Merriam Webster describes “consilience” as “the linking together of principles from different disciplines, especially when forming a comprehensive theory”. Being a person who likes to view the world in a non-binary orientation, like a wave, a continuum, not boxes or labels, this concept is close to my heart. The word literally means “jumping together” and basically the implementation of it would provide you with the ability to apply lessons from one domain to another (for instance, using scientific methodology in solving your personal problems). Building on it I wanted to write about another beautiful idea of Fractals (a mathematical, particularly geometrical concept) and relate it to the economy and subsequently the world at large.

What are fractals?

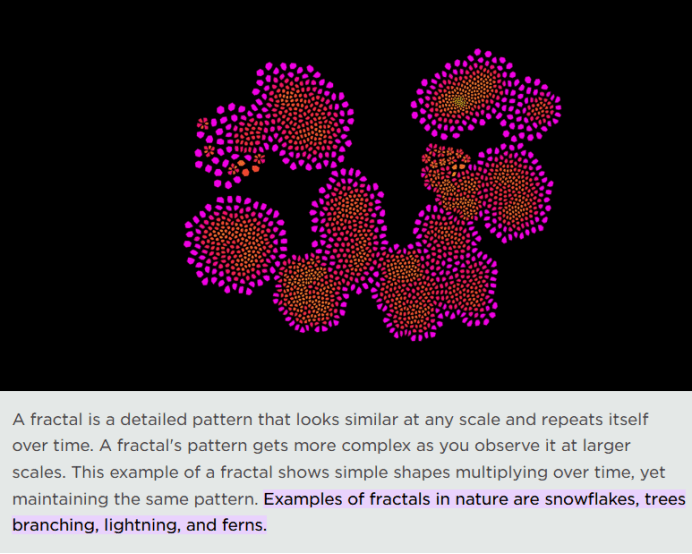

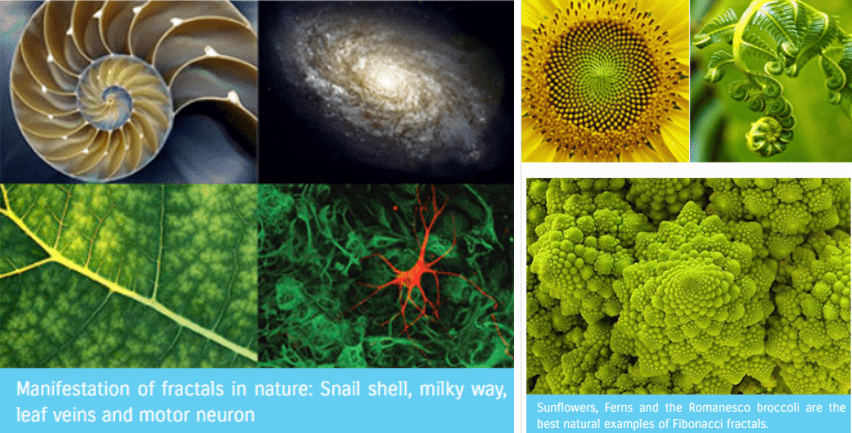

Fractals are all around us. Nature has used them in its design. One can see fractal patterns in trees, coastlines, mountains, snowflakes, hurricanes, and neurons. They are essentially never-ending patterns. They are a paradox as they nature is highly complex yet they are created by a simple process. Benoit Mandelbrot, a great mind and thinker, coined the term first time, and one of the most interesting depictions of it is Mandelbrot Set. (You can view it here, I suggest you do).

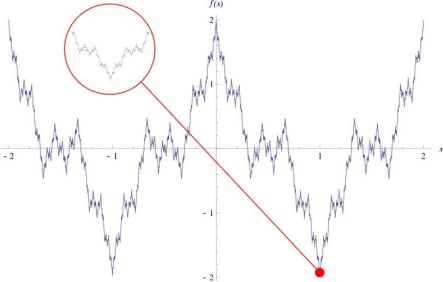

Similarly, if we see the way knowledge is structured, we’ll conclude that it has a certain fractal pattern to it. It branches out from a certain discipline and then sub-divides into more. Each of the sub-divisions has its divisions, and the process goes on. In this case, of course, the fractals would be finite. In the 1960s Benoit Mandelbrot showed how the charts of commodities and equities when mapped on time had a fractal dimension to it. The same holds true for the other markets as well, given all are complex systems where the usual Bell Curve doesn’t work (otherwise known as Gaussian distribution). In complex systems randomness is also very high – fractal randomness points – to the probability of events that can occur in some form of interdependence that is not easily or normally noticed. It is this randomness, these fat-tails or tail-risks, that our current world is a product of. Nassim Taleb has called these “Black Swan” events. (We will discuss these later in upcoming articles).

The founder of fractals, Mandelbrot, further explains how this theory can be used to tell what happens in Wall Street. Modern Monetary Theory fails to account for the tail risks mentioned above. Tail risks, though, do not happen frequently, but when they do, make their impact so great that they alter the course of the future in sundry ways. He gives the analogy of a sailor that if he assumes, the weather is favorable 95 percent of the time, can the possibility of a typhoon be ignored? The reasons MMT doesn’t account for this complexity of financial markets is that a) it assumes these price fluctuations to have no effect on one another and b) all the changes can be explained by the bell curve. As such it ignores the risks. Models and algorithms work the worst when they are most required i.e. just when a crisis is about to eventuate. The story of Long Term Capital Management is a famous one amongst many – so is the 2008 financial crisis.

Just like fractals are a small version of the whole, so are the charts tracking the movements of price – this is called that they have “self-affinity”. Hence, by creating “multifractals” the models can show price fluctuations that a normal system based on MMT won’t account for. There is even a theory that explains this – Fractal Market Hypothesis (FMH). It says that stock prices repeat themselves over a certain time period.

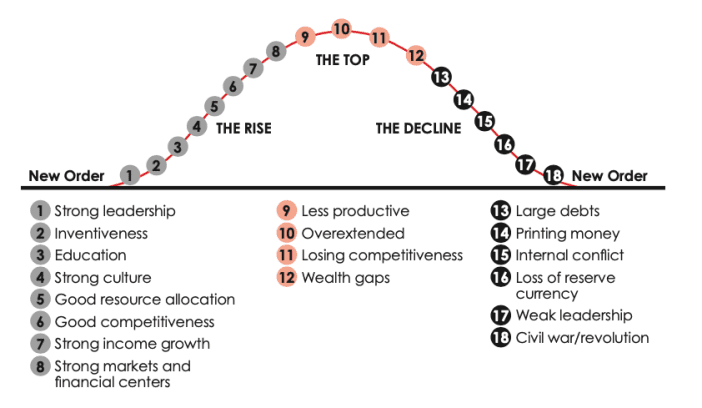

There seems to be a fractal orientation to history itself. Consider what Ray Dalio says in his book, The Changing World Order. He mentions that there are typical cycles driven by certain determinants in every country’s life. They repeat the pattern after every few years. I wonder if we apply the above rule to this description, it (history itself) might turn out to have a fractal distribution too.

As I explained in the starting, the idea of consilience is highly appealing for me. The avenues it opens for one’s thinking and the tools it provides in understanding how the world works are priceless. We need to subscribe to a non-binary mode of thinking as the world is too complex of a system to just be defined by labels and “isms”. We cannot grasp it. We can realize this and be humble and always stay prepared that there might be an unforeseen event lingering around the corner that can capsize the contemporary calm. Understanding fractals might be one of the many ways to do that. True knowledge is realizing how humble we are in front of the mega-complex world we live in. The idea of fractals certainly puts me a step closer to this humility.