What if you had a corporate asset that was never used? Your first response might be that corporate asset obviously has no value. And you’d probably be right. However, there are costs – acquisition costs, maintenance costs, storage costs, depreciation costs, salvage costs – associated with all assets. So, to incur all of those costs and then not do anything with that asset would be fiduciary negligence at its worse.

Welcome to the world of dark data!

And it’s not just dark data; it’s Dracula Datain the sense that the costs and potential liabilities (associated with GDPR, Personal Identifiable Information, Fair Credit Reporting Act, etc.) slowly eat away at the organization’s balance sheet while exposing the organization to unnecessary compliance and regulatory risks.

But if you think dark data is an Information Technology (IT) problem, then that’s probably why you have a dark data problem. Let me explain…

Data Strategy Driven by the Business Strategy

“Organizations do not need a big data strategy; they need a business strategy that incorporates big data!” – Bill Schmarzo

I love starting my customer meetings with this statement. I want to immediately challenge my customers with how they determine the value of data. Many organizations view data as a cost to be minimized. These organizations view their data strategy as an activity independent of supporting the organization’s business strategy. The result: Dracula Data.

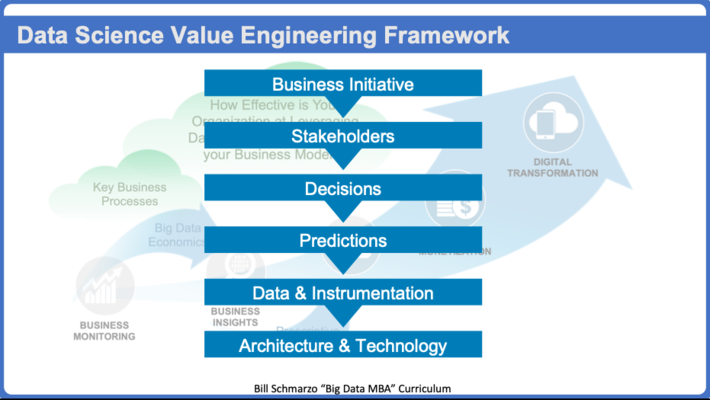

Instead of developing your data strategy as an independent activity owned by IT, contemplate how your data strategy supports your business strategy with the customer, product and operational insights uncovered in the data. Organizations need a value engineeringmindset that links their data strategy to the organization’s business initiatives (see Figure 1).

Figure 1: Data Science Value Engineering Framework

If your organization seeks to become more effective at leveraging data and analytics to power its business models, then the Data Science Value Engineering Frameworkis how you do it.

Understanding the Economic Value of Data

Economics provide a forward-looking perspective on determining asset valuation. Organizations that use an economics frame to measure and manage their business operations focus on the value that an asset can generate. Not only does economics provide a forward-looking valuation frame, but the unique characteristics of digital assets (such as data, analytics and applications) exploit that economics frame even further.

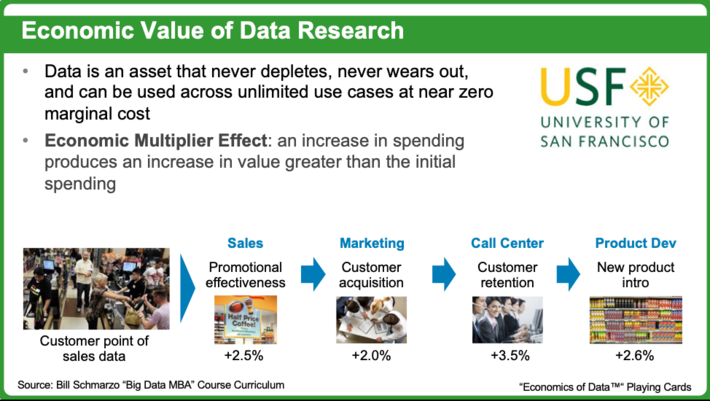

Research we conducted at the University of San Franciscoopened the door to an industry conversation on the economic value of a corporate asset that never depleted, never wore out and could be used across an unlimited number of use cases at zero margin cost (see Figure 2).

Figure 2: Understanding the Economic Value of Data

Figure 2: Understanding the Economic Value of Data

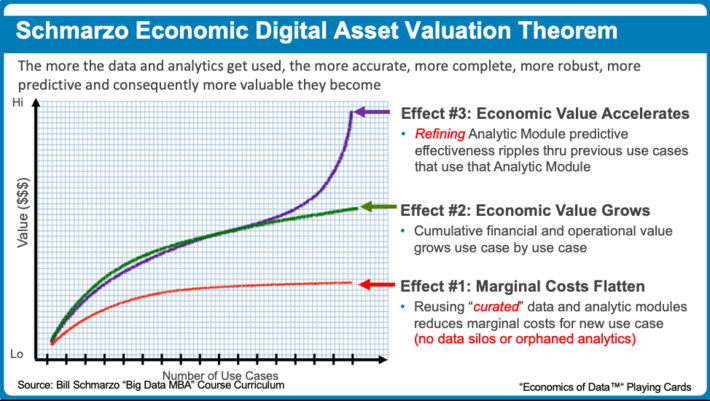

The economic characteristics of digital assets manifest themselves in several ways (Figure 3):

- Economic Costs Flatten. The cumulative costs of the data and analytic digital assets flatten as the Marginal Cost from the re-use of the data and analytic digital assets approaches zero.

- Economic Value Grows. The cumulative financial, operational and customer value increases as digital asset re-use accelerates time-to-value while reducing implementation risk.

- Economic Value Accelerates. The Economic Value of the digital assets accelerates via the refinement of the digital asset. The data assets get more complete and the analytic assets get more accurate through refinement that improves predictive effectiveness.

Figure 3: Schmarzo Economic Digital Asset Valuation Theorem

See the blog “Why Tomorrow’s Leaders MUST Embrace the Economics of Digital Transf…” for more details on the “Schmarzo Economic Digital Asset Valuation Theorem” (my attempt to be awarded a Nobel Prize in Economics).

Getting Stakeholders to “Think Like a Data Scientist”

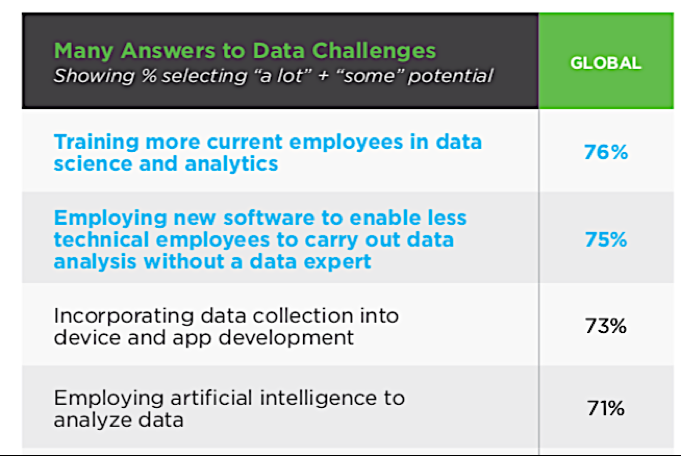

Splunk published research on dark data titled “Dark data. Bright future” that stated that nearly 55% of an organization’s data is dark. One of my key take-aways out of the research was that the number one way to address the dark data dilemma was to train more employees in data science and analytics (see Figure 4). I could not agree more!

Figure 4: Create “Citizens of Data Science to address Dark Data Challenge

Time and again we see those organizations that are most successful with data science are those organizations that integrate the business stakeholders into the data science process on Day One. Data Science success may be more dependent upon gathering the insights and perspectives of a diverse set of business stakeholders than it is on the machine learning frameworks themselves (that’s sure to rile up my data scientist friends). It is the business stakeholders who provide the invaluable guidance about the business, customer and operational value of the organization’s key business initiative, understand the metrics and key performance indicators against which progress and success will be measured, pinpoint the most valuable/most feasible decisions that support the business initiative, categorize the predictions they need to optimize those decisions, brainstorm what data sources one might want to explore, and quantify the costs associated with False Positives and False Negatives.

That is exactly the focus of my new workbook “The Art of Thinking Like A Data Scientist”; create “Citizens of Data Science” who can collaborate with the data science team to identify, codify and operationalize the above data science requirements. As a result, not only will the organization maximize data science and business success, but it will also uncover and monetize those dark data sources buried throughout the organization.

See the blog “What is ‘The Art of Thinking Like a Data Scientist’ Workbook and Why it Matters” for more details on the workbook.

Dark Data Summary

- If you think dark data is an Information Technology (IT) problem, then that’s probably why you have a dark data problem.

- It’s not dark data; it’s Dracula Data where the costs and potential liabilities slowly eat away at the organization’s balance sheet while exposing the organization to unnecessary compliance and regulatory risks

- “Organizations do not need a big data strategy; they need a business strategy that incorporate big data!” – Bill Schmarzo

- The economics of the data and analytic digital assets can simultaneously drive down operational costs while increasing (and even accelerating) the organization’s ability to create new sources of value. It is hard to find any other corporate assets that share these same behaviors.

- If you want to address your dark data problem and unleash the economic value of your data, then train your business and operational stakeholders to “think like a data scientist”.