A long, long time ago (maybe 10 years) the data analytics industry was fairly easy to define and track. Back in that pre-historic era SAS was considered the gold standard of analytics companies with a comprehensive range of solutions addressing the demands of many industries. Given the relative paucity of data, analytics tended to focus on those industries that generated usable data. Companies that were part of the analytics universe back then would have included:

- risk oriented data and analytics companies – such as the credit bureaus and FICO primarily serving the financial sector,

- marketing services companies that served the direct marketing industry and the retail sector

- A variety of software companies including data prep companies (ETL solutions such as Informatica), business intelligence companies (such as Cognos and Business Objects).

SAS is arguably still the leader of the pack today, but it is a more confusing landscape – more players, new solutions and different end users. Most importantly, the analytics field today has been driven by an explosion in data (the 4 V’s), the rise of e-commerce, the increasing importance of business users (citizen data scientists).

These forces have combined to give rise to a number of trends:

- start-ups have emerged to leverage data and technology focusing on new industries and business problems

- some consolidation in the sector – particularly as the gorillas (IBM, Oracle, Microsoft, SAP, Adobe) have expanded their analytics offerings, but the analytics field is still in the early stage, high growth phase.

- Data and services companies have moved upstream to develop more integrated end-to-end solutions, and software companies have expanded their industry IP with domain specific services capabilities (industry specialists).

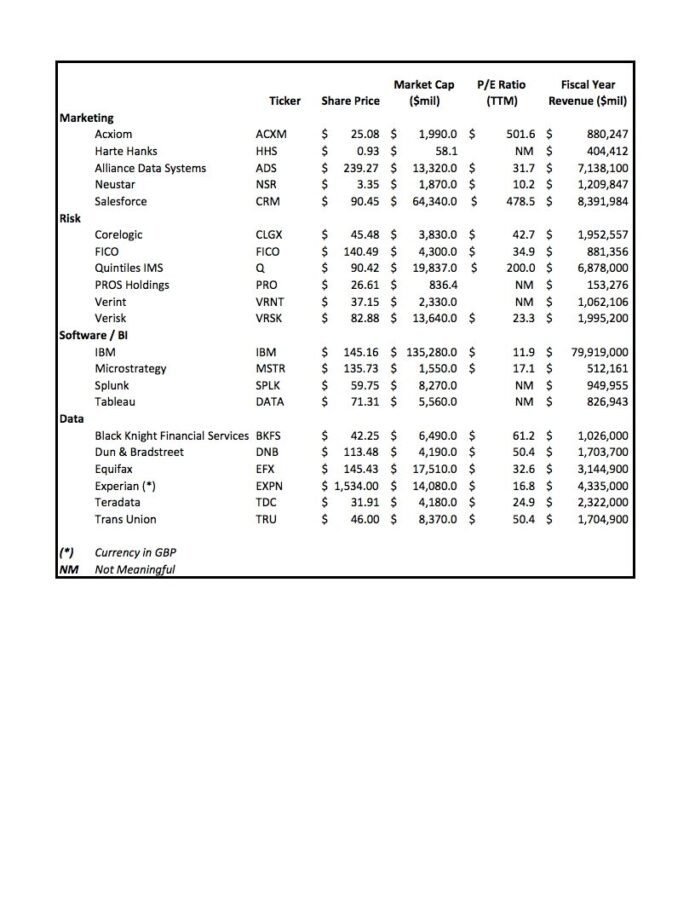

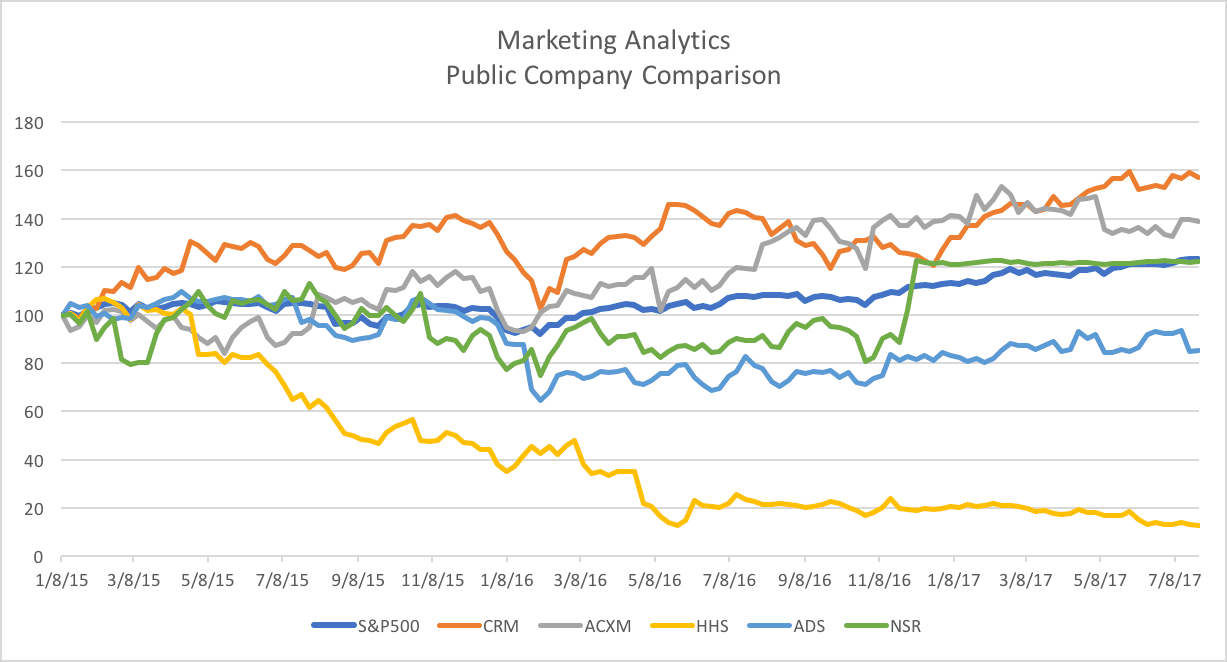

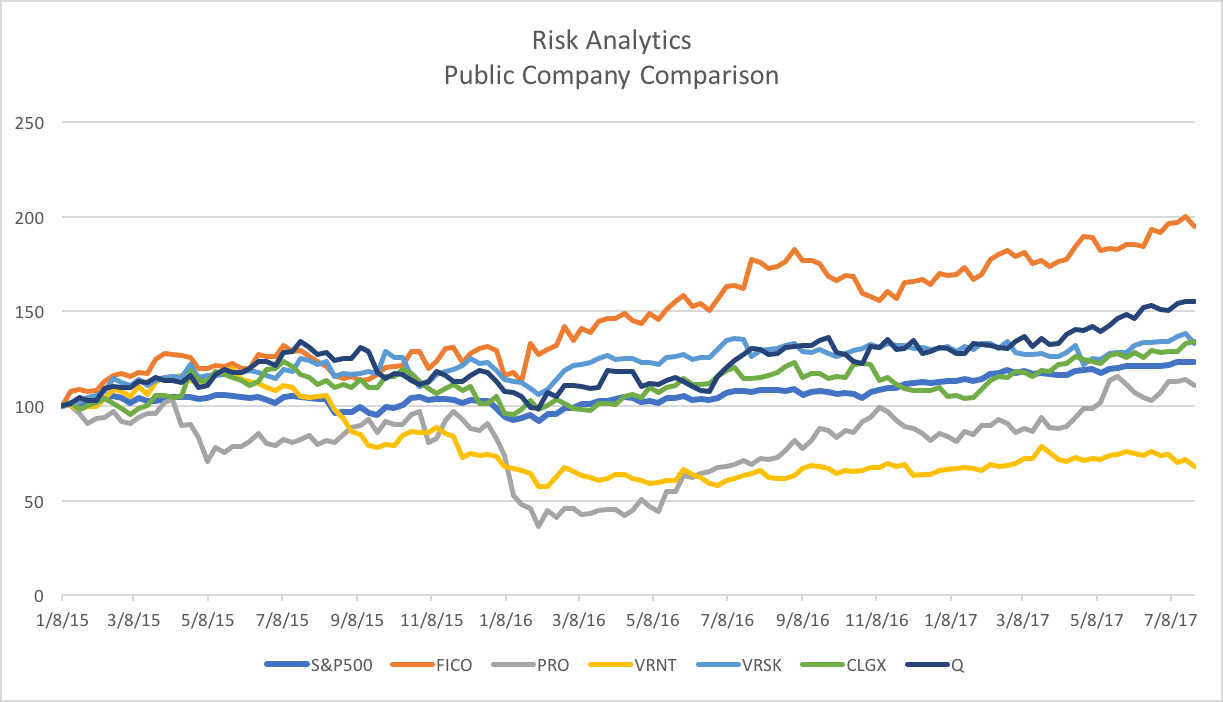

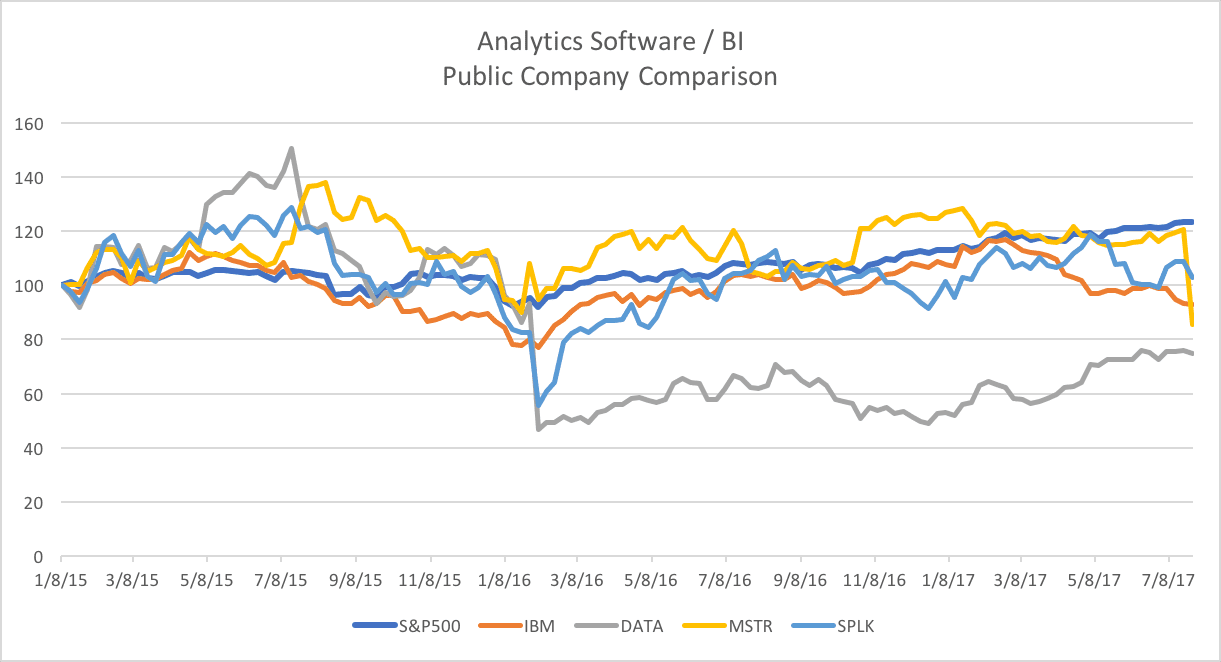

With all this activity and the indisputable rise of analytics as a distinct field, how are the winners (and the non-winners) faring on Wall Street? The first step in assessing this is to define the key segments of the data analytics universe – a somewhat subjective exercise! There is no generally accepted definition of data analytics as a discrete market sector. Wall Street tends to view companies at a fairly high level (software, business services) and even the industry analyst firms tend towards functional classifications (for example, Gartner analysts report on such areas as Digital Marketing Analytics, Data Science Platforms, Business Intelligence and Data Science Platform and more). For the purposes of this analysis I have categorized the field into four discrete segments and identified those public companies which are principally engaged in each segment.

I have ignored the performance of the industry gorillas – Microsoft, Oracle, SAP etc., with the exception of IBM, which generate the majority of their revenue and profit from their non-analytics mainstream businesses. I have included IBM, however, because of the size and scope (and publicized strategy) of their analytics businesses, even though it is difficult to identify how much those businesses contribute to consolidated results. I have also included the post-merger entity of Quintiles IMS which was formed last year to combine the data and technology business of IMS with the life sciences solutions of Quintiles. Given the size of the industry, the volume of data generated as well as the amount of political noise currently surrounding the industry, one would expect that the sector will generate significant analytics activity in the coming years.

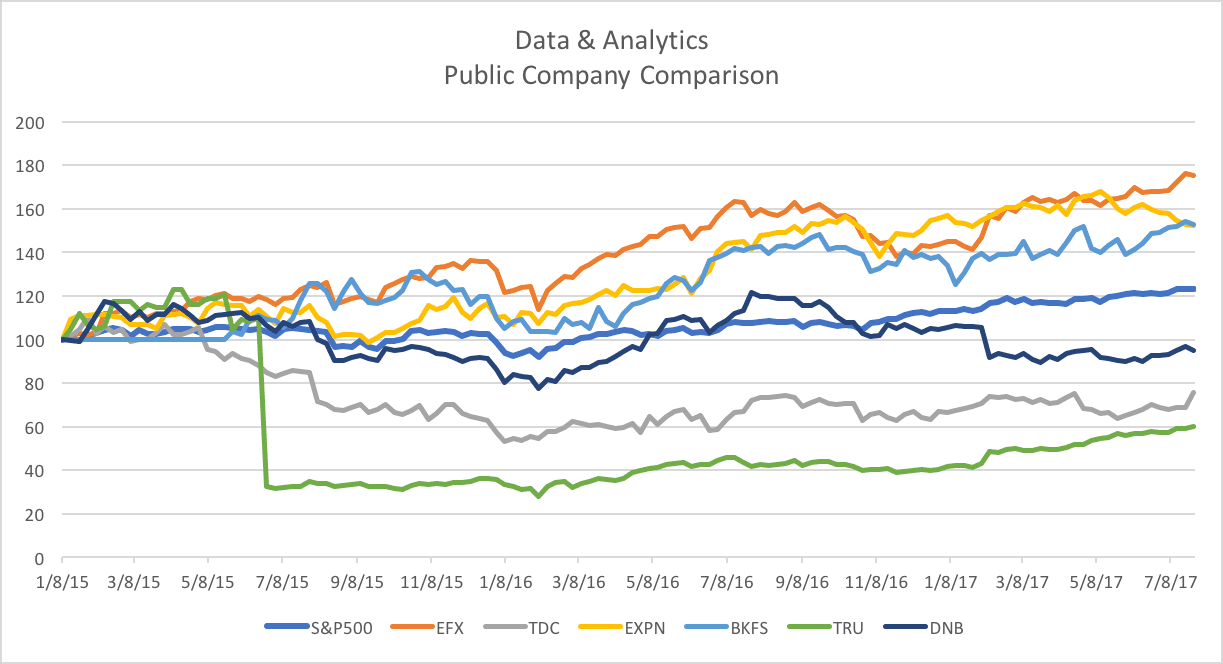

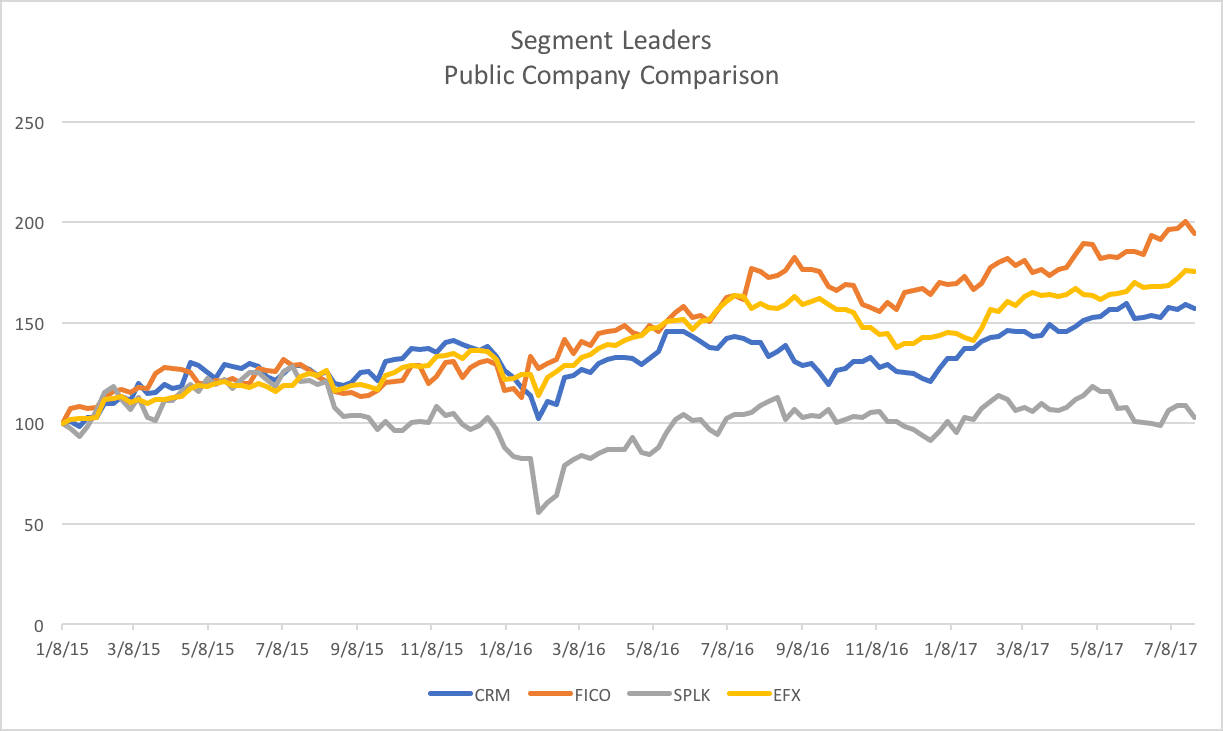

In reviewing the stock price performance of each segment for the last 2 years or so (January 2015 through July 2017) companies have both under-performed and out-performed the broader market (S&P500). The winning stock price performers in each category are:

- Marketing analytics – Salesforce

- Risk analytics – FICO

- Software / BI – Splunk

- Data & analytics – Equifax

In looking at these leaders compared against each other, FICO emerges as the best performing stock of the four segments over the past 30 months or so and all categories, with the exception of the analytic software/BI segment, have outperformed the broader market. FICO is the smallest of these companies in terms of revenue (around $900 million) and primarily serves the financial sector whereas the other segment leaders all have a broader vertical footprint. Salesforce, on the other hand, has continued to grow impressively from a high base with current revenue at $8.4 billion. QuintilesIMS has performed well in the risk analytics segment and, given that it is still in the process of integrating the 2 entities, it may outperform in the next year or so. One possible conclusion is that those businesses with a concentration in a single industry with the right attributes (data intensive, regulated, complex) have tended to perform well relative to those businesses with a broader mission (although there are many exceptions to this theory).

It is probably unfair to over-analyze the software/BI category as it is currently constituted because it does not include the results and performance of the major software companies and their analytics businesses (Microsoft, Oracle, SAP etc.) as they are included in their broader results. As noted, IBM has been included but its stock price has been negatively impacted by the declining performance of its legacy business units and they do not separate out the results of their analytics businesses. Interestingly, Splunk, founded in 2003, has demonstrated the best stock price performance of companies in this segment. It is focused on analyzing machine-generated big data, capturing real-time data from which the user can generate visualizations, dashboards and other reports.

The market has been unforgiving for stand-alone analytic software and BI companies that incur disappointing results – Tableau’s stock price took a hit in early 2016 when it missed its guidance and it has yet to regain much momentum – notwithstanding a strong recovery in top line growth. This is symptomatic of the more competitive (and maturing) environment emerging in the BI space with Microsoft’s Power BI, Qlik and MicroStrategy all introducing new releases that are gaining market share and making purchase decisions more difficult and the stock market performance more volatile. This is evidenced by a similar fate befalling MicroStrategy in mid-2017.

One result of this increased volatility may be that private companies in the space will see an industry deal (at current attractive valuations), or otherwise remaining private, as more appealing options than the vagaries of being a public company. Trade sales can generate attractive valuations – Qlik was sold to the private equity firm, Thoma Bravo in June 2016 for around $3 billion and Birst, a smaller BI company, was purchased by technology solutions vendor, Infor, in June 2017 for an undisclosed price. However, although industry heavyweights are cashed up, many are waiting for more clarity around the regulatory and tax environments before embarking on major M&A programs. Consequently, I expect the leading performers noted herein to ramp up their M&A activity in the next 18 months or so while the laggards are at risk of being acquired.

On the private company front, there are lots of new market entrants addressing both new and existing business problems through the use of new data sources and more advanced and user-friendly analytics (refer my post on “A database of 800 analytics companies” which includes a database of about 900 companies). These companies may well be on M&A shortlists as activity picks up. This list show a large number of emerging companies in the fields of marketing analytics and cybercrime which is not surprising and a consolidation in those segments is likely. How are these private companies faring? It is difficult to say although there will obviously be winner and losers. One proxy for assessing the health of this sub-segment of the analytics market is the level of funding activity by the VC community (the subject of a future blog).

At the end of the day, however categorized, the sector will always be defined by 3 core capabilities – data, software and domain expertise and will address 3 buckets of broadly defined business problems (marketing, risk, operations). Companies such as SAS, Oracle, Microsoft, Salesforce (and potentially IBM) have developed the secret sauce to deliver all of these elements to a diverse client base. However, for many companies and their sales teams, the ability to sell into different industries with different needs will always be challenging (and M&A is not a panacea) and a focus on their core market is a more reliable strategy. However, given the level of startup activity, all these companies have a significant runway for earnings and market growth and strong demand for analytic scientists.