect/hindsight mostly; therefore, a gap would always exist between the problem(s) and solution(s). Also, we learn through trial and error, and this has been the basis of most human knowledge, as acknowledged by Nassim Taleb in his collection of books, Incerto.

To solve these persistent, perpetual problems perpetuating in professional and personal life, the use of mental models is very helpful (and I have continued to stress this throughout in my articles here). They help us deconstruct and see the nodes that matter. Consider them as tools. One such tool is Occam’s Razor. In simple words, Occam’s Razor, also known as the law of parsimony, says that the simplest explanation is better or preferable than the complex one. It posits that we should strive to find simple solutions instead of complex ones. Look around, the world is full of examples related to the latter.

The name relates to William of Ockham, whose distinct way of making decisions derived from this approach. This even dates back to the times of Aristotle, who said, “we may assume the superiority, other things being equal, of the demonstration which derives from fewer postulates or hypotheses.” William of Ockham said something beautiful regarding problem-solving that would later become the basis of this heuristic: “Plurality is not to be assumed without necessity – it is futile to do with many what can be done with few.” Theologian and scientist Libert Froidment used this term first time in 1649.

This approach is widely used in both professional and personal life. For example, in medicine, doctors now try to diagnose the fewest number of causes that might be causing a multiplicity of diseases in a patient. Even Newton used this to form his brilliant yet simplest laws. Think of this razor as a tool that can help you cut off extra fat from a problem so you can see its probable solution. Einstein said that “…the supreme goal of all theory is to make the irreducible basic elements as simple and as few as possible without surrendering the adequate representation of a single datum of experience”.

Even if we take climate change and the proposed solutions, the fact that almost 70 million people account for more than 15 percent of global emissions, more than the poorest 50 percent, amounting to 3.5 billion! I have always posited that instead of complex theories and models, why don’t we form a list of those (70 million) people or their habits and then work on reducing their carbon footprint? Often the simplest advertisements are the best, and the simple designs the most graceful. Even in the marketing and business world, we tend to see that companies shave extra layers of features off their products to make the one being offered more prominent and useable.

Ray Dalio also has “Simplify” as one of his principles. Quoting this famous saying “Any damn fool can make it complex. It takes a genius to make it simple.” In investment and economy, this can also mean that you let go of the extra or complex details and try to focus on the bigger picture view. This can also be related to Daniel Kahneman’s book, Noise, where he mentions how important it is for us to differentiate between this and the signal. The ticker symbols in any stock exchange keep on changing every minute (if not a second) but do you decide on every movement? Or do you just follow some signal(s)? Such as the future direction of the Fed’s monetary policy! Good investment decisions also include letting go of extra details that create noise.

Source: Ray Dalio, Principles

However, as with every mental model, this Occam’s Razor isn’t universal – we should always remember domain specificity. We live in a highly complex world, and we need to embrace it to make a proper decisions. In the example above, targeting those 70 million people might be a good idea, but what about if the businesses they are doing that need to close down to achieve our goal of unemploying hundreds of people? Similar concerns occur when we talk of energy transitions and the political economy of this endeavor, as millions of employees are attached to the oil and gas sector. It also has a huge part in global stocks relating it to a financial crisis.

However, Occam’s Razor seems to be a very nifty tool for many domains and in multiple domains. As with everything, we just need to be careful not to cut ourselves with it.