In complex systems, not all parts or components are of equal value. Some parts or components can have an oversized influence on the overall system’s performance to achieve specific outcomes. These parts or components are known as force multipliers (Figure 1).

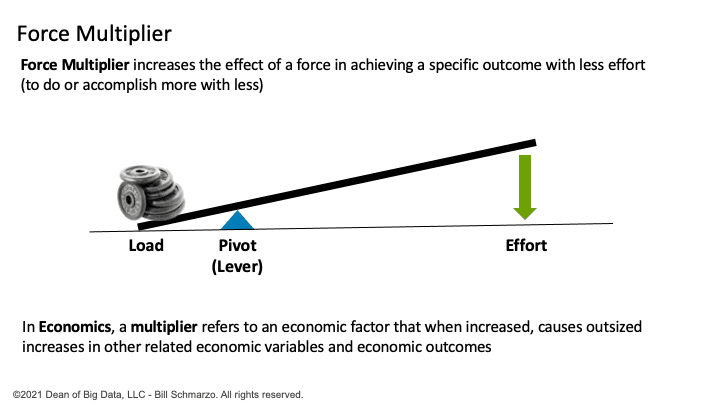

Figure 1: Understanding Economic Force Multipliers

In the military, a force multiplier is a factor or a combination of factors that gives personnel or weapons the ability to accomplish greater feats than without it. For example, air support can be used to significantly increase the effectiveness of group forces.

In economics, a multiplier broadly refers to an economic factor that, when increased or changed, causes outsized increases or changes in other related economic variables. For example, the fiscal multiplier effect becomes a force multiplier when an initial injection of cash into the economy causes a bigger final increase in national income.

Identifying and leveraging Force Multipliers are key to getting more value from your existing assets and “doing more with less” from an effort-to-outcomes perspective.

And the same holds true for Data Economic Force Multipliers.

Data Economic Force Multipliers

Force multipliers exist in the data sciences realm; that is, there are data sources that when combined with other data sources, make those original data sources significantly more valuable.

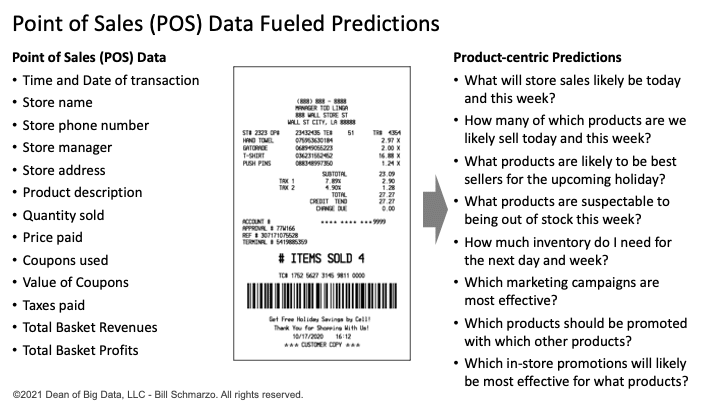

For example, the Retail industry has massive Point of Sales (POS) data that captures details about what products are sold at what prices at which stores with what promotions and at what times and days of the week (Figure 2).

Figure 2: Point of Sales (POS)-driven Predictions

POS data has traditionally been used by retailers to support product placement, promotion, in-store merchandising, pricing, and inventory decisions such as:

- What will store sales likely be today and this week?

- How many of which products are we likely sell today and this week?

- What products are likely to be best sellers for the upcoming holiday?

- What products are suspectable to being out of stock this week?

- How much inventory do I need for the next day and week?

- Which marketing campaigns are most effective and how will that impact inventory?

- Which products should be promoted with which other products?

- Which in-store merchandising will likely be most effective for what products?

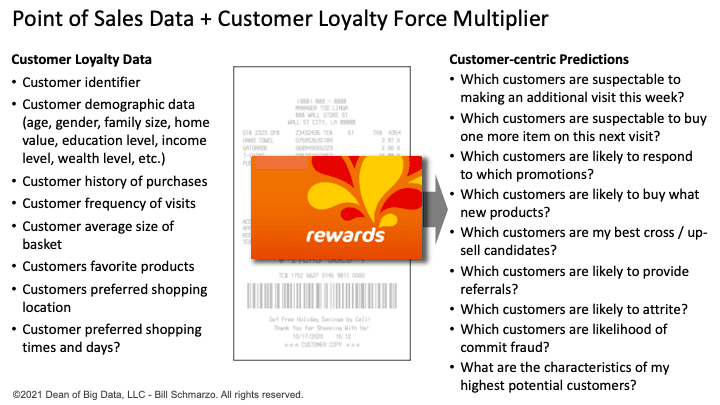

But wait, there’s more we can do when we exploit the Data Economic Force Multipliers! Augmenting your POS data with Customer Loyalty data yields more accurate, timely, and relevant store, product, merchandising, inventory, and marketing campaign decisions, but at the more granular customer and customer segment levels (Figure 3).

Figure 3: POS + Customer Loyalty-driven Predictions

We can super-charge our product-centric decisions when we can add customer-level analytic insights (predicted behavioral and performance propensities), including:

- Which customers are suspectable of making an additional visit this week?

- Which customers are suspectable to buy one more item on this next visit?

- Which customers are likely to respond to which promotions?

- Which customers are likely to buy what new products?

- Which customers are my best cross / up-sell candidates?

- Which customers are likely to provide referrals?

- Which customers are likely to attrite?

- Which customers are likelihood of commit fraud?

- What are the characteristics of my highest potential customers?

Other industries also have these Data Force Multipliers including:

- In the Insurance industry, adding a Telematics Tracker data can yield inviable insights into personalized pricing and promotions, unsafe driving patterns and insurance risks, geographical areas more suspectable to accidents, ideal prospect characteristics and behaviors, vehicle safety and performance characteristics, and more.

- In the area of asset management in the manufacturing, construction, and facilities management industries, adding a GPS tracker data to your assets can yield insights into asset utilization optimization, demand forecasting, capital planning, predictive maintenance, load balancing, product replacement, and more.

- In the healthcare and professional sports industry, adding Fitness Band data can yield insights into a patient’s (athlete’s) overall health monitoring, preventative healthcare recommendations, emergency response, personalized diet and workout effectiveness, load management, and more.

- In manufacturing and energy, adding a vibration and/or heat sensor data to your manufacturing machinery can yield insights about performance anomaly detection, predictive maintenance, asset remaining useful life, load balancing, asset usage optimization, and more.

What these data economic force multipliers have in common is that they add an additional level of granularity to the predictions and decisions that optimize your organization’s business and operational outcomes. These data economic force multipliers add a dimension of individual human (i.e., customer, patient, athlete, student, technician, engineer) or device (turbine, compressor, chiller, press, engine) predictive behavioral and performance propensities.

Remember when it comes to Big Data and IOT data:

It isn’t the volume of data that’s interesting; it’s the granularity.

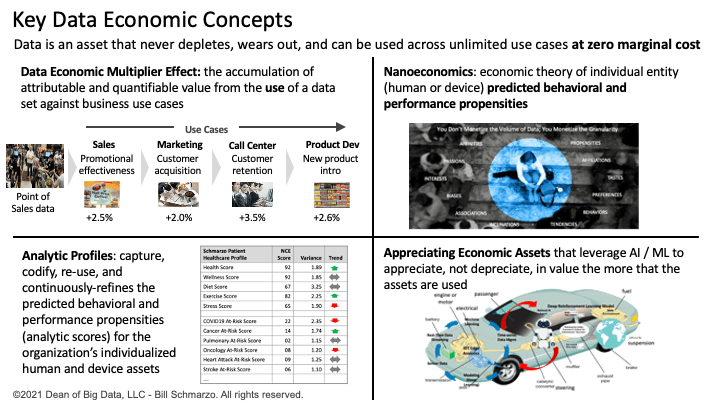

Also, these Data Force Multipliers activate Schmarzo’s economics concept of Nanoeconomics.

Data Force Multipliers Exploit Nanoeconomics

Nanoeconomics is economic theory of individual entity (human or device) predicted behavioral and performance propensities.

Leveraging nanoeconomics, organizations can make individualized operational and policy decisions that dramatically reduce execution costs while simultaneously improving effectiveness of these operational and policy decisions. Yes, we can “do more with less”.

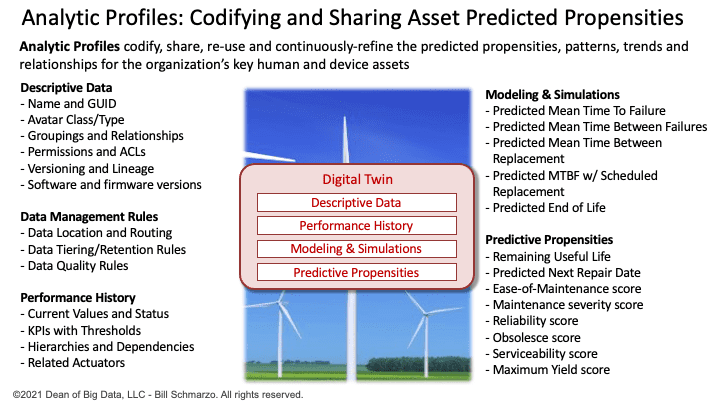

As I discussed in the blog “Analytic Profiles: Key to Data Monetization”, Analytic Profiles codify the propensities, patterns, trends and relationships for the organization’s key human and device entities. Instead of storing the raw data about an organization’s key entities (customers, patients, students, engineers, operators, athletes, compressors, clutches, cars, CAT scanners, turbines), Analytic Profiles capture the analytic scores that codify the entity’s behavioral and performance propensities (Figure 4).

Figure 4: Analytic Profiles for Codifying and Sharing Asset (Entity) Predicted Propensities

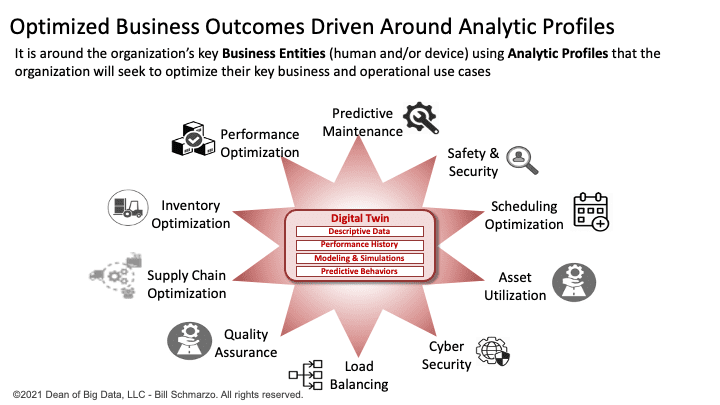

Analytic Profiles capture the analytic scores and insights to apply against multiple use cases – detect anomalies, predict next best action, optimize utilization, load balancing, minimize inventory, rationalize products, predict maintenance – that power an organization’s monetization efforts (Figure 5).

Figure 5: Optimized Business and Operational Outcomes Driven Around Analytic Profiles

Data Economics Force Multiplier Summary

Force Multipliers increase the effect of a force in achieving a specific outcome with less effort.

I have expounded several data economic concepts such as those captured in Figure 6.

Figure 6: Key Data Economic Concepts.

You can now add Data Economic Force Multiplier to that list.

Not all data sets are of equal value. Some data sets have the potential to dramatically increase or multiple the value of other data sets. Identifying and empowering those Data Economic Force Multipliers is the key to getting more value from your existing data assets and “doing more with less” from an effort-to-outcomes perspective.

Identifying, integrating, governing, and managing those data sets the stage for organizations to exploit (explode?) their data sets to create new sources of customer, product, service, and operational value.