New & Notable

Top Webinar

DSC Webinar Series: How to Scale NiFi Deployments to Enable Universal Data Distribution

Ben Cole | August 29, 2023 at 3:08 pmRecently Added

Using window functions for advanced data analysis

Erika Balla | April 15, 2024 at 1:53 pmWindow functions are an advanced feature of SQL that provides powerful tools for detailed data analysis and manipulation...

Get ready for future innovations with large language models

Prasanna Chitanand | April 12, 2024 at 2:00 pmNowadays, almost all businesses use generative AI and large language models after realizing their ability to boost accur...

5 mistakes to avoid in CMMC compliance

Erika Balla | April 12, 2024 at 11:02 amThink of a battlefield — not filled with soldiers but cyber warriors. The Defense Industrial Base (DIB) stands as ...

Building reliable and efficient ETL pipelines: Best practices for data wranglers

Ovais Naseem | April 11, 2024 at 3:26 pmData is crucial for your business—it helps with decisions and growth. But sometimes, it’s stuck in different pla...

How is machine learning changing the landscape of FinTech?

Pritesh Patel | April 11, 2024 at 9:13 amMachine learning in FinTech is a critical enabler in tech-driven banking, where efficiency and innovation are key to sta...

The new era of data handling: Tools that transform business strategies

Ovais Naseem | April 10, 2024 at 1:48 pmData Automation Tools play a crucial role in transforming how businesses handle data. They offer advanced functionalitie...

DSC Weekly 9 April 2024

Scott Thompson | April 9, 2024 at 1:42 pmAnnouncements Top Stories In-Depth...

Growth of open-source AI technology and democratizing innovations

Tarique | April 9, 2024 at 10:45 amNot too long ago, Artificial Intelligence was a vague concept that mostly found its relevance in science fiction movies ...

How data impacts the digitalization of industries

Jane Marsh | April 9, 2024 at 9:03 amSince data varies from industry to industry, its impact on digitalization efforts differs widely — a utilization strat...

The impact of quantum computing on data science

Aileen Scott | April 9, 2024 at 8:27 amThe collaboration of data science and quantum computing appears as a new milestone in the future of data science, despit...

New Videos

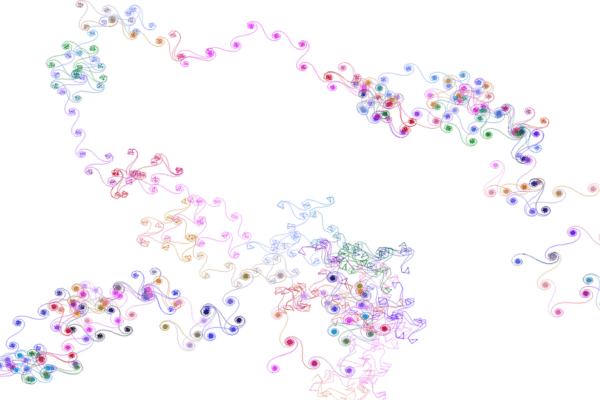

7 GenAI & ML Concepts Explained in 1-Min Data Videos

Not your typical videos: it’s not someone talking, it’s the data itself that “talks”. More precisely, data animations that serve as 60-seconds tutorials. I selected…

30 Python Libraries that I Often Use

This list covers well-known as well as specialized libraries that I use rather frequently. Applications include GenAI, data animations, LLM, synthetic data generation and evaluation,…

The Business Analysis Benefits and Limitation Of AI and Synthetic Data

Enterprises increasingly deploy machine learning models to analyze corporate data that informs vital business issues.